Decarbonisation of fashion’s supply chain could cost $1 trillion, but it is likely more economically viable than executives think. Yet factors mask this reality:

- 70 percent of fashion emissions occur upstream, yet suppliers struggle with the upfront costs of decarbonisation initiatives due to tight margins and high financing costs.

- Cost-effective levers (e.g. energy efficiency) typically involve significant collaboration and shifts in business operations that can leave suppliers exposed to risks such as slower lead times and adjustments to order volumes.

- Competing business priorities are often prioritised over sustainability initiatives that are comparatively difficult to measure in terms of impact and return on investment.

Additionally, the fashion value chain spans thousands of players with limited integration. This restricts the impact of investment and makes charting an optimal, cost-effective path to decarbonisation inherently complex:

- There are over 300,000 fashion brands worldwide, each representing no more than 3 percent of total industry sales.

- Meanwhile, approximately 60 percent of global apparel production is conducted by small- and medium-sized suppliers, who may struggle with uncertain volume commitments, and competing sustainability initiative requests from brands. Similarly, they often lack the credit and guarantors to secure funding.

On top of this, there is an “action-intention” gap when it comes to consumers and sustainable fashion. While 46 percent of UK shoppers say they avoid buying fast fashion, more than half made a purchase at a fast-fashion retailer in the past year.

Consumers’ willingness to pay a premium for sustainable goods remains unclear. In the US and UK, for example, 61 percent of consumers rank price as a more important consideration than sustainability in fashion purchases.

This places the onus on brands to actively engage and educate consumers to ignite demand for sustainable products. With the exception of a handful of brands, the industry has yet to unlock a marketable, at-scale value proposition for sustainable fashion.

Brands, suppliers and innovators are struggling to make progress

Brands are deprioritising sustainability and scaling back their commitments

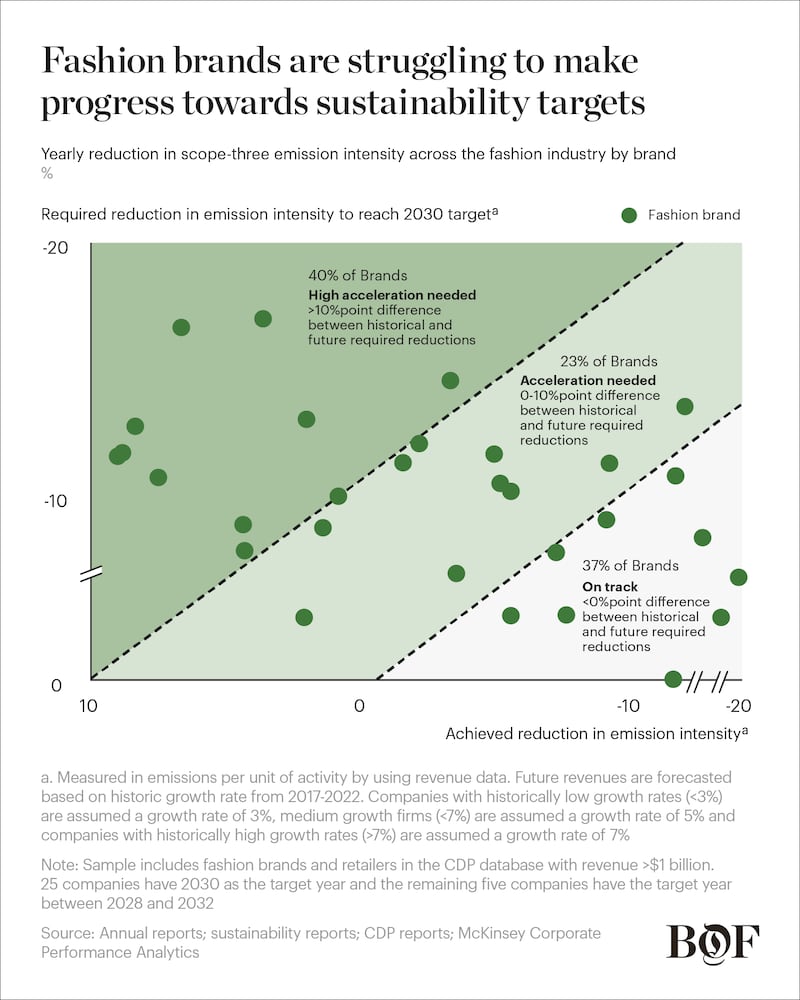

63 percent remain behind on their sustainability commitments. Yet only 18 percent of fashion executives rank sustainability as a top three risk to growth in 2025, compared to 29 percent for 2024.

Many fashion brands are scaling back their commitments, for example by pushing back or dropping their net zero targets.

Suppliers are also deprioritising sustainability

Over 40 suppliers have failed to meet commitments to set science-based sustainability targets, largely due to feasibility and high costs.

Sustainable innovations are struggling to scale

Swedish textile recycler Renewcell filed for bankruptcy in February 2024. It has since been refinanced and renamed Circulose by Altor Equity Partners with a focus on scaling the compelling technology with new financing and support. Similarly, Bolt Threads paused operations of its leather-alternative Mylo, backed by Stella McCartney and Adidas in June 2023. Both reported difficulties securing sufficient financing and volumes required for scale.

Other sustainable material players, such as TomTex, are now seeking partnerships outside of fashion to secure larger order volumes.

Inaction is not an option. The fashion industry can focus on cost-effective decarbonisation

Brands must consider swift action

By 2030, global apparel consumption is projected to rise by 63 percent to 102 million tonnes. On this trajectory, by 2050 the apparel industry would represent more than one quarter of the world’s carbon budget. Similarly, regulation such as the EU Strategy for Sustainable and Circular Textiles signals a shift away from voluntary action, with potential financial penalties for non-compliance.

Brands must consider their role as value chain orchestrators, acting collectively to fast-track critical mass and scale while sharing costs and risks among players.

Brands can explore cost-effective decarbonisation

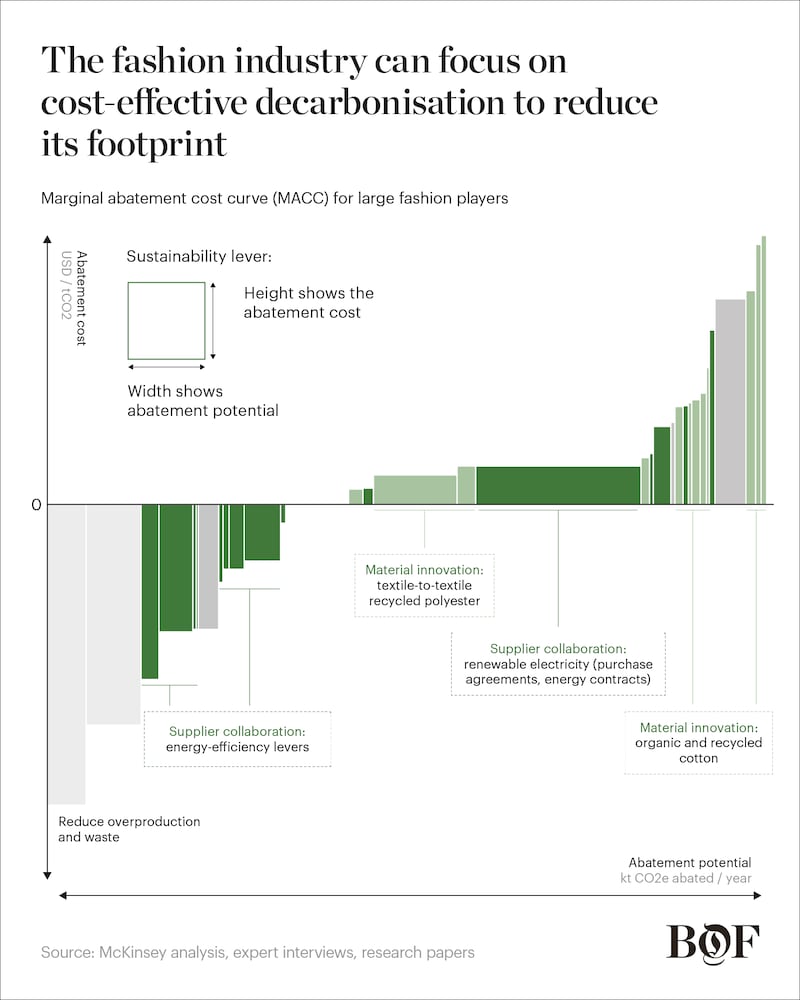

Contrary to common perception, implementing sustainability levers can drive cost-efficiencies and up to 50 percent of tier-two emission abatement can be cost neutral.

Brands can achieve dual savings across emissions and costs. For example, collaborating with suppliers on low-cost energy efficiency levers can offset more expensive initiatives such as sustainable material innovation. Additionally, reducing waste and overproduction can be achieved through effective inventory management.

Long-term brand-supplier collaboration is an integral part of reducing industry emissions

Tier-two production, the stage in which fabrics are produced and treated, accounts for between 45 and 65 percent of fashion’s scope-three emissions. Yet 75 percent of fashion brands fail to involve suppliers in their sustainability initiatives. Driving decarbonisation is a long-term, complex process where the onus often falls on suppliers to fund and execute initiatives. While examples of collective action are emerging, more brands will need to participate to drive meaningful scale:

- Consolidate and partner on strategic commitments: Fashion brands can focus on fewer supplier relationships, consolidating sourcing to reach critical mass. Doing so helps brands influence and support their suppliers’ sustainability and operational improvements. Brands should focus on their top 60 to 80 percent of supplier volumes, either in core or high-volume categories.

- Embrace long-term commitments to suppliers: To justify the upfront implementation cost and complexity of sustainable practices, brands should enter long-term strategic commitments with suppliers through volume offtakes, lead-time extensions and short-term price premiums.

- Collectively address industry bottlenecks: Brands can play an active role in reducing implementation barriers, such as engaging financial institutions to provide suppliers with interest-free loans or discounting future orders. Similarly, brands can collaborate with suppliers and policy makers to identify high-priority levers and educate suppliers on best practices related to energy efficiency, effective planning and partner collaboration.

H&M Group, Bestseller and Copenhagen Infrastructure Partners (CIP) announced plans to develop the first offshore wind project in Bangladesh to power manufacturers in the region with renewable energy. The project is forecast to cut emissions by around 725,000 tonnes annually and support the country in its goal of supplying 40 percent of the nation’s power through renewable sources by 2041.

The Future Supplier Initiative, announced in June 2024, aims to bring down the cost of financing for decarbonisation projects by having brands help underwrite the debt their suppliers take on. This is facilitated by the Fashion Pact, in partnership with Apparel Impact Institute, Guidehouse and DBS Bank. The initiative aims to match projects with the highest potential for impact, identifying common factory units, interventions and costs, to enable a global and regional joint effort between fashion brands.

PVH Corp. teamed up with Standard Chartered Bank and HSBC Bank USA to create a new financing programme for suppliers that exceed PVH’s Human Rights and Environmental Supply Chain standards, offering favourable trade finance options and discounted financing to incentivise sustainability projects.

Brands can create favourable conditions for sustainable-material innovators to scale

In recent years, several sustainable-material start-ups have emerged, demonstrating transformative technologies and clear value propositions. But few have succeeded in reaching scale and significantly reducing fashion’s use of emissions-intensive materials.

Brands must de-risk the commercial prospects for new business building. Those that do so will not only accelerate emission abatement but also secure early-mover advantage through access to sustainable materials at lower prices than peers:

- Place fewer, bolder investments: Brands should take a more focused approach to backing material innovation, making larger investments that provide start-ups with the capital to scale operations and meet the capacities required for an industry transition.

- De-risk the commercials: To provide start-ups with the runway needed to scale and become cost-competitive, brands can offer funding options directly, through debt financing for example, or indirectly, signalling clear demand through off-take agreements and multi-year arrangements.

- Build material-innovation muscle: Brands must develop an in-house understanding of the technicalities and economics of adopting new materials. To do so, they must adjust business processes such as absorbing short-term increases in material costs and managing volumes through phased introduction.

H&M Group and Vargas Holding launched Syre, a new venture to scale textile-to-textile polyester recycling in March 2024. Syre is backed by private equity and venture capital firms TPG Rise Climate, Giant Ventures and Norrsken, and closed a $100 million Series A funding round in May 2024.

H&M secured an off-take agreement with Syre worth $600 million over a seven-year period, covering a significant share of H&M’s long-term need for recycled polyester. The objective of this agreement is to rapidly scale the technology. Meanwhile, Syre announced plans to open two large recycling plants in Iberia and Vietnam as part of a broader plan to have 12 production plants at full speed worldwide by 2032.

Inditex, as part of its effort to reach 25 percent next-gen materials by 2030, announced a three-year partnership with Ambercycle to help scale its textile-to-textile recycled polyester. The partnership, announced in 2023, includes a purchase commitment whereby Inditex will purchase 70 percent of Ambercycle’s production, supporting the company to scale and construct its first commercial factory, which is expected to start production in 2025.

How should executives respond to these shifts?

Commit to sustainability initiatives

Adopt a “dual mission” addressing profitability and sustainability together while collaborating with stakeholders to commit to emission abatement initiatives. Brands and manufacturers can cost-effectively reduce their emissions through joint investments.

Shift towards an action-oriented, collective model, sharing best practices on supplier decarbonisation and financing solutions that can meaningfully scale initiatives and reduce financial risk.

Commit to commercialisation — the stage between development and widespread availability. This helps solutions avoid getting stuck sub-scale, while also capturing first-mover advantage and maximising potential.

Rethink long-term supplier contracts

Embed new processes for supplier sourcing, creating a collaborative model for working with tier-two suppliers.

Ensure adherence to decarbonisation plans through aligned incentives and commercial contracts. Use marginal abatement cost curves to identify and prioritise sustainable initiatives in conjunction with suppliers.

Consolidate suppliers to achieve critical mass without becoming overly reliant on any single supplier. Brands should independently select tier-one suppliers and work with suppliers to set stricter sustainability criteria for tier-two contracting with tier-one suppliers.

Get granular on data

Partner with leading traceability and impact measurement providers and collaborate more closely with suppliers on data transparency. To set targets, suppliers need detailed data on their carbon emissions. Securing this data requires time, technology and know-how.

Map the entire value chain — including tier-three suppliers, the first stage in the value chain that deals with raw material processing — to improve data visibility and quality. This work is critical for setting more attainable sustainability targets, prioritising and sequencing decarbonisation initiatives and measuring their impact.

This article first appeared in The State of Fashion 2025, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.