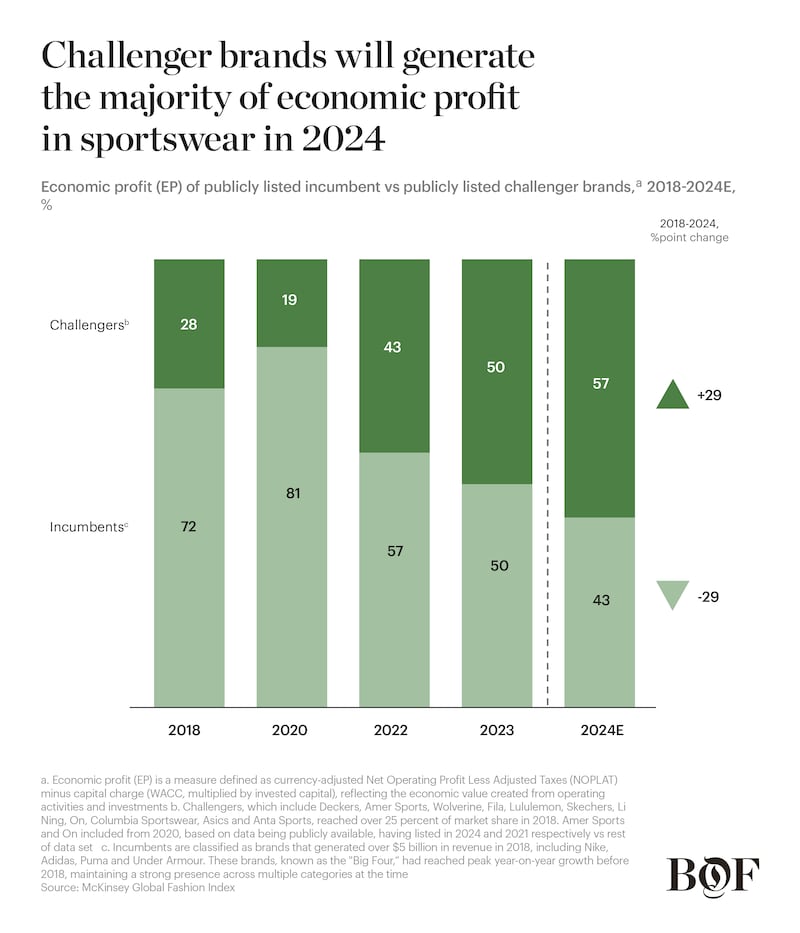

In 2024, challenger sportswear players — such as Deckers (owner of Hoka) and Asics — are expected to create over 50 percent of the segment’s value, surpassing incumbent sportswear brands known as the “Big Four” (Nike, Adidas, Puma and Under Armour) in economic profit for the first time, according to the McKinsey Global Fashion Index.

Challengers have succeeded by growing revenue faster than incumbents while also expanding their profitability. Challengers are expected to have grown revenues 18 percent per year between 2020 and 2024E — 14 percentage points above incumbents — and improved profitability by 4 percentage points over the period, while incumbents saw profitability decline 2.4 percentage points.

Privately owned challengers are also seeing exceptional growth globally, including New Balance, Vuori and Alo Yoga.

In The State of Fashion 2025, BoF and McKinsey explain how the battle between challenger and incumbent sportswear brands will heat up in the year ahead, and how leaders in the industry should act to capture their share of market growth.

Challenger brands have aggressively taken market share by targeting niches and expanding reach

Delivering Visible Innovation

In recent years, incumbents have been excessively reliant on incremental improvements to their performance technologies. These innovations are often less noticeable and garner less consumer attention.

On the other hand, challenger brands have reimagined running footwear with visible innovations that deliver both performance and recognisable differentiation. Hoka’s oversized midsoles offer unique cushioning and are easily identifiable, while On’s CloudTec® soles use a distinct, pod-like design to provide runners with support.

Targeting Specialised Categories

While incumbents focused on a broader set of sports categories, many challengers tailored offerings around smaller ones, targeting new customers and more niche sports.

Lululemon built its business to $6 billion in 2021 by addressing the athleticwear gap for women, which incumbents had failed to conquer. Women’s sales represented less than 25 percent of Nike’s wholesale sales in fiscal 2023 and of Under Armour’s total sales in 2023. Meanwhile, Arc’teryx and Salomon have delivered on ambitious growth plans by focusing on outdoor sport communities with marketing that enticed casual sneaker customers.

Tapping Into Cultural Marketing

Challengers borrowed from incumbents’ marketing playbooks, focusing on celebrities and culture. New Balance and Alo Yoga, for example, tapped high-profile celebrities such as Jack Harlow and Kendall Jenner. While incumbents struggled with authenticity due to a wide fanbase, challengers conveyed greater authenticity with communities.

Vuori and Gymshark focused on grassroots marketing, building ties with Southern California yogis and the English gym scene, respectively, while Hoka engaged running clubs and partnered with cultural platforms such as Hypebeast and End.

Filling Wholesale Whitespace

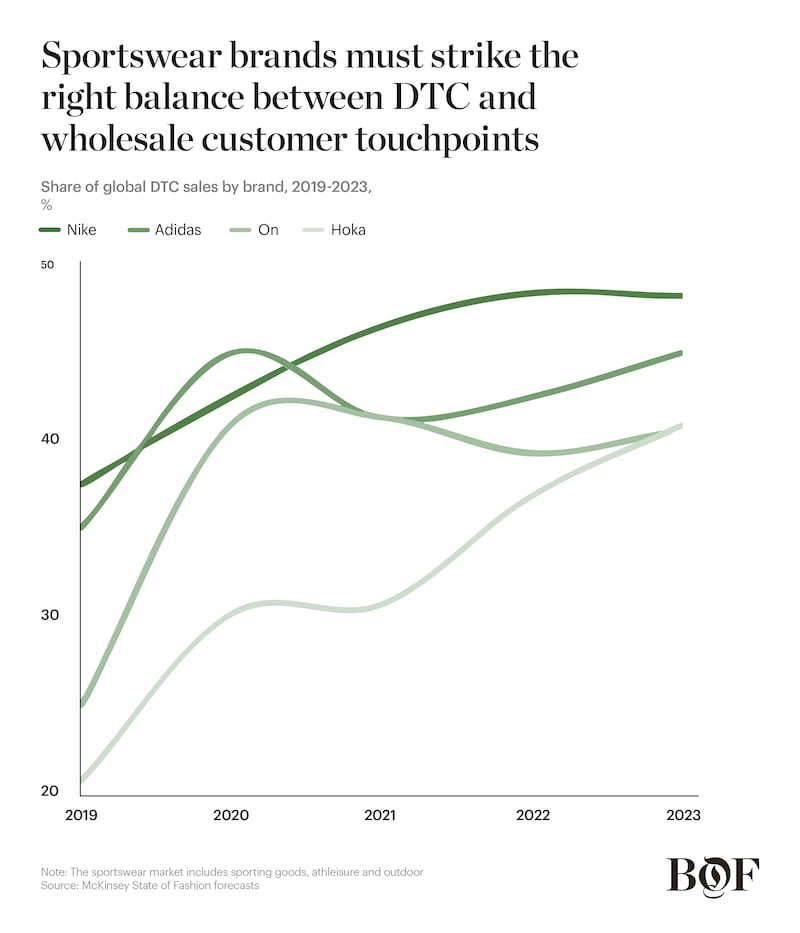

In the late 2010s, incumbent brands such as Nike and Adidas began to actively shift distribution towards direct-to-consumer (DTC) channels, de-emphasising wholesale.

While incumbent brands moved away from some wholesale partners, challenger brands moved into highly visited retailers, like Dick’s Sporting Goods and JD Sports. Many challengers capitalised on the shift by pursuing wholesale-first strategies, driving 65 to 70 percent of sales.

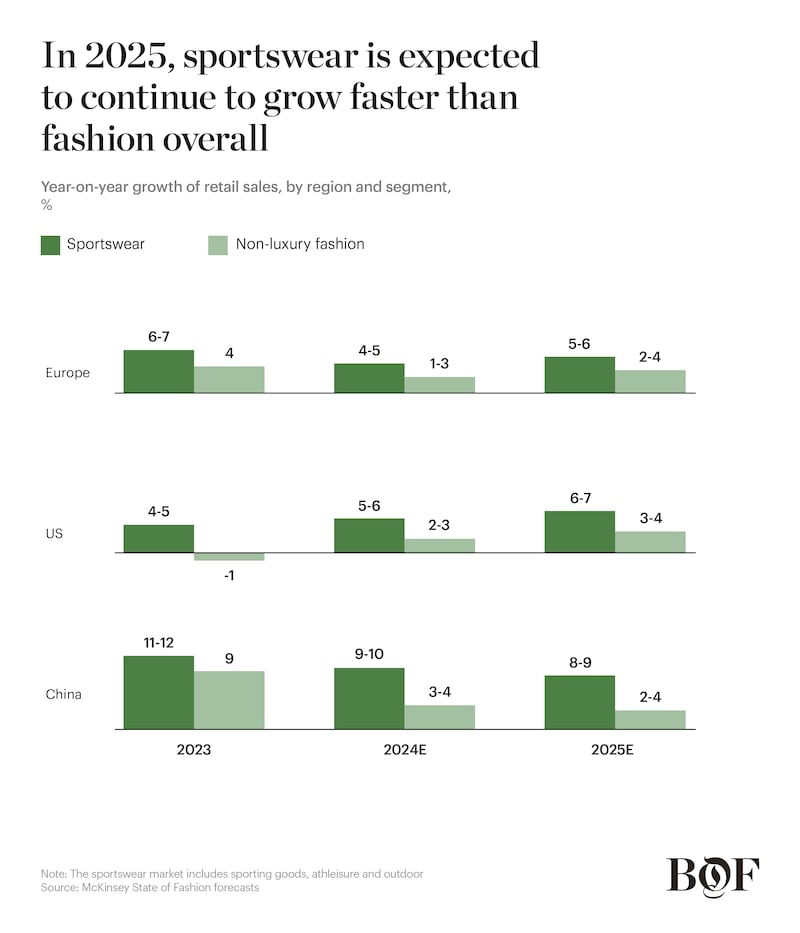

In 2025, sportswear is expected to continue to grow faster than fashion overall

In 2025, sportswear’s growth is expected to continue to outpace the broader fashion market in key regions, by 5 to 6 percentage points in China, 3 percentage points in the US and 2 to 3 percentage points in Europe.

As much as 90 percent of sportswear companies are predicting either steady or increased sales in the year ahead. Key growth drivers include the increasingly blurred boundary between fashion and activewear, the prioritisation of health and wellbeing across age groups, and growing access to sports content and events:

- Two in three Millennial and Gen-Z customers wear athleisure multiple times per week.

- 56 percent of Gen-Z customers consider fitness a very high priority, and older generations are becoming more active globally.

- The global sports tourism sector is expected to grow by 18 percent by 2030.

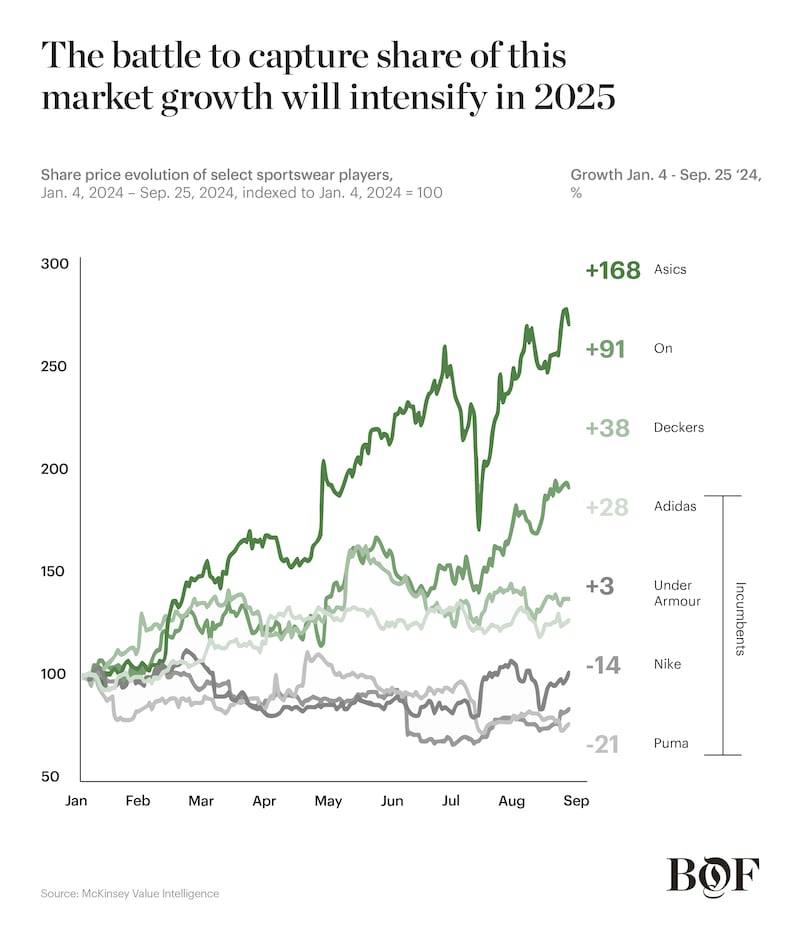

The battle to capture share of this market growth will intensify in 2025

Challengers have continued to see gains in their stock performance. From January to the end of September 2024, Asics’ share price jumped 168 percent, On’s rose 91 percent and Hoka-parent Deckers’ was up 38 percent.

Meanwhile, incumbents have seen a more negative development — except for Adidas, which regained momentum with the revival of its hit Samba sneaker. This reinforces the need for incumbents to refresh their strategies around product, marketing and channel.

To win share, brands will diversify their offerings, balancing reach and cultural credibility

Diversification is a common growth tactic and a core part of the incumbent playbook

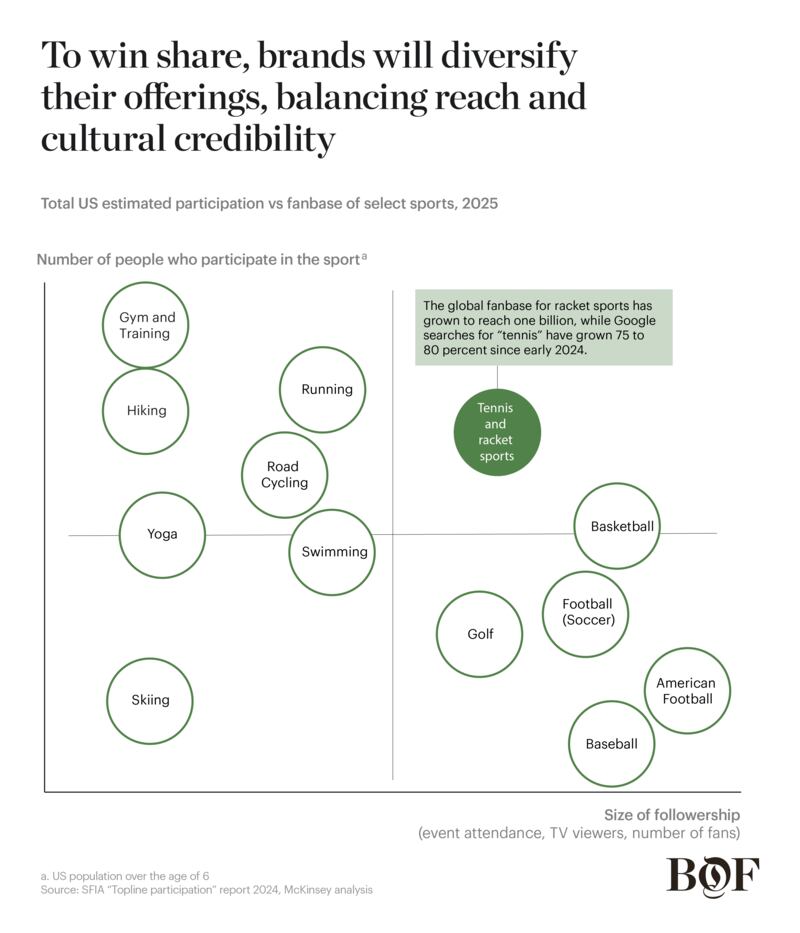

However, challenger brands have also diversified in order to grow. In choosing how to diversify, brands must balance catering to sports that give them access to the largest customer bases (high participation rate), with those that drive the most cultural credibility (high number of fans following the sport).

Performance and athleisure brands are going deeper into each other’s territories

For example, Alo Yoga, known for athleisure, yoga and training gear, launched its first performance-focused running shoe in 2024, while On is expanding into categories such as training and tennis, aiming to double its share of apparel sales in three to five years. Lululemon plans to double its men’s business by 2026 compared to 2021, focusing on performance sports such as golf and tennis.

Material and product innovations are crucial for brands to build credibility in sports categories

Fewer breakthrough innovations have emerged in recent years, with patent grants dropping 55 percent between the fourth quarter of 2021 and 2023. While Nike has faced scrutiny about its innovation stream from retailers, it is the most active in terms of patents, filing the most patents (182) in the global sports industry in the fourth quarter of 2023.

Players are expected to create authentic messaging amplified by ambassadors

Long-Term Potential of Athlete Sponsorship

The sports sponsorship market is expected to grow from $63 billion in 2021 to $109 billion by 2030.

Some athletes, especially younger stars, are opting to partner with smaller brands, as these contracts could offer more control over their image. Despite lower rates, smaller brands have offered athletes creative control or equity stakes, as seen between Holo Footwear and NBA player Isaac Okoro. This shift could encourage brands to offer more flexible deals to retain and attract talent.

Brands are recognising the long-term potential of emerging talent, supported by initiatives allowing college athletes to sign deals. New Balance signed Coco Gauff six years ago and now she is one of the most marketable female athletes. In 2022, Nike signed WNBA player Caitlin Clark, the No.1 WNBA draft in 2024.

Celebrity Endorsement for Brand Storytelling

Looking ahead, challengers and incumbents will likely be more strategic about which celebrities they tap for partnerships, prioritising credible spokespeople over the ones who just have the largest followings.

In June 2024, Zendaya signed a multi-year collaboration with On, which the brand intended to drive meaningful storytelling around movement and wellbeing.

During the same month, Puma named K-pop star Rosé, from the group Blackpink, as its long-term global ambassador. Rosé’s style aligns with Puma’s aesthetic, making her an ideal fit to redefine Puma’s classic products and head up the “Rewrite the Classics” programme.

Convergence of Sports and Local Culture

As sports and culture continue to converge, incumbents and challengers may focus more on connecting with local audiences by incorporating cultural elements into their marketing.

During the 2024 Paris Olympics, New Balance collaborated with local artists such as Franck Pellegrino in its Marais store. New Balance also brought Joe Freshgoods’ “From Prom to Paris” project to life through personal art exhibitions.

Adidas is reconnecting with Chinese youth through its “In China, for China” strategy. This includes localisation through partnerships with the China Literature and Art Foundation to promote sports culture through the “Century Masters” programme, which aims to reach 10,000 schools annually. Adidas has also teamed up with Chinese actor Chen Xiao to promote its initiatives across China.

Sportswear brands must strike the right balance between DTC and wholesale customer touchpoints

On and Hoka are planning to continue their expansion into direct-to-consumer (DTC). Nike and Adidas, meanwhile, are renewing part of their focus on wholesale after shifting heavily towards DTC and experiencing missed sales targets and rising inventory levels.

DTC will be used for customer experience and community building: Adidas is launching its new premium outlet format, “The Pulse,” in the UK, designed for convenience and to easily adapt to high-demand products and new collections. Hoka opened its first US flagship in New York in June 2024, which will also serve as an events space.

Wholesale will be used to increase reach and brand presence: Brands are expected to prioritise high-traffic retailers or culturally relevant partners, such as Dick’s Sporting Goods and End, and seek ways to integrate into their ecosystems, for example through offering exclusive deals to loyalty members. Lululemon, which does 90 percent of sales through its own channels, partnered with Zalando to expand its distribution in Europe.

Competition for shelf space is growing: Sportswear retailers are elevating stores and expanding to attract more traffic, while reducing their reliance on single brands. Sports Direct is planning to open 10 new flagship stores, while JD Sports acquired Finish Line and Hibbett in North America. Foot Locker is expanding its product range in response to shifting consumer preferences towards a broader selection of brands, in line with its 2023 “Lace Up Plan,” which includes an aspiration to reduce Nike’s share of sales from 70 percent in 2023 to around 55 to 60 percent by 2026.

How Should Sportswear Executives Respond?

Invest in innovation in the core product and beyond

- Create breakthrough product innovations that are visible and marketable with rapid athlete-to-consumer pipelines.

- Diversify into new categories by balancing reach and credibility, without losing sight of core offerings.

- Reintroduce styles from core franchises by innovating archival designs and tapping into consumer trends.

Double down on marketing that conveys innovation benefits

- Create compelling product marketing content that clearly conveys the innovation’s benefits and newness, cutting through the noise with a simple, impactful message.

- Execute targeted marketing strategies that make innovations visible through credible channels such as run club communities.

Build authentic partnerships at all levels

- Secure emerging athlete collaborations early, with attractive and flexible contracts.

- Refocus messaging on the brand’s roots with clear, authentic storytelling by working with celebrities that align to the brand’s narrative.

- Tap into communities with local activations and events in key markets to gain credibility and generate excitement.

Develop a distribution strategy with distinct channel roles

- Use direct-to-consumer channels to drive customer engagement and brand storytelling.

- Engage in strategic retail partnerships to maximise reach and profitability. Ensure consistency across customer touchpoints by offering connected membership programmes between the brand and retailer.

This article first appeared in The State of Fashion 2025, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.