LONDON — On Monday, star designer Phoebe Philo released the first drop from her long-awaited namesake brand via phoebephilo.com The digital-first debut came just after 3pm in London, where Philo established her venture in July 2021 after a three-year hiatus from fashion, with a minority investment from French luxury giant LVMH, her former employer.

Since Philo’s 2017 departure from the group’s Celine business — where she delivered a highly successful relaunch, turning the label into the world’s most influential fashion brand while more than tripling annual sales to over €700 million, according to estimates — hundreds of thousands of loyal “Philophiles” have eagerly awaited her return.

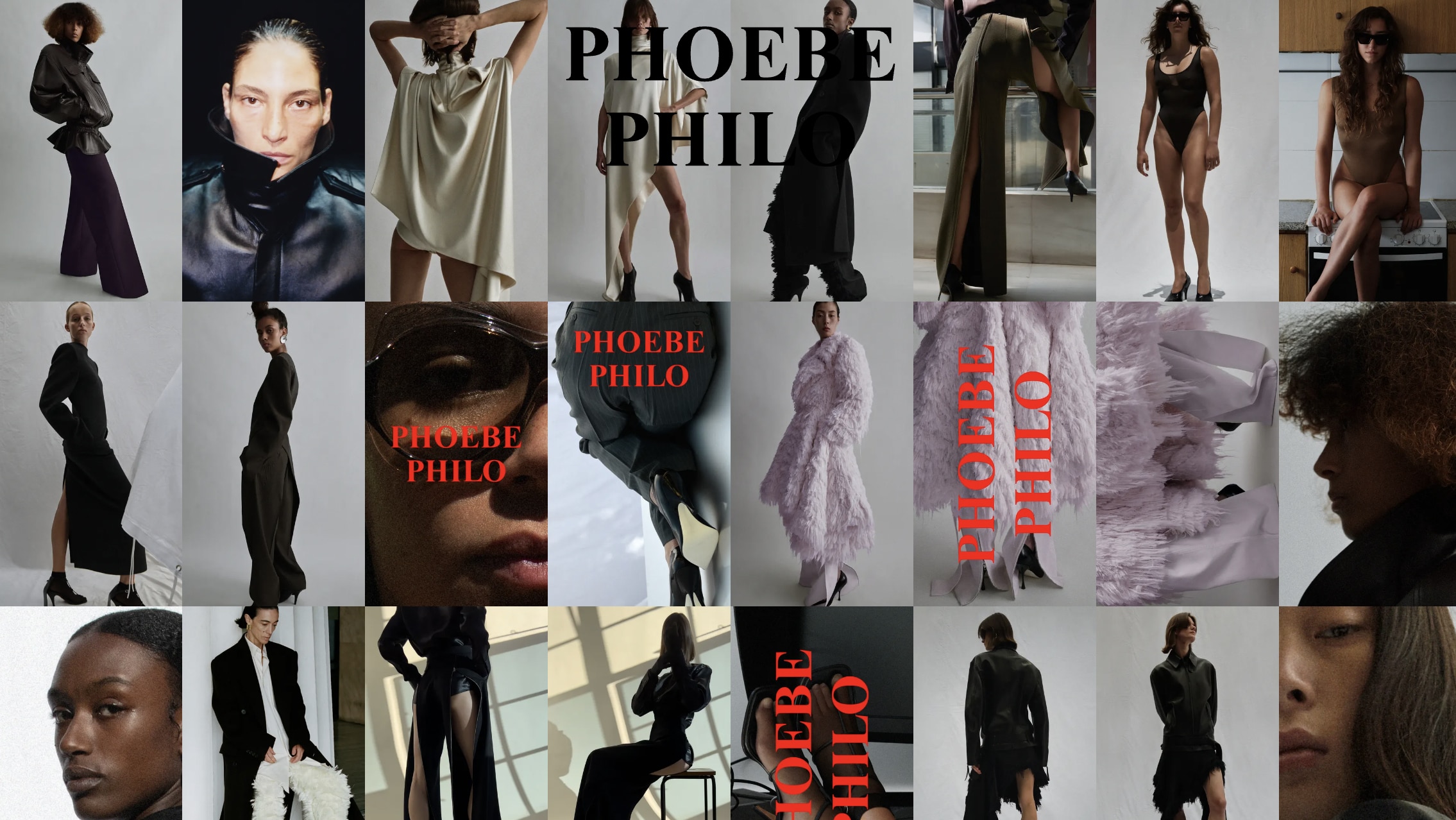

Philo’s new project has plenty for fans of the minimalist chic that ruled her Celine, as well as a raunchier undercurrent. And because the designer’s new label is a start-up, with investment levels far lower than Celine, her go-to-market strategy couldn’t be more different.

What does the first drop include?

Monday’s drop is the first delivery of what Philo is calling A1, the first instalment or “edit” from “a seasonless, continuous body of work.” The collection contains 150 styles across ready-to-wear, bags, shoes and other accessories, all with little-to-no branding. Sunglasses start at $450, while shearling jackets top out above $20,000. Leather bags run from $3,500 to $8,500.

There is plenty for fans of the designer’s minimalist Celine, from a strong-shouldered black cashmere coat to a suit with a high-waisted, floor-length skirt, as well as a harder, raunchier looks, like ripped and torn skirts and pants that unzip all the way up the backside, reports BoF editor-at-large Tim Blanks after a visit to Philo’s studio to see the clothes up close. All-important accessories include large-scale leather totes.

What is the go-to-market strategy?

Phoebe Philo’s new venture is a start-up. If Philo had wanted to helm a bigger business, she could surely have walked into a creative directorship at any number of major labels. Instead, she has chosen another path. “To be independent, to govern and experiment on my own terms is hugely significant to me,” she said in the statement to BoF back in 2021.

This has implications for Philo’s go-to-market strategy. While the venture will surely have a leg-up over other designer projects thanks to backing from luxury’s biggest conglomerate, the label doesn’t plan to follow the traditional luxury playbook: today’s launch came with neither high-gloss stores nor a multi-million-dollar fashion show.

Instead, Philo, who famously snubbed social media at Celine and was a latecomer to e-commerce, is embracing digital distribution as her primary path to market.

Philo’s first drop is available only via her own website. There is no physical retail, nor wholesale distribution, keeping costs low and margins high. Volumes have been sharply limited so the site offers “notably less than anticipated want.” The focus on scarcity, in some ways reminiscent of the model perfected by streetwear giant Supreme, is designed to ensure demand always outstrips supply, creating a sense of urgency amongst would-be shoppers and eliminating the risk of unsold inventory. This makes the label more sustainable, both economically and environmentally.

How did the launch go down?

Though they had received email updates notifying them of Philo’s 30th October launch, many registered “Philophiles” woke up Monday unsure exactly when phoebephilo.com would go live. The precision of Supreme drops — which happen at a fixed hour every Thursday — this was not.

And yet eager fans refreshed their browsers in anticipation until the launch came, soon after 3pm London time, with an email blast saying “phoebephilo.com is now open” and the unveiling of a minimalist website with a unconventional black background featuring a scrollable collage of mood shots and a grid of products available for shipping to Europe, the UK and the US. Currently, the site does not ship to the key China market.

The first item to sell out was a silver “Mum” necklace at $4500, though not all of the pieces were available to shop immediately. A luxe-looking coat in cream glossy viscose twill with all-over hand-combed embroidery came with the note: “Contact client services.” Meanwhile, the label’s quilted Drive bags, which appear in images on the site, were not included in the first delivery.

By Monday evening, many items had sold out including kitten-heel club loafers, drop-shoulder knit turtlenecks, leather bombers and a $4,800 tote with rectangular hardware resembling Philo’s best-selling “Classic” bag for Celine. But plenty of options including menswear-inspired overcoats, high-heeled ankle boots and ultra-oversized totes priced at $8,500 remained in stock.

Will it work?

Although building a direct e-commerce channel is more complex than simply wholesaling to third-parties, it offers better margins and far greater control over everything from customer data to pricing, making it much easier to rapidly test and optimise a strategy. In a noisy market, going direct-to-consumer also allows young labels to send a much clearer brand signal.

Marketing can be a challenge. DTC ventures often sink because they spend too much to reach customers, who don’t always buy at full price. It certainly helps to have star power at the helm. Philo is no Kardashian. The designer still holds social media at arm’s length. But she has her loyal Philophiles, whose email addresses have helped to quickly populate a valuable customer database, and the approach is so targeted that early drops are bound to perform brilliantly.

To be sure, LVMH has been burned by its digital-first misadventure with Rihanna’s short-lived Fenty fashion label. But what ultimately sank that project was a misalignment between the pop star’s fan base and Fenty’s prices, as well as poorly executed product. Philo, with her affluent fanbase and exacting approach to design, isn’t facing either of these challenges.

What comes next?

Two more deliveries of A1 are expected by year end, with A2 to follow in the Spring of 2024. The cadence of these drops remains undefined, and that may be on purpose: a web store that opens only at irregular intervals can create a sense of urgency and event.

Whether Philo can turn the online concept into a meaningful business remains to be seen. Longer term, her target customer may need to expand beyond wistful “Philophiles” to VICs on Mytheresa and Net-a-Porter: busy women in need of a reliable arbiter of taste.

As for LVMH, the group’s 2022 investment in Aimé Leon Dore suggests they are keen to continue experimenting with ways in which streetwear dynamics like scarcity-driven drops and tribal consumerism can be brought to other aesthetics and price points. Stay tuned.

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.