This article first appeared in The State of Fashion: Beauty report, co-published by BoF and McKinsey & Company.

Barring a financial market meltdown, beauty M&A is unlikely to lose its sheen any time soon. Both corporate and financial investors have good reason to gravitate towards beauty, a consumer category that continues to prove its attractiveness thanks to hefty amounts of resiliency and strong gross margins, despite economic headwinds. But competition for the most attractive assets will likely be intense. Deal partners on both sides of the table will need to recalibrate their expectations for deal success.

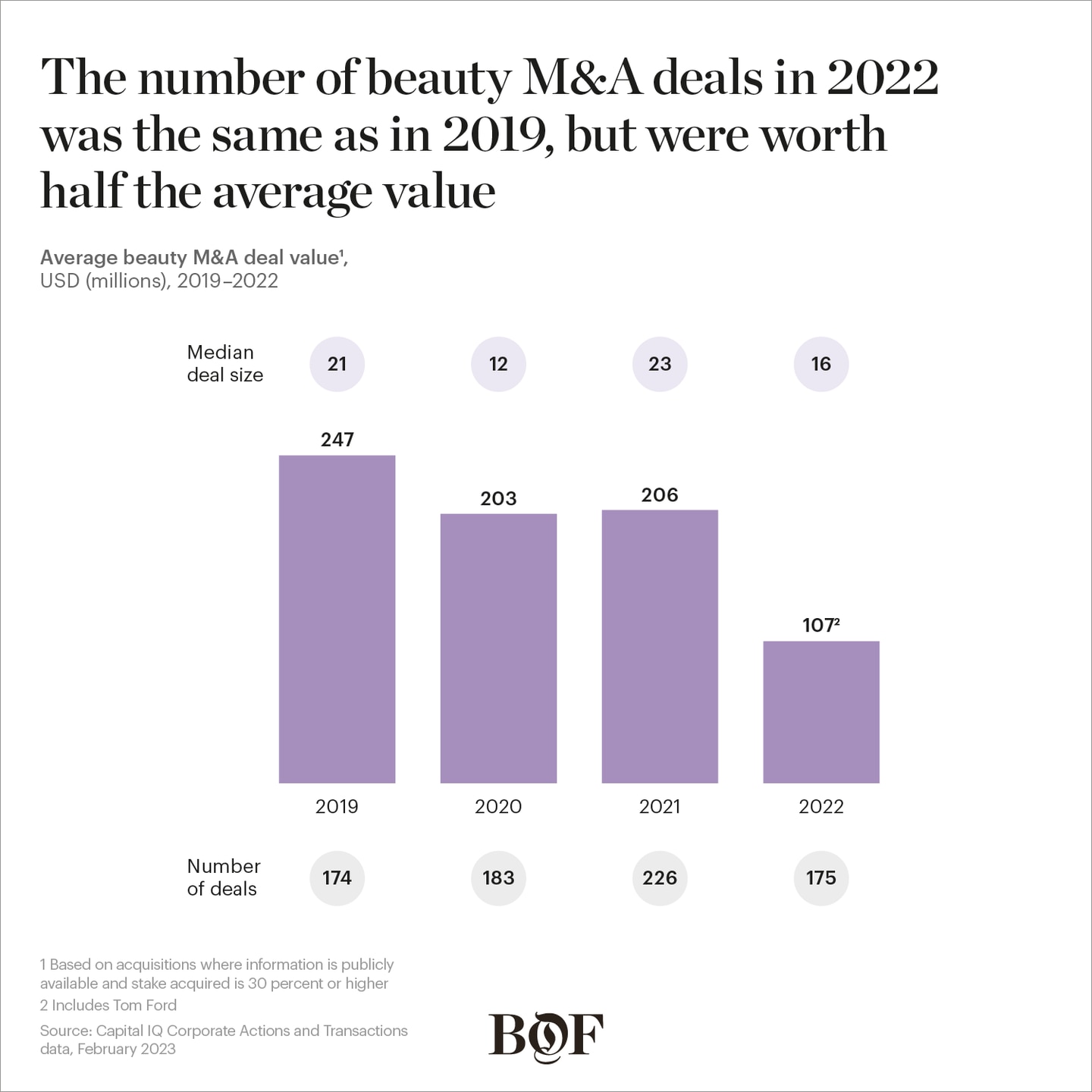

In many respects, the recalibration began in 2022. The onset of economic volatility and uncertainty last year impacted M&A: the average beauty M&A deal value in 2022 was less than half that of 2019 despite a similar number of deals taking place. Industry observers expect deal volume and average value to tick downwards in the short term, from the post-pandemic high when competition for sought-after challenger brands drove up valuations to record multiples. For example, Shiseido bought skin care brand Drunk Elephant in 2019 for $845 million, at least eight times its annual revenue of just over $100 million. The same year, Coty paid $600 million for a 51 percent stake in Kylie Cosmetics, with estimated annual net revenue of $177 million, which implied a 6.8 times revenue multiple.

Even as market uncertainties persisted in the early months of 2023, beauty’s attractiveness to deal-makers remains steady. EBITDA margins are averaging around 15 percent to 25 percent and, globally, McKinsey estimates that skin care, hair care, cosmetics and fragrance will see a compound annual growth rate of 6 percent through 2027.

Private equity and other financial investors will likely fuel deal-making as they look to add beauty brands to their portfolio companies or offload previous beauty acquisitions. These range from private equity players Advent International and TSG Consumer Partners to venture capital investors such as VMG Partners, Forerunner Ventures and Lerer Hippeau.

But it’s among beauty conglomerates that M&A will continue playing a particularly prominent role. Acquisitions are a necessary part of their strategy to increase growth and maintain their competitive edge. Of the 139 beauty deals that closed in 2022 to acquire stakes of 30 percent or more, conglomerates accounted for about 90 percent. Several of these conglomerates have also established their own early-stage investment arms, which include The Estée Lauder Companies’ New Incubation Ventures and L’Oréal’s Circular Innovation Fund.

It’s among beauty conglomerates that M&A will continue playing a particularly prominent role. Of the 139 beauty deals that closed in 2022 to acquire stakes of 30 percent or more, conglomerates accounted for about 90 percent.

For instance, Puig, owner of Paco Rabanne and Jean Paul Gaultier, announced plans in May 2022 to buy a majority stake in Byredo — the luxury fragrance brand founded in Stockholm in 2006. Though Puig did not disclose the agreed price, press reports at the time said Byredo’s valuation could be as high as $1 billion. A few months later, The Estée Lauder Companies announced its $2.8 billion acquisition of Tom Ford.

Discerning Deal-Makers

Recent earnings have provided evidence of how acquired brands can give their new owners a boost. In the second half of 2022, for example, The Estée Lauder Companies reported skin care sales declined 20 percent year on year, which was largely attributed to two of its oldest brands, Estée Lauder and Clinique. But The Ordinary, a brand The Estée Lauder Companies bought in 2021 which is known for its lower prices and ingredient-centric philosophy, offset category declines.

Conglomerates are also leaning into M&A to stay relevant and nimble in today’s market that requires innovation and novelty to capture consumers’ share of wallet. “M&A fills and accelerates the development pipeline. It’s critical to have what will appeal to the next generation,” said Nini Zhang, managing director at Bank of America’s consumer and retail investment banking group.

In return, corporates can facilitate global expansion by providing access to foreign distribution networks and leveraging relationships built over decades with partners. These investors also typically already have — or possess the expertise to build — infrastructure and systems that can reduce costs, streamline processes and provide economies of scale when, for instance, negotiating with suppliers or landlords.

According to Zhang, buyers and sellers need to ask themselves, “Where can corporates take the brand using their footprint, commercial structure, capabilities over the next five to 10 years?”

Sometimes, if the answer to that question doesn’t come easily, it may be better to reconsider a deal, even if it has long closed. In 2021, Shiseido carved out and sold colour cosmetics brands Laura Mercier, BareMinerals and Buxom to Advent International as part of a global strategy rethink to realign its focus on skin care, despite having acquired the brands only in the 2010s. Similarly, The Estée Lauder Companies closed makeup brand Becca Cosmetics that same year, less than five years after acquiring it for a reported $200 million. While Becca was once a beauty favourite, post-acquisition it struggled to cultivate a loyal consumer base and suffered as colour cosmetics sales declined even further during the pandemic.

And as proven all too often in the past, timing is critical — as in the case of L’Oréal’s April 2023 announcement of its $2.5 billion acquisition of personal care and grooming brand Aesop. Following the announcement, industry watchers observed that the deal would give L’Oréal a brand that has both luxury and mass appeal. The deal took place at a critical moment in Aesop’s journey to cult favourite, which The Business of Beauty likened to The Estée Lauder Companies’ acquisition of Le Labo in 2014, just when the perfumer’s Santal 33 was riding a wave of popularity.

What’s on the Horizon?

Where does this leave target brands? While a focus on revenue generation once sufficed to make a buzzy start-up attract suitors, evidence of sustainable profitability will be front of mind for investors. Meanwhile, the strength of intangible (and sometimes hard-to-value) assets such as strong brand identities, visionary leadership or loyal customer communities could make or break a deal. Targets will also need to indicate that they have the potential to scale in new markets or categories, using storytelling or product development strategies that can resonate across markets regionally or even globally. Due diligence will also need to sense check for any incompatibility between buyers and their targets.

Meanwhile, acquirers’ post-merger plans must address and mitigate common risks in such deals — like the acquired brand losing longtime loyal customers. Whether they are long-term or short-term buyers, acquirers must also incentivise management teams to stay engaged and ensure the continuity of the brand DNA as it scales.

Deal-making is at an inflection point. Ongoing economic and geopolitical uncertainties underscore how buyers and sellers must anticipate different approaches to M&A as market conditions change. Industry observers expect fewer, higher quality deals in the near term. Increasing challenges in acquiring larger brands are expected to result in a greater focus on targets earlier in their lifecycles than their predecessors. Over the longer term, beauty deal activity is likely to continue at pace or increase due to the sector’s attractiveness.

“I don’t think we will go back to the high-volume environment of 2021, but it will continue to be reasonably robust with a steady flow of brands coming to the market,” said Cosmo Roe, partner at Goldman Sachs. “I don’t see a change in valuations in the near term. Even if cost of capital is up, the truth is these categories are super competitive and there are many well-capitalised buyers.”

Skin care, niche fragrance and hair care will be closely watched by buyers, due to those categories’ expected growth, increased premiumisation and potential for product innovation. Private equity investors will also look beyond brands for opportunities to participate in beauty’s growth, considering contract manufacturers, turnkey solution providers or ingredient suppliers.

For their part, conglomerates will seek to bring more brands into their fold, much along the lines of what L’Oréal has already been doing: prior to its acquisition of Aesop, it purchased clean skin care brand Youth To The People in 2021, and Skin Better Science in 2022, to further fill out its Dermatological Beauty division.

“We see a relatively solid pipeline of assets and in terms of size,” said Goldman Sachs managing director Jelena Djuric. “The majority of businesses that get sold in the category are within $75 million to $200 million in sales; we would expect that the majority of activity will be in this range.”

Overall, M&A is expected to continue with fewer, higher-quality deals at high multiples in the near term. In this environment, acquirers will need to become more sophisticated, building on experience from previous deals and sharpening their ability to identify long-term winners through increasingly stringent due diligence processes. This will require zeroing in on the few differentiated and scalable businesses and having the conviction to back them.

For a deeper look into the report, join us for the global livestream of The Business of Beauty Global Forum on May 30 and 31, 2023. Click here for all the details on how to sign up.