Estée Lauder Companies first-quarter earnings on Thursday laid bare the uphill journey incoming CEO Stéphane de La Faverie has ahead of him.

The beauty giant announced net sales had declined 4 percent to $3.36 billion, with a particularly painful 11 percent slide in China, and a 7 percent drop in skincare, its biggest category. It also trimmed its second-quarter sales outlook from flat to minus 8 to 6 percent. Earlier in the day, the company withdrew its 2025 guidance and cut dividend payments by 47 percent. Estée Lauder’s stock slid more than 20 percent to a 10-year low.

The results were more than the latest in a string of bad quarters – they represented a resetting of expectations that could all-but vanquish investor confidence that the company will find a quick solution to its growing list of problems, said Filippo Falorni, a director in Citi consumer’s practice, which downgraded its recommendation on Estée Lauder’s stock to neutral on Thursday. He said the company’s inability to foresee how much sales would drop in China was particularly concerning.

“Investors have already lost a lot of trust … but withdrawing the guidance is kind of the last straw,” he said.

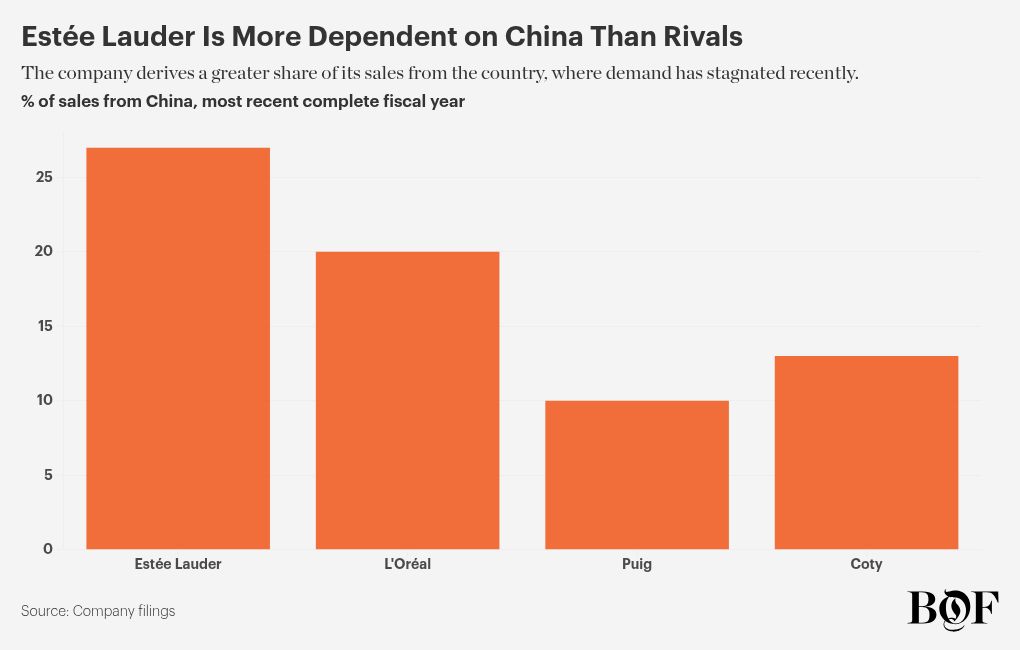

Estée Lauder’s sales have fallen steadily since the start of 2023, led by ongoing softness in China, which makes up around a third of the company’s business, as well as a drag from the closely linked travel retail sector. It reported sales growth around 5 percent in May for the first time since the end of 2022, but couldn’t sustain the momentum. In early 2024, rival L’Oréal eclipsed it as the biggest prestige beauty company, while its core brands, which include cosmetics makers Too Faced, Tom Ford and Mac Cosmetics, were all cited as underperforming in Thursday’s earnings in the key US market.

“We are working hard to rebalance the company and avoid future overexposures to areas of the world that are too volatile,” said incumbent CEO Fabrizio Freda on a call with analysts. But as outgoing chief financial officer Tracey Travis said, “We obviously still have much more to do.”

De La Faverie’s appointment is the capstone on a company-wide shakeup that’s seen incumbent chief executive and chief financial officers Freda and Travis announce their retirements, William P. Lauder and Jane Lauder, two of the founder’s grandchildren, step down as executive chair and chief digital officer, respectively.

While he’s not the outside hire investors favoured, de La Faverie, who will take the top job on Jan. 1 after more than 13 years at Estée Lauder Companies, has prior experience at L’Oréal, so can bring some outside perspective. With the adjustment to the roles of Lauders Jane and William, the company now has less family control over its day-to-day operations. And, by cutting dividends, the company has more headroom for reinvestment in its brands outside of the covenants of the profit recovery plan.

Figuring out which brands are worth saving is step one. Olivia Tong, a managing director at Raymond James said she expected a “deep brand by brand assessment” to be a key early priority for de La Faverie.

“The company needs to make some hard decisions to better focus the portfolio towards long-term sustainable and profitable growth,” she said.

Fix the China Problem

First, de La Faverie will need to come up with a solution for China – or an alternative. Many international prestige brands have struggled as the country’s economy has faltered, with consumers increasingly seeking out domestic brands they feel offer better value for their money.

However, Lauder was hit harder than most, partly because China had become so key to its sales, but also because of its strategy. It hinged largely on daigou, a practice wherein customers on the Chinese mainland deputise others to purchase on their behalf in other nearby regions at a lower cost, and on travel retail outposts in the area, effectively doubling its exposure to volatile markets. Falorni also noted that the majority of its products are still made in the US, creating long lead times for shipping and forecasting. New distribution centres in the region have helped incrementally, and a production facility is set to open in Japan.

Falorni said while the market has been soft, there’s also been a shift in the market that favours mass, more affordable brands, while Estée Lauder Companies still measures itself as against other premium brands.

“They’re not willing to acknowledge [this shift],” he said, adding that cost savings are also necessary throughout the business given its performance. “Most businesses in their position would be much more aggressive on cost-cutting.”

Estée Lauder Companies plans to rebalance its regional growth, with Freda saying that its exposure to China has already reduced by 10 percent since the 2022 fiscal year. “Strategic reset is at the core [of our plan],” he said.

This can partly be achieved by right-sizing inventory levels, as well as continued improvement in its margins, which it has grown by a few percentage points. It’s also targeting key growth markets in regions like Latin America and other parts of Asia like Japan to increase overall diversity.

However, even offsetting the China decline, the company only grew sales 1 percent globally.

Fix the US Problem

Estée Lauder Companies also has issues on its home turf. Sales declined 2 percent in the US in its first-quarter earnings, with many of its core premium brands such as Too Faced and Mac Cosmetics cited as softening. Clinique, which launched on Amazon in March, was a bright spot, but Travis said the Estée Lauder Companies’ overall market share in the US has progressively declined over the last year.

Beauty companies like Coty, L’Oréal and Unilever’s prestige arm have all raised concerns over a slowdown in the US, but Estée Lauder Companies is also facing issues with its channel mix and brand offering. Historically reliant on department stores, it was slower to deepen its relationship with speciality stores like Sephora and Ulta Beauty, and it faces stiff competition from trending brands like Shiseido-owned skincare line Drunk Elephant, L’Oréal-backed skincare maker Cerave and a raft of indies like cosmetics brands Saie, Kosas and Westman Atelier which are popular with consumers.

It has taken steps to stem its losses, partly by debuting seven brands including its titular Estée Lauder line on Amazon, and introducing Clinique to Ulta Beauty, all of which Freda said were performing well.

Still, de La Faverie will need to be mindful of not diluting the brand equity of its portfolio — a fine line with increased distribution.

Fix the Brand Problem

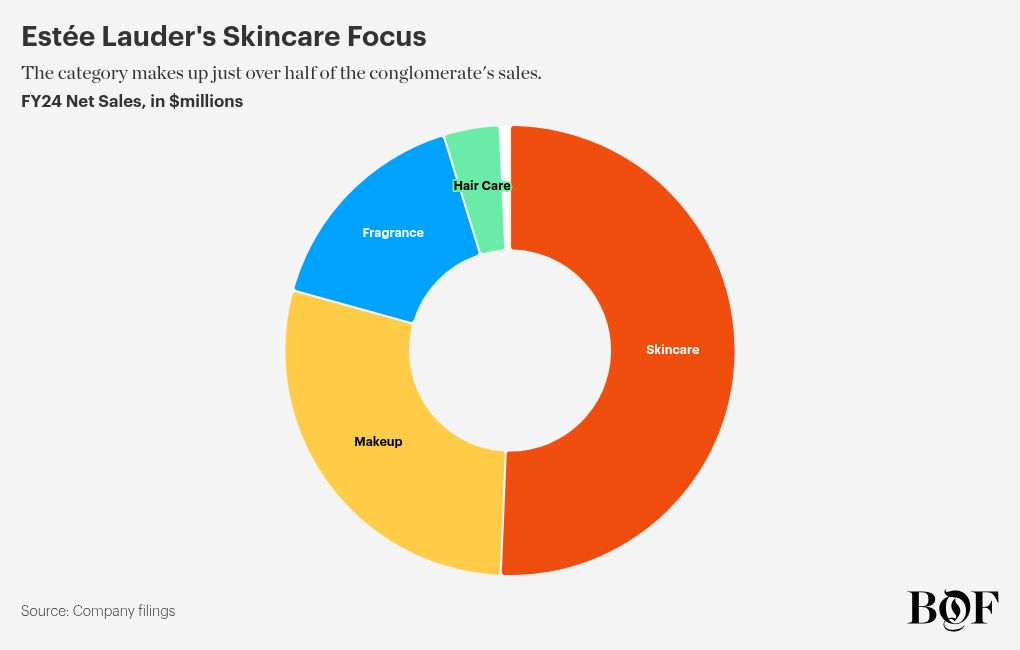

Regional woes aside, de La Faverie’s biggest mission might be that of revitalising the company’s portfolio. Skincare makes up almost half of its overall sales, partly because of its reliance on China where it’s a top category, but fragrance and body care are more buoyant categories in the overall beauty market. Its hair care division has consistently underperformed, with the natural-inspired line Aveda name-checked as underperforming in salons, likely against more modern competitors such as K18, Olaplex and Kérastase.

While some brands like Too Faced and Mac Cosmetics have big social media followings, its brands lack the huge engagement competitor brands like Dior Beauty, Cerave and E.l.f Cosmetics get. De La Faverie will need to find ways to build affection and stickiness for its core brands, and make them products shoppers consider core replenishment items, not occasional treats. A stronger value proposition is needed as aspirational customers retreat in the US. Rebuilding value shouldn’t be around promotional bundles or discounts, but instead investment in the brands to make their offerings feel truly “worth it”.

The company also needs to examine its portfolio divesting unsalvageable brands and investing more in trending lines, like the fragrance makers By Kilian, Le Labo and newly-launched Balmain Beauty. Its biggest and best-known lines, including Mac Cosmetics, could also use some new thinking.

One thing the company and its investors are in alignment on: the business needs to get faster, and fresher.

“We need brand builders, but we need also people that will act with urgency, speed, courage to make the needed changes,” said Freda.

Ironically, that speed and urgency could be a long time coming, given the depth of the company’s issues and the choice of an internal hire for the top job.

“Any turnaround is going to be a multi-year journey,” said Falorni.

Sign up to The Business of Beauty newsletter, your complimentary, must-read source for the day’s most important beauty and wellness news and analysis.