The plunging value of Japan’s yen has kept archival-fashion seller Sam Barback busy.

The Japanese secondhand market has been an important source of vintage items from labels like Undercover, Number (N)ine and Issey Miyake for Barback’s Los Angeles-based web store, Groupie, since its launch in 2016. But over roughly the past year, Barback said he’s been to Japan three times, including one 11-day trip in January where he visited more than 60 secondhand stores.

“A lot of inventory that’s normally inaccessibly high actually came down to affordable prices,” he said. The biggest opportunity arrived in June, he noted, when the yen fell to a 38-year low relative to the US dollar.

The currency’s historic decline this year fueled a boom in shoppers from around the world visiting Japan in search of designer goods at a relative discount. Luxury has been one target as well-heeled travellers flooded cities like Tokyo, driving double-digit growth for a number of brands.

But it has also powered a surge in sales in Japan’s robust secondhand trade, which has long drawn foreign shoppers looking for used designer fashion. Today secondhand shopping has become a hallmark of visiting Japan popularised on TikTok, while customers outside the country also buy goods online through services such as Buyee, which connects its more than 500 million users to Japanese e-commerce marketplaces such as Mercari Japan, Yahoo! Japan Auctions and Zozotown.

“When I interact with those customers, I think many of them are early adopters to purchasing items from Japan, especially in the US,” said Sei Sato, head of the cross-border e-commerce division at Buyee, which saw sales for used fashion goods double between April and June 2024, with the largest numbers of users buying from the US and greater China. “They’re aware of this financial situation and smart enough to take advantage of it.”

At retailers in Japan sales have risen as well, thanks to tourists and domestic shoppers, who still make up the bulk of Japan’s used-fashion sales, seeking cheaper options amid a cost-of-living crisis. Komehyo, a Japanese department-store chain specialising in used goods, reported record-high net sales for its “brand fashion” business — up 34.5 percent compared to the previous year in the quarter through June. Zozotown reported a 10.2 percent increase in used-fashion sales between April and June of 2024.

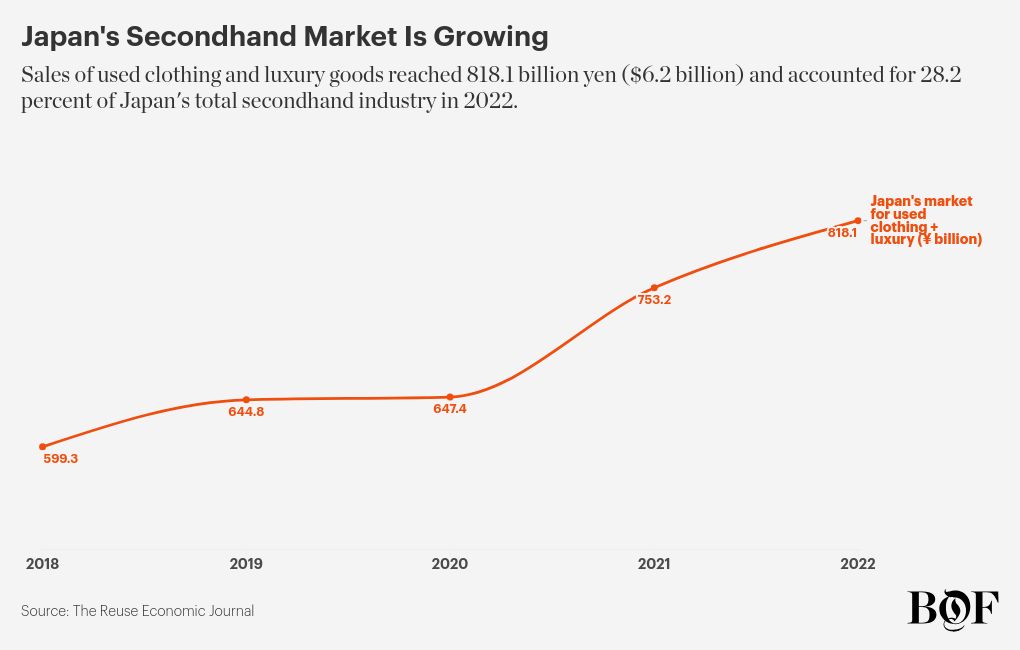

The yen is now rebounding against a softening dollar, climbing back to where it was in January. But Japan’s strong secondhand market remains set to keep growing. Strategy and consulting firm EY forecasts it will grow to $27 billion by 2030.

Japanese Thrifting’s Viral Growth

Sato said Japan’s vast inventory of used luxury and high-fashion goods traces back to the 1990s, a period of economic stagnation known as “The Lost Decade.” Japanese consumers who had become hooked on luxury during the boom years of the 1980s wanted to keep shopping but were looking for bargains. Eventually the country started attracting international shoppers looking to buy used fashion.

“I would say that the biggest change has been the influx of people that are coming to Japan to buy secondhand clothing,” said Reginald Aaron Pipkin, a creator who has lived in Japan since 2010 and is behind the Japanese fashion YouTube channel The Casual.

Pipkin believes the Western appetite for Japanese secondhand clothing grew with the rising interest in archival fashion. Even before the yen’s depreciation, thrifting within Japan and buying vintage Japanese clothing from proxy sites was a common practice among fashion obsessives.

The yen’s fall made it that much easier for these international shoppers to take advantage of the offerings from sellers in Japan. The US-based resale marketplace Grailed said direct transactions between Japanese sellers and US buyers increased nearly 60 percent year-over-year in June and July 2024. Sales were primarily for Japanese-founded brands such as Kapital, Number (N)ine, Yohji Yamamoto and Undercover, while Japanese marketplace Rakuten Rakuma said domestic brands such as Issey Miyake, Angelic Pretty and Goro’s were popular amongst foreign buyers.

Prices haven’t just plummeted to clearance levels and remained there, though. Barback said they are loosely tied to the dollar. “But the quick fluctuations — the 10-percent up or down within a month — can really change things,” he pointed out.

Sato noted that high international shipping costs make inexpensive items less appealing to buyers outside of Japan, which is one reason pricey luxury products are more sought-after on Buyee. The most popular brands are currently Louis Vuitton, Chanel, Hermes, Cartier and Dior. The company’s proxy customers aren’t too different from shoppers flying into Japan to take advantage of the exchange rate when purchasing luxury at retail. Women who use the service are in their 30s and 40s and buying bags or clothing. Men are mostly buying watches.

Cultural Commerce

Although the Bank of Japan intervened in the yen’s plunge by raising interest rates in March and July — and most economists expect another hike before year end — Sato isn’t concerned about a stronger yen reducing sales. He believes proxy shoppers are generally drawn to the condition of used goods and the large supply of vintage clothing in Japan.

“In Japan, the smallest defects or damages [on used goods] affect resale prices dramatically. Whereas in the United States, the same damage will not affect the resale value much,” Sato said.

Tourists find Japan’s secondhand market alluring in part because of the vast number of thrift stores. One of the most popular domestic chains is 2nd Street, which grew from 419 stores in Japan in 2015 to 838 stores in 2024, according to company filings. Since 2018, 2nd Street has also been opening US stores and currently has 37 locations across several states.

Pipkin finds that Japanese thrift stores also attract tourists because of how they’re merchandised to address specific consumer tastes. One floor of used-goods department store Komehyo will be dedicated to handbags while another is focused on menswear. The company said in its most recent earnings that it “enhanced the in-store inventory” to respond to more in-store shoppers and foreigners.

“A lot of these chain [thrift] stores aren’t targeting Japanese shoppers as much as they used to, especially in high-density areas like Shimokitazawa or Harajuku,” said Pipkin.

He believes larger awareness around Japanese fashion overall is just a byproduct of Japanese pop culture going mass. The country’s exports of anime and similar content are nearly equal to those of semiconductors and steel, Nikkei recently reported. The Japan National Tourism Organisation reported that more than 21 million tourists visited Japan through July, on pace to break its annual record-high of 31.9 million tourists in 2019.

“Now, everybody’s coming to Japan, and with the advent of platforms like TikTok, Reels and Shorts, you have more people sharing this information than ever before,” Pipkin said.

The uniqueness of Japan’s used-fashion market makes it a draw on its own, according to Barback. There’s a much greater supply of used designer clothing than in the US. He added that he’s glad shoppers in the West are realising how good the secondhand shopping is in Japan.

“I would love for more people to get over there,” he said. “There’s enough clothes to go around.”