Last week was a bad time to be a tech billionaire. When the pandemic drove the world online, the founders of Facebook, Google and Microsoft reaped wealth gains described as “pornographic” and cemented their position as among the richest cohort ever to have trod the planet. Well, the “good times” are over. Sort of.

The world’s biggest tech companies reported their latest earnings last week and, for most, the news was bad. Meta (formerly Facebook), Alphabet (formerly Google) and Microsoft saw billions wiped off their values as investors began to worry that the best days of the tech titans were behind them. As investors made for the exit, the five biggest tech stocks crashed by a combined $950bn (£820m) at their lowest point. The slide also hit the fortunes of their creators.

Facebook co-founder Mark Zuckerberg’s fortune plunged by $11bn on Wednesday after Meta Platforms reported a second straight quarter of disappointing earnings. Shares in the company dropped by a fifth – a sharp depreciation that has brought Zuckerberg’s overall decline in wealth this year to more than $87bn. The numbers may be no more than arithmetically diverting – Zuckerberg, 38, is still worth about $38bn, according to Bloomberg – but that is a striking drop on the $142bn he could count on in September 2021. Almost all of his wealth is tied up in Meta stock; he holds more than 350m shares. As of Thursday, Zuckerberg ranked 28th on the Bloomberg list, a 25-place drop from his previous third-place positioning.

Meta’s 71% fall in value this year is due to many things, including advert-tracking controls instituted by Apple, a softening in digital ad spending, the challenge to Facebook-owned Instagram by TikTok, and Meta’s multibillion-dollar investment in the metaverse – the virtual world it is throwing money at despite a less-than-warm reception, even from its own staff.

That investment has troubled investors. Zuckerberg has said he expects the project to lose “significant” amounts of money over the next three to five years. On Wednesday, he asked for patience.

“I think we’re going to resolve each of these things over different periods of time,” Zuckerberg said. “And I appreciate the patience, and I think that those who are patient and invest with us will end up being rewarded.” Wall Street seems pretty out of patience.

The CNBC TV presenter Jim Cramer, who has been a booster for Meta, looked close to tears after the latest results were released. “I made a mistake here,” Cramer told viewers. “I was wrong. I trusted this management team. That was ill-advised. The hubris here is extraordinary and I apologise.”

Zuckerberg is not alone. According to Forbes, the tech billionaires have lost a collective $315bn since last year.

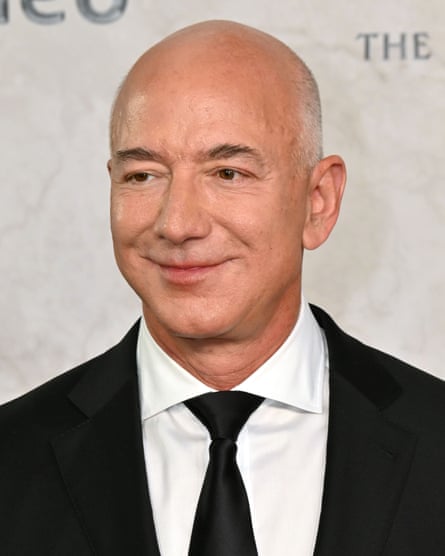

On Thursday, Amazon reported that this Christmas season would be less jolly than analysts had expected and that consumer spending was in “uncharted waters”, triggering a 20% fall in its share price. The decline hit Amazon founder Jeff Bezos by as much as $4.7bn on the day. Bezos had already lost nearly $60bn in 2022, still leaving him with a net worth of about $134bn.

A day earlier, Microsoft’s earnings report showed that the dependable cloud-computing earnings growth at its Azure division was slowing, triggering a nearly 8% decline in the company’s valuation. That will hit Bill Gates, whose fortune has declined this year by close to $30bn to about $109bn.

Even Tesla founder Elon Musk, the world’s richest man and now the owner of Twitter, has not been immune to the downturn. Shares in Tesla, the electric vehicle maker, have fallen 43.7% in the year to date. That’s reduced the would-be Mars coloniser’s fortune by $58.6bn over the past 12 months to a still astronomical $212bn.

But despite the week’s stock market bloodshed, 56 of the 65 tech billionaires on Forbes magazine’s list – one that includes Oracle founder Larry Ellison, Google founders Larry Page and Sergey Brin, Twitter founder Jack Dorsey, and former Microsoft chief executive Steve Ballmer – are still wealthier than they were three years ago.

Earlier this year, Chuck Collins, the director at the Institute for Policy Studies thinktank who directs its programme on inequality, estimated that US billionaires had seen their combined wealth rise more than $1.7tn, a gain of more than 58%, in the pandemic. The recent declines have, Collins now says, reduced that to $1.5bn, or 51%.

“The gains were so extraordinary in the two years of the pandemic, it was almost pornographic,” he said. “The billionaires essentially disconnected from the real world and the real economy. Even if their wealth is now adjusting down, who else had a 51% gain in their assets in the past two years?”

The billionaires are not the real victims. Tech companies have come to dominate US stock markets and their decline is dragging down the wider market, and with it the pensions and savings of Americans who are also struggling with rising interest rates and a 40-year high in inflation.

The larger question is: how long will this fall continue, and who will be hurt the most? It’s unlikely to be big tech’s aristocrats. “If wealth is going to vanish from the economy, this is the best place for it to vanish from,” Collins says. “It may slow the trickle into philanthropy, but the reality is most billionaires are giving to their own foundations and donor-advised funds. But it might mean there’s less dynastic wealth, which in the end I think is a good thing.”