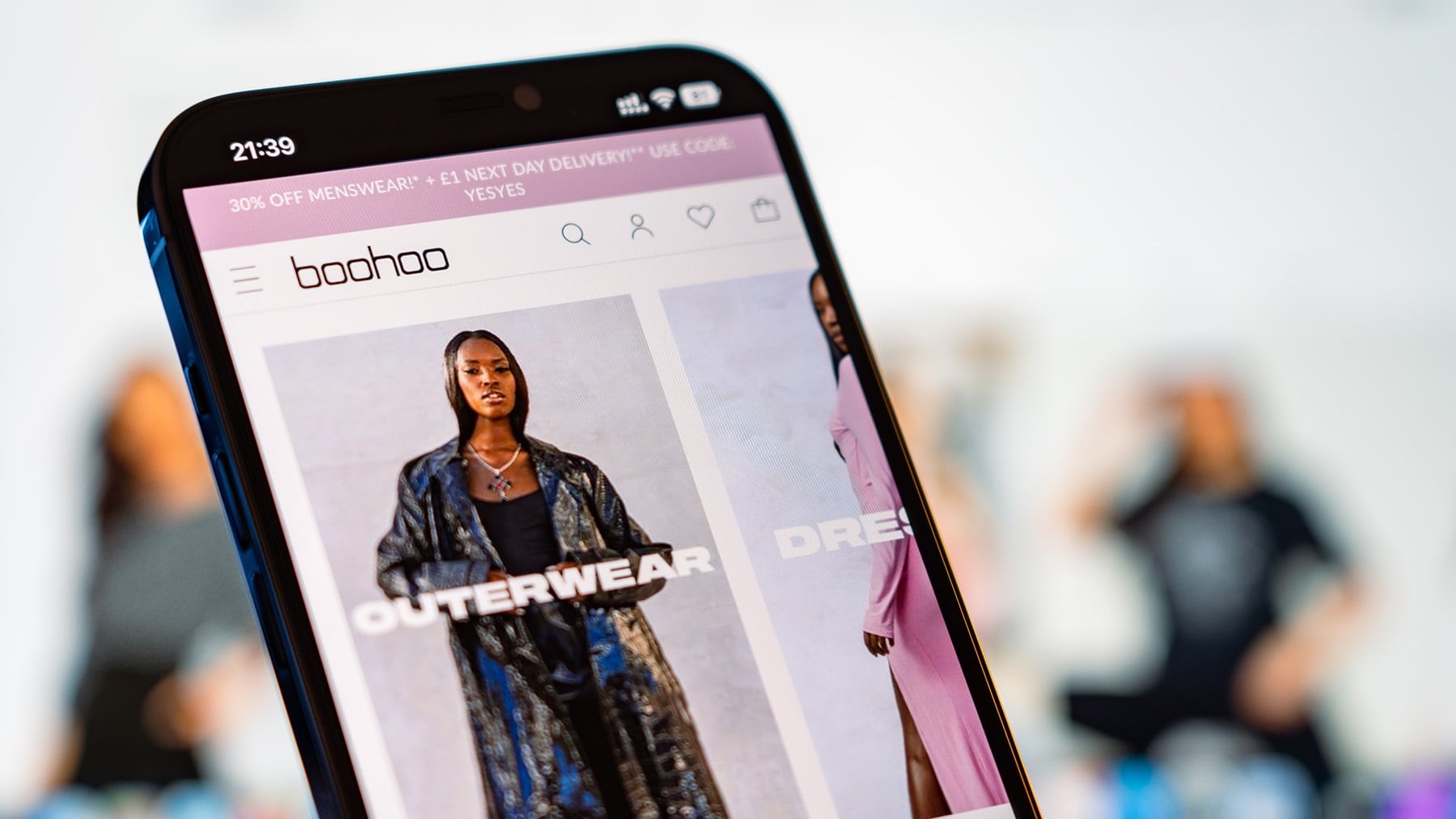

Mike Ashley has asked fast-fashion brand Boohoo Group Plc to appoint him as chief executive, in the British billionaire’s latest confrontation with a struggling retailer.

Ashley’s Frasers Group Plc accused the Boohoo board of ignoring its largest shareholder while presiding over an “abysmal” trading performance, in an open letter published Thursday.

It called for an emergency general meeting for shareholders to vote on the election of Ashley and Mike Lennon, a restructuring expert, as directors.

Boohoo shares rose 4.6 percent in early trading, but are still 30 percent down since the start of the year. Frasers was little changed.

Boohoo CEO John Lyttle stepped down last week as the company announced a strategic review that could lead to its breakup. Frasers said Thursday that no parts of the business should be sold without consulting it and other shareholders.

Ashley owns more than a quarter of Boohoo’s shares, as well as major stakes in retailers including Hugo Boss and Mulberry. On Wednesday he withdrew a takeover bid for Mulberry, the British handbag maker.

Ashley has a history of building up stakes in underperforming retailers and aggressively pursuing the power to implement changes.

Frasers said it has tried to engage with Boohoo’s board, including earlier this month when it said it was denied a meeting with founder and executive chairman Mahmud Kamani.

“We recognise stonewalling when we see it, and these tactics of ‘delay and ignore’ are no longer tolerable in the context of the continued value destruction that the board is overseeing,” Frasers’ statement said.

Boohoo said it’s reviewing Frasers’ request and will respond in due course.

By Julian Harris

Learn more:

Inside Frasers Group Owner Mike Ashley’s Controversial Acquisition Strategy

In British retail, it’s becoming a question of which retailers Mike Ashley doesn’t have a stake in, rather than which ones he does.