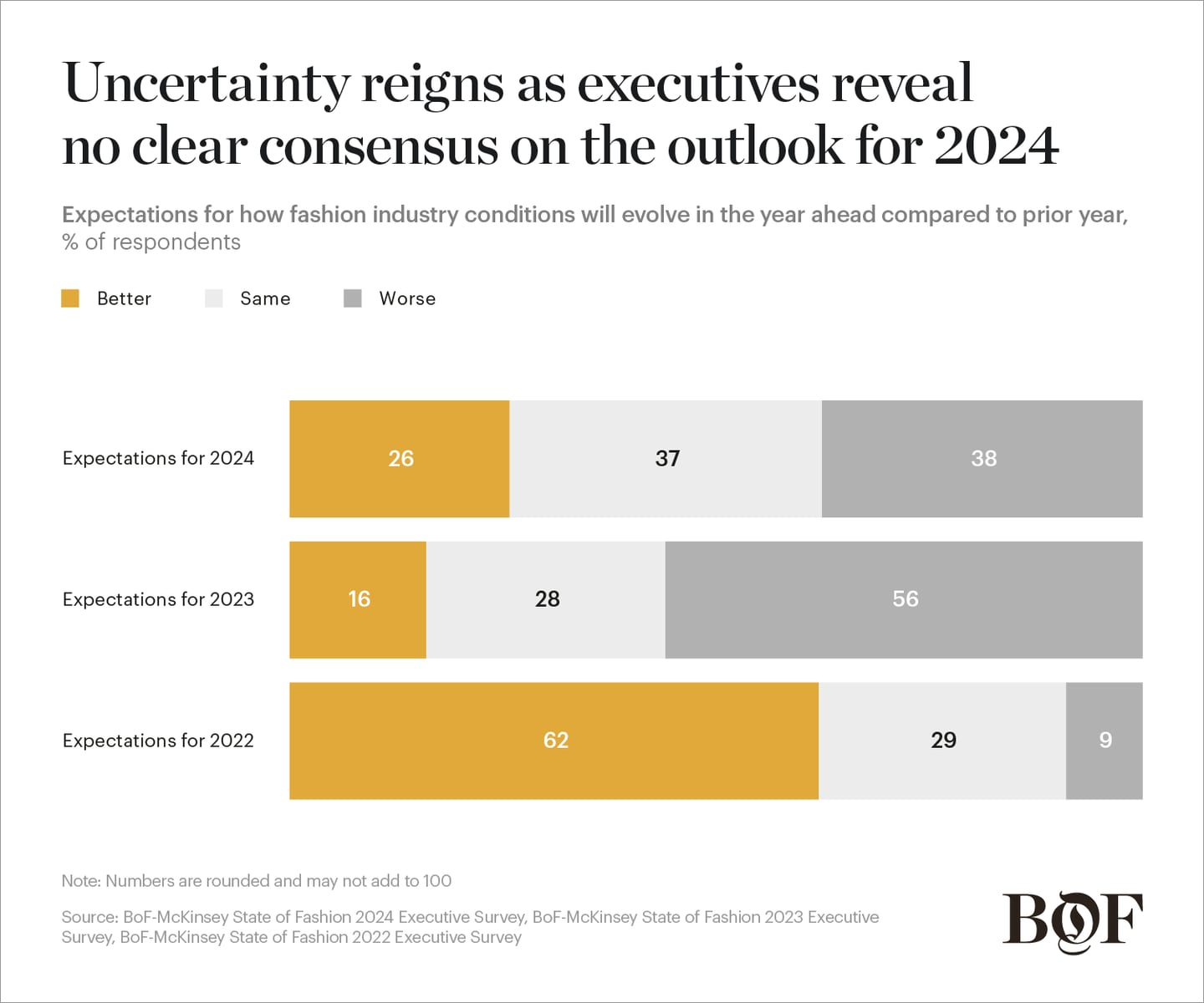

Fashion industry executives looking towards 2024 are on edge. The most prominent sentiment among fashion leaders is “uncertainty,” according to the BoF-McKinsey State of Fashion 2024 Executive Survey. Causes for concern include geopolitical events, weakened economies and the continuing impact of high interest rates. Yet executives also see some reason for optimism in specific markets and segments.

Looking ahead to 2024, 26 percent of respondents to the survey conducted in early September expected conditions to improve year on year, 37 percent expected conditions remain the same and 38 percent expected the situation to worsen, marking the biggest divide in executives’ expectations for the year ahead since the inception of the BoF-McKinsey survey in 2017. Yet the outbreak of the Israel-Hamas war in October underscores the uncertain environment, raising questions about whether a regional widening of the conflict could impact the global economy and have ramifications for the fashion industry.

Geopolitics continue to be a firm fixture on executive radars — 62 percent of respondents to the survey cited geopolitical instability as the top risk to growth, while economic volatility is cited by 55 percent.

Inflation concerns appear to be diminishing. Among surveyed respondents, 51 percent cited inflation compared to 78 percent in the previous year’s survey, perhaps an acknowledgement that central bank policies are starting to achieve their intended results, after inflation rates began rising to historic highs in the US and Europe in 2022.

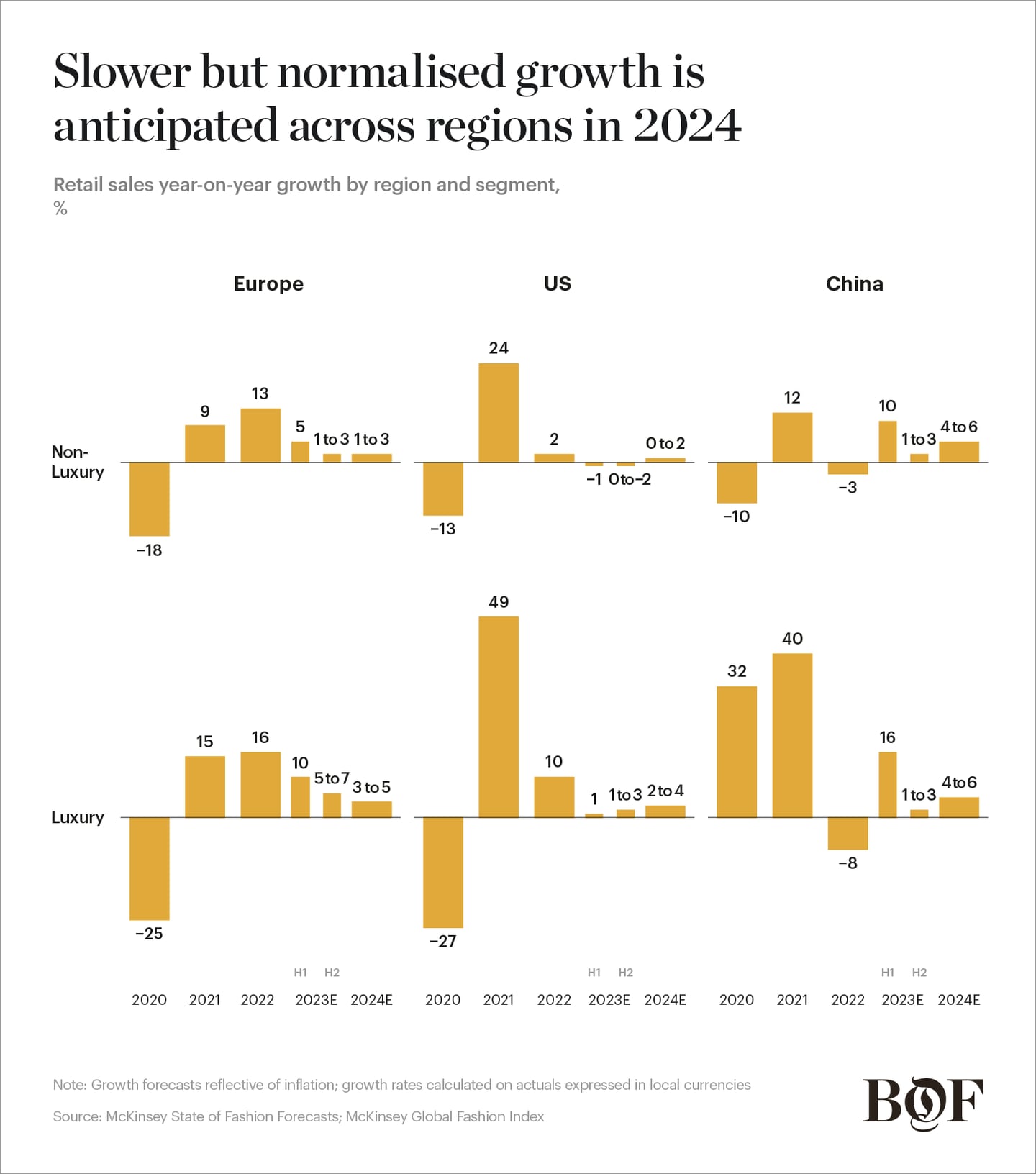

As for business performance, top-line year-on-year growth is expected to be lacklustre in 2024, at between 2 percent and 4 percent globally, according to the McKinsey Fashion Growth Forecasts. However, regional and country variations in both luxury and non-luxury segments will be evident.

Non-Luxury’s Steady Path

Overall, non-luxury retail sales growth is forecast to remain steady year on year in 2024 at between 2 percent and 4 percent. In Europe, non-luxury growth of between 1 percent and 3 percent is expected, after recording 5 percent in the first half of 2023 and 1 percent to 3 percent in the second half, due to slumping consumer confidence and declining household savings, amon

g other factors. When taking into account the forecasted high core inflation of around 3 percent to 4 percent, the growth outlook is even more limited.

In the US, non-luxury growth is forecast at 0 percent to 2 percent amid declining consumer sentiment. Slightly slower increases in the rate of inflation — forecast at around 2 percent to 3 percent in 2024 — may result in mildly more positive growth. However, a “soft landing” is forecast if, as expected, the country avoids outright recession, helping inflation to get under control more quickly than in Europe. E-commerce activity is expected to pick up after the post-pandemic slowdown in which consumers rebalanced spend towards in-store retail. Among survey respondents, 64 percent identified owned online channels as a more important growth driver than in the previous year.

In China, non-luxury demand remains relatively weak compared to historical growth rates, reflecting economic uncertainty and subdued consumer confidence. Even so, growth is projected to outpace that of the US and Europe, at 4 percent to 6 percent. Positive factors include subdued inflation and the ongoing expansion of the middle class, which is underpinning demand for contemporary and premium fashion. Consumer sentiment shifts towards trading down are also bolstering the large mass-market segment. More opportunities within growth categories such as sportswear and outdoor wear will likely be spurred by government initiatives and shifting consumer preferences for healthier lifestyles and wellbeing.

Luxury’s Restraint

Luxury’s global retail sales growth is forecast to slow to between 3 percent and 5 percent in 2024, from between 5 percent and 7 percent in 2023, as consumers restrain spending after a post-pandemic shopping surge.

In Europe, year-on-year growth of between 3 percent and 5 percent is predicted in 2024, compared to 10 percent in the first half of 2023 and 5 percent to 7 percent in the second half of the year. An anticipated rise in inbound tourism, boosted by Paris’ hosting of the Olympic and Paralympic Summer Games, will likely be a growth driver, as will a pipeline of store openings in tier two and tier three cities across Europe.

In the US, luxury is expected to grow at 2 percent to 4 percent year on year in 2024, compared to 1 percent in the first half of 2023 and between 1 percent and 3 percent in the second half. This would represent a return to the long-term pace, with slightly stronger sales driven by higher-end aspirational brands. However, the luxury boom of recent years is not likely be rekindled. Rather, stabilisation at a lower level is expected. A strong dollar against, for example, the euro may also lead to some spend shifting abroad.

As for China, luxury growth of 4 percent to 6 percent is expected, compared to 16 percent in the first half of 2023, which dropped to between 1 percent and 3 percent in the second half. Though moving in the right direction, the projected growth rate in the year ahead stands in sharp contrast to 2020′s 32 percent and 2021′s 40 percent. Renewed uptake of international travel may dampen domestic demand, as affluent consumers resume shopping for luxury outside the country. However, it’s worth noting that the size of China’s luxury market remains almost double what it was in 2019.

While the biggest fashion markets are seeing only tepid signs of renewed growth, others may be more compelling. When asked about the countries or regions they believe will be the most promising in the year ahead compared to 2023 in the survey conducted in September, executives cited the Middle East (51 percent net intent), India (39 percent net intent) and Asia Pacific (34 percent net intent). North America and China recorded 8 percent and 3 percent respectively, while Western Europe was negative 11 percent.

As for expanding physical footprints, the US, Middle East and Asia Pacific stand out as priorities, with executives reporting net intent of 44 percent, 45 percent and 45 percent respectively. North America is the biggest investment destination, with 48 percent of executives citing footprint expansion plans in the region, compared to 44 percent in Western Europe.

Eyes on the Prize

In 2024, 71 percent of surveyed executives said they will focus on increasing sales, compared to 63 percent the previous year. Achieving that growth will likely require laser-sharp attention on pricing and promotion strategies, with a large portion of investment directed to potential quick wins.

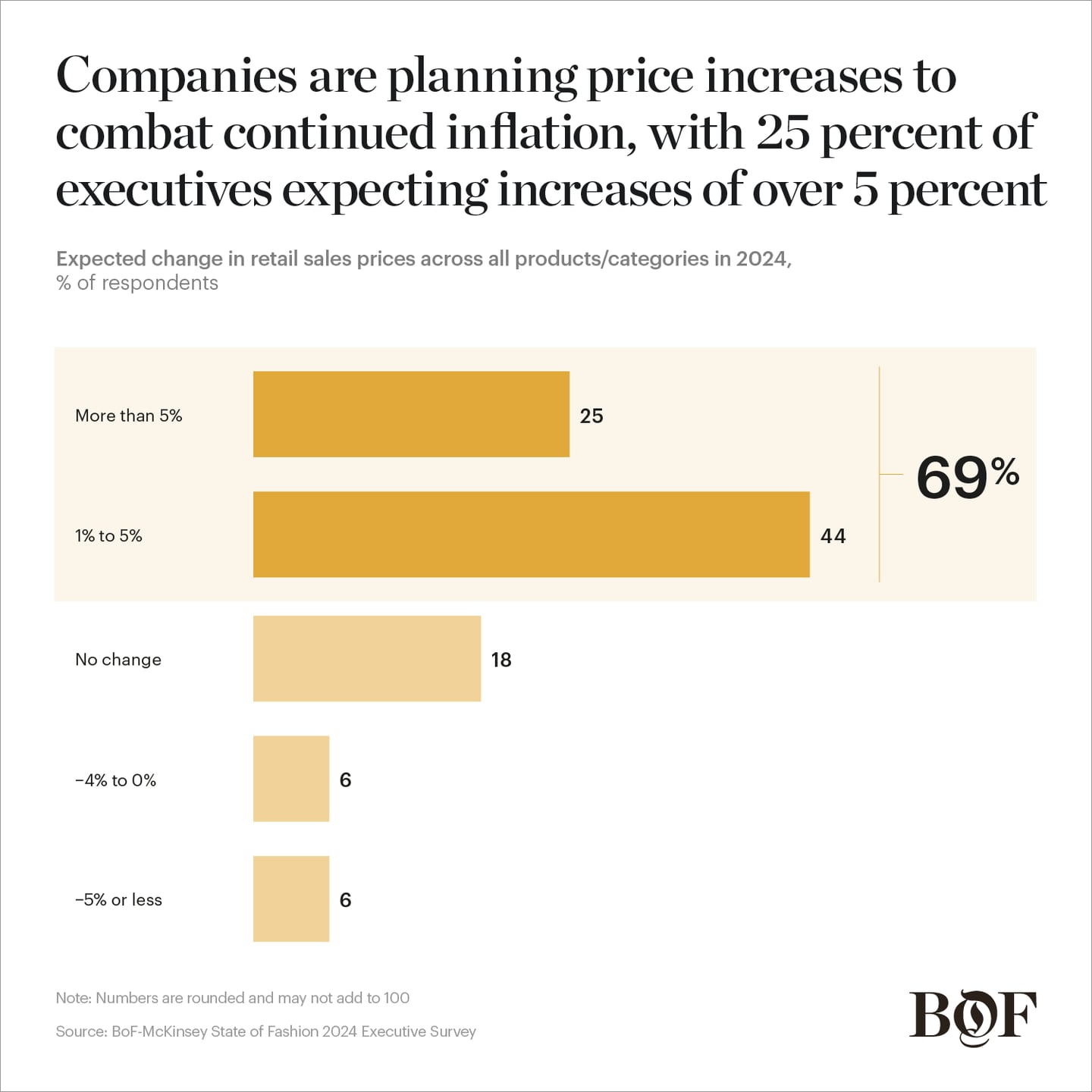

Indeed, pricing strategies are likely to be particularly critical given weakening prospects for volume growth. Net intent to raise prices across the industry is 50 percent, with 69 percent of executives planning to lift prices, compared to 58 percent a year ago. Among the surveyed executives, 44 percent expect to raise prices by up to 5 percent, while 25 percent plan price increases of more than 5 percent. Companies that succeed in driving growth through price rises will likely take a precise, carefully tailored approach.

Simultaneously, decision makers will likely keep a tight grip on costs and investments. However, the industry has already seen widespread cost cutting, suggesting the focus should be on stricter controls rather than cuts.

The good news is that executives expect cost pressure to abate, with just 18 percent of executives predicting their companies’ cost of goods sold (COGS) to grow more than 5 percent next year and 19 percent expecting selling, general and administrative expense (SG&A) to rise more than 5 percent. This is in contrast to last year, when 55 percent expected COGS growth of more than 5 percent, and 40 percent expected SG&A growth of more than 5 percent. One reason is fading concern about inflation, with 12 percent and 18 percent of executives expecting COGS and SG&A respectively to remain steady, compared to 1 percent and 3 percent last year. Additionally, the successful implementation of cost measures over the last couple of years have already absorbed many of the potential cuts.

Strategic Priorities

As climate change continues to gather pace, fashion executives remain focused on building more sustainable businesses. When identifying the biggest challenges and opportunities in the year ahead, some 12 percent cite sustainability as a principal opportunity for 2024, placing it at the top of the C-suite agenda. However, reflecting the scale of the task and rising regulatory pressure, 12 percent also name it as a top challenge. Finding a balanced way to implement sustainability improvements and risk-reduction programmes with competitive advantages is likely to be a key challenge for fashion executives in 2024.

Another opportunity high on executives’ agendas is an innovation that has been surrounded by buzz in 2023: artificial intelligence, and particularly generative AI. Given its application across the fashion value chain and among functions, fashion companies are already starting to experiment cautiously. Those efforts are likely to continue in 2024, with a view to scaling use cases where there are demonstrable performance upsides.

As for consumers across markets, discretionary spend is likely to zero in on categories and brands on which they feel they can rely. Hard luxury goods — jewellery and watches — as well as leather goods are emerging as key categories, as more players enter the market and consumers seek to invest in pieces that will maintain or increase in value over time. Meanwhile, focused brand-building may help companies stave off challenges across segments, with consumers gravitating towards brands with the greatest differentiation and brand storytelling.

In the face of an uncertain future marred by continued macroeconomic challenges, fashion executives may need to make bold decisions: leading players cannot allow an ambiguous outlook to cloud decision making when seeking to capture growth opportunities ahead.

The 10 fashion industry themes that will set the agenda in 2024:

1. Fragmented Future

In 2024, the global economic outlook will likely continue to be unsettled. As new and ongoing financial, geopolitical and other challenges weigh heavily on consumer confidence, fashion markets in the US, Europe and China are facing differing headwinds, requiring suppliers, brands and retailers to bolster contingency planning, among other measures.

2. Climate Urgency

The frequency and intensity of extreme weather-related events in 2023 mean the climate crisis has become even more visible, leaving the fashion value chain especially vulnerable. With climate risks worsening across continents, the fashion industry can’t hold off any longer on building resilience into its supply chains and helping to abate emissions.

3. Vacation Mode

Consumers are gearing up for the biggest year of travel since before the pandemic. But a shift in values means travellers have a different set of expectations, even as shopping remains high on the agenda. Brands and retailers should consider refreshing distribution and category strategies to meet travellers wherever they are.

4. The New Face of Influence

It’s time for brand marketers to update their influencer playbooks. A new guard of creative personalities is gaining brands’ attention, winning trust and fandom among key audiences. Working with these personalities in 2024 will require a different type of partnership, an emphasis on video and a willingness to relinquish a degree of creative control.

5. Outdoors Reinvented

Technical outdoor wear has been propelled by consumers’ post-pandemic embrace of healthier lifestyles as well as “gorpcore,” and is likely to accelerate even further in 2024. More outdoor brands will likely launch lifestyle collections while lifestyle brands embed technical elements into collections, further blurring the lines between functionality and style.

6. Gen AI’s Creative Crossroad

After generative AI’s breakout year in 2023, use cases are emerging across creative industries, including fashion. Capturing the value of this transformative technology in 2024 will require fashion players to look beyond automation and explore its potential to augment the work of human creatives.

7. Fast Fashion’s Power Plays

Fast-fashion competition will likely become even fiercer in the year ahead. Challengers, led by Shein and Temu, are changing tactics around price, customer experience and speed. Success for disruptors and incumbents will likely hinge on their ability to adapt to evolving consumer preferences, while navigating regulations that may impact the industry.

8. All Eyes on Brand

Brand marketing will likely be back in the limelight in the year ahead as the fashion industry confronts a shifting landscape in which performance marketing no longer reigns. Consumers’ emotional connections to brands will likely be critical as fashion marketers reorientate their playbooks to emphasise long-term brand-building strategies.

9. Sustainability Rules

The era of the fashion industry self-regulating sustainability is drawing to a close around the world. Across jurisdictions, new rules could have a widespread impact on both consumers and fashion players. Brands and manufacturers need to revamp business models to align with the changes ahead.

10. Bullwhip Snaps Back

Changes in consumer demand have resulted in the “bullwhip effect,” where cuts to orders increase in magnitude at different parts of a supply chain, putting pressure on fashion’s suppliers. Now, if supply is to keep pace with anticipated renewed demand, brands and retailers should consider focusing on transparency and bolstering strategic partnerships.

This article first appeared in The State of Fashion 2024, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.