Thailand’s booming luxury market is about to go into overdrive with the opening of a $3.2 billion upscale shopping district in the capital’s diplomatic quarter. One Bangkok, managed by TCC Assets Thailand and Frasers Property, is one of the largest property developments coming online in the country.

Connecting the business districts of Sathon and Silom with Rama IV Road, One Bangkok features Thailand’s first high-street-style row of duplex luxury boutiques dubbed The Parade. The scheme’s three retail zones — The Parade, The Storeys and Post 1928 — opened on Oct. 25, marked by an extravagant ceremony hosting more than 10,000 guests, featuring performances by international singers and Thai superstar “PP” Krit Amnuaydechkorn who serves as brand ambassador for Balenciaga.

Once completed in 2026, the wider development is expected to comprise three shopping centres, five office towers, five hotels and three residential towers.

“This mega project built the first luxury shopping boulevard with more than 20 street-facing facades catering to all — from premium to tier-one luxury brands,” said Joe Chan, retail leasing manager at One Bangkok, adding that brands are increasingly focused on expanding store networks beyond the city’s malls.

Retailers that have opened during the first phase include multi-brand luxury boutique Club 21, which sells everything from JW Anderson and Jacquemus to Moncler and Comme des Garçons in its stores across the Southeast Asia region, and mono-brands for Thai labels Jim Thompson and Ravipa, China’s Urban Revivo and Swatch.

Six months ago, One Bangkok executives informed BoF that over 80 percent of the overall space had been leased but declined to disclose any of the brands that have signed up for areas in the development that have yet to open.

Thailand’s $2.4 billion luxury market

With developments like this, Thailand is consolidating its position as a hub for luxury consumption in the region. Euromonitor International projects that the Thai personal luxury goods market will reach 83.8 billion Thai baht ($2.4 billion) in retail value this year, increasing at a compound annual growth rate (current value CAGR) of 9 percent through to 2029 when it is forecasted to be worth 128 billion Thai baht ($3.6 billion).

While international tourists are an important driver of Bangkok’s luxury boom there has also been significant growth in domestic demand — from both affluent Thais and expats working for multinational firms based there.

Thailand’s ultra-high-net-worth individual (UHNWI) demographic — defined as those with assets surpassing $30 million — is set for substantial growth, according to property consulting firm Knight Frank. Projections indicate a 14.7 percent increase in UHNWI numbers by 2028. Thailand stands as the third-largest hub for UHNWIs in Southeast Asia, trailing only financial powerhouse Singapore and the far more populous nation of Indonesia.

“For years, Thailand has been well positioned to cater to affluent high-net-worth individuals (HNWIs or US dollar millionaires) with its world-class luxury malls and retail conglomerates, fuelling industry growth and global visibility,” said Alex Anton, co-founder of 2-Times, an invite-only luxury online retailer and event-based private shopping service in the Asia-Pacific region. “[It’s] a trend that the pandemic accelerated digitally too, leading to an overall boost in demand for luxury goods.”

With its localised private clienteling specialists who cover Thailand, South Korea, Japan and Greater China for clients in markets like Hong Kong, Singapore and Australia, 2-Times has noted a 35 percent year-on-year sales uplift from Southeast Asia this year, said Anton. “Thailand comfortably accounted for the largest share of traffic with sales up 22 percent, and Singapore was in second place up 10 percent.”

Local female executives are helping to drive a sales spurt in the luxury jewellery and watches category, says MingYii Lai, project leader and research manager for Southeast Asia at Daxue Consulting. “This highlights [Thai] women’s growing empowerment and financial independence, reflecting a broader cultural shift where female leaders are influencing the buying decisions [of each other] and those of their followers.”

The race for space

It’s not just new properties like those in the One Bangkok district that are looking to capture this influx of local and foreign shoppers. Legacy malls like Siam Paragon, Gaysorn, the six-year-old IconSiam and Central Embassy are pulling out all the stops by feverishly expanding their tenancy rosters. Some are repurposing adjacencies for existing tenants and others are expanding their footprints in a bid to persuade luxury brands to open more outlets and larger stores.

“Some retail malls are renovating a lot and reshuffling their tenants, and many of the luxury brands are building duplexes or even triplexes in malls,” confirmed Chan.

Siam Piwat group’s Siam Paragon is set to unveil several new flagship stores in the latter half of the year, including the first Dolce & Gabbana concept store in Southeast Asia, a fresh Gucci concept, and Casablanca making its Thai debut. The mall operator has already opened 20 new luxury boutiques this year, including Chaumet and Ami Paris. Last year, it opened 35 luxury boutiques across Siam Paragon and IconSiam. Notable additions included the Thai debut of Loro Piana and the first menswear boutiques from Louis Vuitton and Fendi.

Saruntorn Asaves, executive VP and head of the shopping centre business division at Siam Piwat, said traffic at Siam Paragon, Siam Center, and Siam Discovery surpassed 37 million people during the first half of the year, adding that he is expecting higher growth in the second half.

At the Gaysorn Amarin mall, Louis Vuitton opened a multi-faceted experiential building earlier this year dubbed ‘LV The Place Bangkok’, home to the brand’s first restaurant in Southeast Asia, created in collaboration with award-winning Bangkok-based Indian chef Gaggan Anand.

Besides One Bangkok, there is another ‘mega project’ in the capital that bowed just last year: the EM district. Siam Paragon’s co-owner, The Mall Group, launched its $403 million development Emsphere as an anchor for the 650,000 sqm district. EM comprises two other shopping complexes, Emporium and EmQuartier, both of which host luxury labels. New stores opening in the district include Ami’s first Thailand store, Gentle Monster’s first physical store and Cartier’s largest boutique in the country.

Supaluck Umpujh, the Mall Group chairwoman who championed the development of the EM district, is also leading the company’s retail expansion in Thailand’s popular resort cities and islands such as Hua Hin and Phuket.

Ambitious tourism goals

Thailand has ambitious goals for its tourism industry, which accounts for somewhere between 11 and 18 percent of GDP. Targeting an unprecedented 40 million foreign tourists next year — a figure that would surpass pre-pandemic records — the country’s new prime minister Paetongtarn Shinawatra hopes to earn 3.4 trillion baht ($101 billion) in tourism revenue.

Tourists from diverse nationalities are a key driver of the Thai luxury market with Chinese, Arab, Indian and Russian visitors playing an outsized role. As Lai points out, Bangkok’s strategic location and airline connectivity also regularly attracts affluent shoppers from nearby countries Cambodia, Laos and Vietnam.

One company looking to tap the travel retail market even more is Central Group which not only owns an extensive portfolio of malls across its home country and other Asian nations but also controls European luxury retailers like Selfridges Group department stores in the UK, Ireland and the Netherlands, KaDeWe in Germany, Switzerland’s Globus, Italy’s La Rinascente and Illum in Denmark.

The conglomerate has earmarked 15 billion baht ($461 million) in investment over five years to expand its presence in popular tourist destinations beyond Bangkok, including developments in Chiang Mai and Krabi. A key project in the latter location is a 4.5-billion-baht mixed-use complex called Central Krabi set to open this year, featuring a shopping centre, residential areas, condominiums, and hotel facilities.

In Bangkok, the firm is set to unveil its upgrade of the Chidlom department store next month, following a 4-billion-baht renovation. “The transformation of Central Chidlom isn’t just a makeover. We’re redefining the shopping experience to make [it] an iconic destination in the city and a hotspot for global customers seeking a unique, customer-centric experience,” said Natira Boonsri, CEO of the group’s Central Retail-owned Central Department Store Group unit, noting that the store has Chanel, Louis Vuitton, Gucci and dozens of other luxury brands as concessions in the 60,745 sqm space.

While Bangkok has long been considered the primary gateway and transit hub for luxury retail shoppers visiting other destinations in Thailand, tourist patterns are shifting. For one, there are now more direct international flights to some of the country’s islands and beach resorts. Luxury brands have responded by trying to capture more spend outside the capital at travellers’ final destinations, such as Phuket and Koh Samui. Prada, for example, is said to be opening its first boutique outside Bangkok, in Phuket.

Developers are leading the way into the provinces. In September, Siam Piwat Simon — a joint venture between real estate investment trust Simon and Siam Piwat — announced the expansion of Siam Premium Outlets to Phuket, set to open in 2026. Meanwhile, Central Group’s Central Pattana plans to nearly double the luxury store space at Central Phuket by the end of this year.

The luxury offering on the island will soon grow even more, says Wilaiporn Pitimanaaree, senior VP of Central Phuket, citing plans to quadruple the size of its luxury zone from 2,000 sqm to 8,000 sqm and more than double the number of luxury brand tenants by 2026.

A cultural hub with regional influence

Thailand’s tourist attractions are not the only thing luring international visitors to the country’s shopping districts. A surge in popularity of Thai celebrities overseas is giving a boost to luxury retailers.

Blackpink’s Lalisa Manobal was announced to be the headliner for the Amazing Thailand Countdown 2025 at shopping centre Iconsiam, an event aiming to attract more than 20 million guests in person and through live broadcasts. “This will uplift the image for Thailand and stimulate the economy, especially the tourism sector,” said Supoj Chaiwatsirikul, managing director of Iconsiam.

Thai celebrities are also increasingly effective sales drivers for luxury brands looking to tempt both local and overseas shoppers.

“From a multi-brand speciality store lens, [our] top private clients for Thailand are influenced almost completely by celebrity and ambassador brand endorsements, even going so far as to search terms like ‘Gemini NT LV’ and ‘PP Krit Balenciaga’,” said 2-Times’ Anton, referring to the respective nicknames for celebrities Norawit Titicharoenrak and Krit Amnuaydechkorn and their brand affiliations.

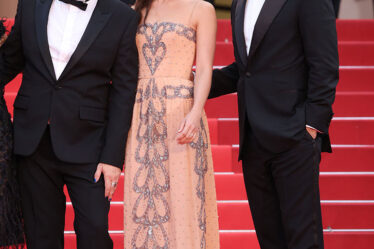

The Korean entertainment industry has paved the way for Thai talent to draw international recognition. Among the most prominent Thai stars who have made their mark are K-pop band members Lalisa Manobal, Got7′s Bambam and (G)I-DLE’s ‘Minnie’ Nicha Yontararak. Musicians Lalisa and Bambam are already brand ambassadors for Louis Vuitton and Minnie is linked to Miu Miu.

“Leveraging the influence of Thai [stars]…and their adoring fan bases greatly enhances the sales efficacy of luxury branded limited-edition releases, which are often viewed as far more desirable than seasonal collections,” Anton added.

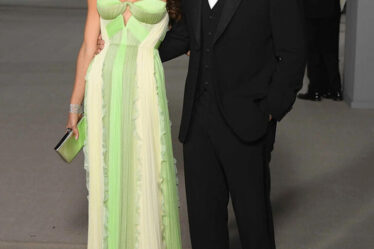

The popularity of Thai television series and movies across the wider Asia region has motivated brands like Dior Homme and Piaget to sign with ‘Apo’ Nattawin Wattanagitiphat. Thai actress Davika Hoorne snagged ambassadorships from Gucci and Bulgari, while ‘Baifern’ Pimchanok Luevisadpaibul partnered with Loewe. ‘Bright’ Vachirawit Chivaaree was tapped by Burberry and Calvin Klein.

A similar phenomenon is happening in Thailand’s beauty sector, though it is the brands themselves that are as much the bait as the celebrities who endorse them. The growing popularity of local Thai ‘T-beauty’ brands across Asia has made their home market an increasingly attractive one for global players to invest in. The net effect is a wide-ranging cosmetics and skincare offering luring shoppers from the wider region.

A few Thai fashion brands have also garnered international recognition thanks to local stars. An outfit by Thai label Pipatchara, for example, created a lot of buzz after Lalisa Manoban wore it at this year’s F1 Monaco Grand Prix, prompting some Instagram users to enquire which retailers sell the brand in Thailand.

It all adds up to increased traffic at Thailand’s retail hotspots. The more that local brands and celebrities broadcast their cool factor and cultural clout abroad, the more overseas consumers choose Thailand for their upcoming shopping trips.