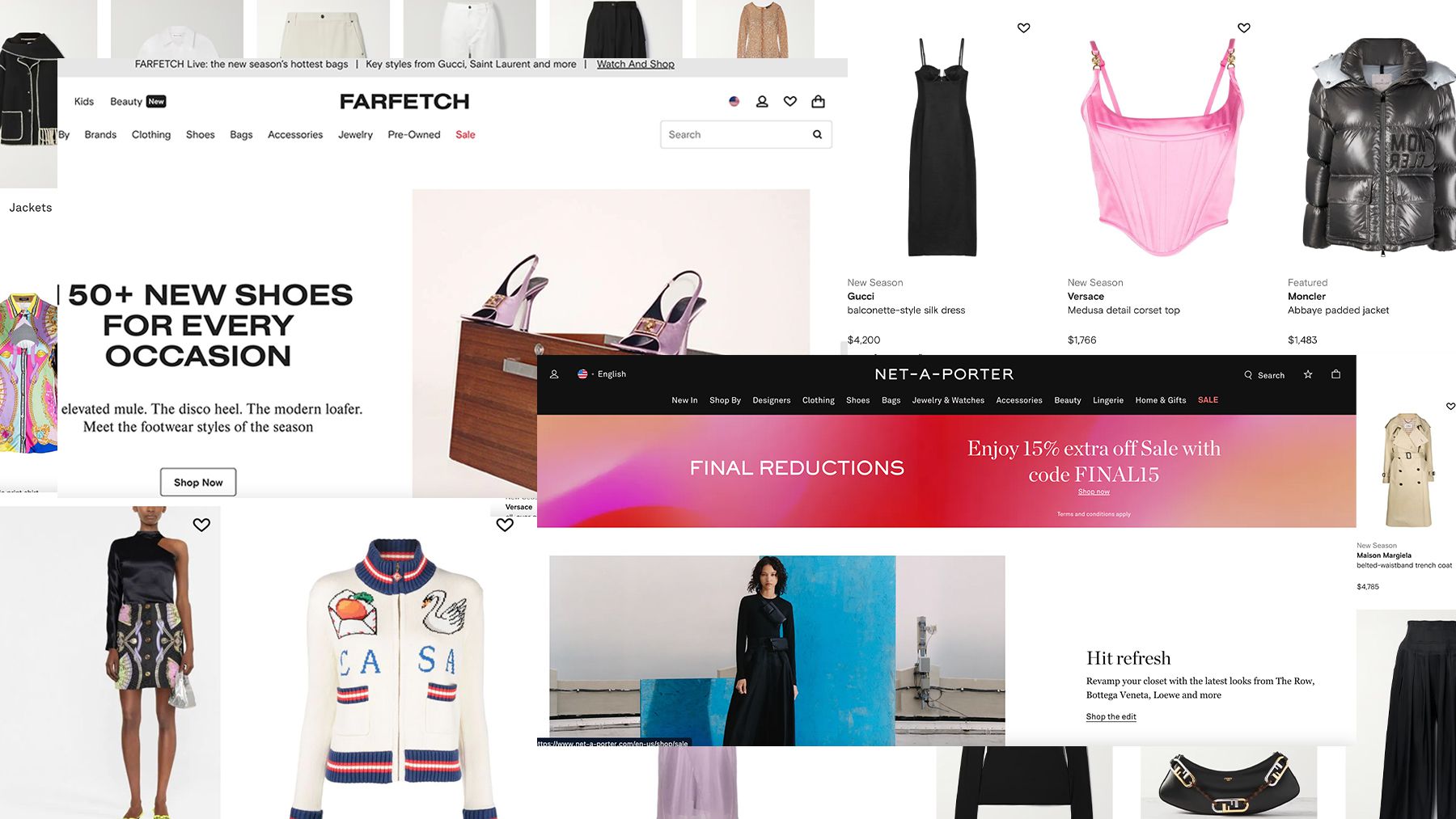

Britain’s competition watchdog on Tuesday said it was seeking comment on whether Richemont’s deal to offload most of its online fashion retailer YOOX Net-A-Porter (YNAP) to Farfetch could harm competition in the UK.

If completed, the deal announced last August would clear the way for Richemont’s labels to sign up for technology run by luxury e-commerce specialist Farfetch.

The Competition and Markets Authority said it was considering if the anticipated acquisition by Farfetch of a shareholding and certain rights over YOOX Net-A-Porter Group may lead to a “substantial lessening” of competition within any market or markets in Britain.

Richemont, maker of Cartier jewelry and IWC watches has said it expects a 2.7 billion euro ($2.93 billion) writedown related to the agreement in which Farfetch will initially acquire a 47.5 percent stake, in exchange for over 50 million Farfetch shares.

The deal comes amid a flurry of industry-wide investments in digital services as luxury players shrug off past skepticism and embrace new channels to reach customers, spurred by a faster shift to online consumption during the pandemic.

Learn more:

Will the Farfetch-YNAP Deal Work? It’s Complicated.

This week, Richemont sold a big stake in loss-making Yoox Net-a-Porter to rival Farfetch, giving the fashion platform a major boost. But it’s hard to make money in online luxury, where the path to profitability remains challenging.