Online shopping can be quite the undertaking these days, but it’s not for a lack of options.

If anything there’s too much choice, between the ever-growing number of e-commerce marketplaces, direct-to-consumer brands and traditional retailers investing in their web presence.

Recently, I was trying to find an outfit for an event, casually browsing my favourite retailers between Zoom calls and deadlines. But a few hours and 50 tabs later, I had shopped myself into a frenzy without anything to show for it.

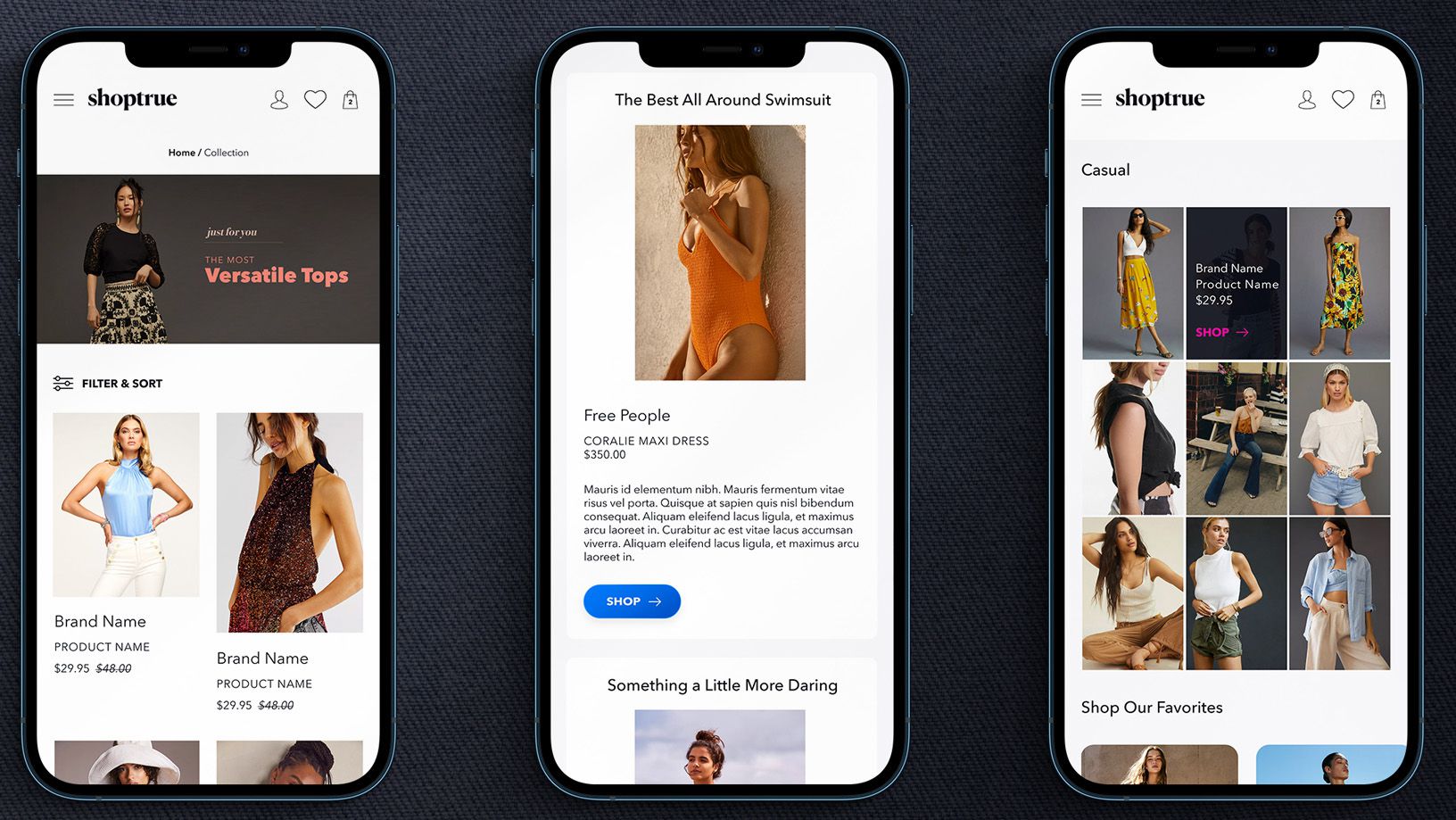

This week, Shoptrue, a new e-commerce start-up, announced it would address this very problem: It wants to be a one-stop destination for online fashion shoppers, a marketplace with over 2,000 brands (the range includes Nike and Valentino) from which consumers can choose through “a personalised experience” fuelled by artificial intelligence. The startup is currently in beta mode and will fully launch next year.

Shoptrue was created by Romney Evans, the founder of True Fit, a size recommendation tool used by a number of online retailers, including Bloomingdale’s and Lululemon. Ensuring the right fit is part of Shoptrue’s formula, which combines the discovery component of online shopping with a recommendation function. Users will take a style quiz before they get started on the site, and the more they interact with listings, the more curated their selection will be.

“It’s curated for you and by you and that distinction is unique,” Evans said. “It gets smarter as you interact with it, and it improves your chances of being inspired.”

In theory, an end-all, be-all destination for online shopping that shows consumers exactly what they’re looking for would be a blessing. But Shoptrue isn’t the first to promise an end to endless scrolling. So far, no retailer has been able to come close to delivering on the promise of personal curation.

After taking Shoptrue’s personal style quiz, the listings that come up for my feed still seem wide-ranging and generic. One of the top results for dresses on my feed is floral even though I had indicated I don’t wear any prints in the questionnaire. But Shoptrue is designed to understand users more as they interact with the platform. Eventually, users will be able to “like” and “dislike” products.

Nailing personalised styling will be a tough task. Stitch Fix is case in point: the fashion company pioneered the subscription model, touting a highly personalised styling service through a combination of AI and human stylists. But more than a decade after it launched, Stitch Fix is losing its active customer base while operating at a loss since 2020. In its most recent quarter, Stitch Fix lost 370,000 active clients, or 9 percent of overall shoppers from the year prior.

Shoptrue’s pitch also is reminiscent of The Yes, the shopping app launched by former Stitch Fix executive Julie Bornstein in 2019. It too involved a personal style quiz and AI-driven recommendations. Last year, it was acquired by Pinterest to boost the tech company’s own e-commerce ambitions, and was quickly shut down by its new owner.

There was also Spring, an early player in mobile fashion (it launched in 2014) that raised more than $100 million. It was acquired by the retail start-up ShopRunner in 2018, and shut down a year later.

Spring and The Yes are among the highest profile among countless other apps and shopping services hoping some amalgamation of discovery, personalisation and service will turn them into the next Amazon.

But despite steadily growing e-commerce sales, it’s hard for new retail platforms to break through.

“You really need a clear value proposition in terms of acquiring and retaining customers,” said Cowen analyst Oliver Chen.

The main problem these new apps face is that the space is already saturated with marketplaces, from Farfetch and Net-a-Porter to Macy’s and Amazon. These are well-established retailers that have had years, sometimes decades, to build a loyal customer base. And even they have at times struggled to sell clothes profitably on the internet.

For discovery, consumers automatically turn to Instagram, Pinterest or TikTok. Each is trying to introduce more shopping features — most recently TikTok, which appears to be developing an international e-commerce fulfilment system, according to job listings.

“People have sticky behaviour,” said Chen, “and consumers have limited appetite for multiple apps.”

That’s not to say it’s impossible for a newcomer to make a splash. Currently, the top downloaded shopping app in the US is Temu, a Chinese marketplace for ultra-affordable fast fashion and other cheap products that launched in September.

Following Temu, Amazon, Walmart, and Shein top the chart. The popularity of these platforms indicate that when it comes to being incentivised to download something new, the most enticing factor just might be price. That’s not to mention, another reason why Temu is so popular is because it has invested heavily in social media marketing. Other startups might not have the resources to do the same.

Still, the online shopping experience is far from perfect, which means there’s white space for companies like Shoptrue. While its selection does include mass brands like Crocs and Adidas, Shoptrue said one of its major assets is being able to gamify the consumer experience. On Shoptrue, users can build collections, or “shops,” of listings based on a theme or occasion that they can share with friends — akin to playlists on Spotify.

For now, I’ll stick with my routine: Open up a dozen e-commerce websites and see what’s on sale.