This article first appeared in The State of Fashion: Technology, an in-depth report co-published by BoF and McKinsey & Company.

Fast-changing consumer demand and persistent supply chain disruptions are just a few of the factors adding to the complexity of operating a fashion brand today.

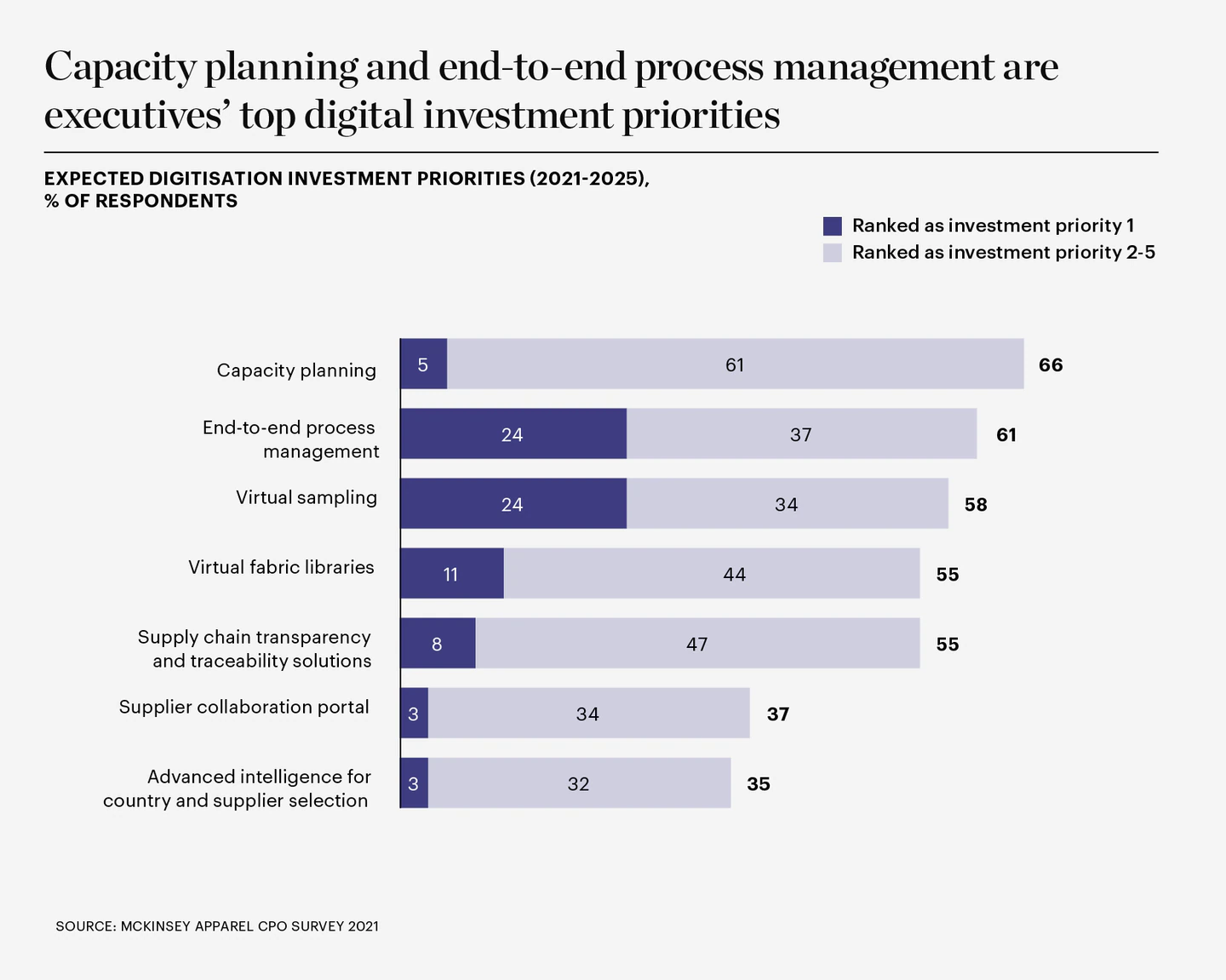

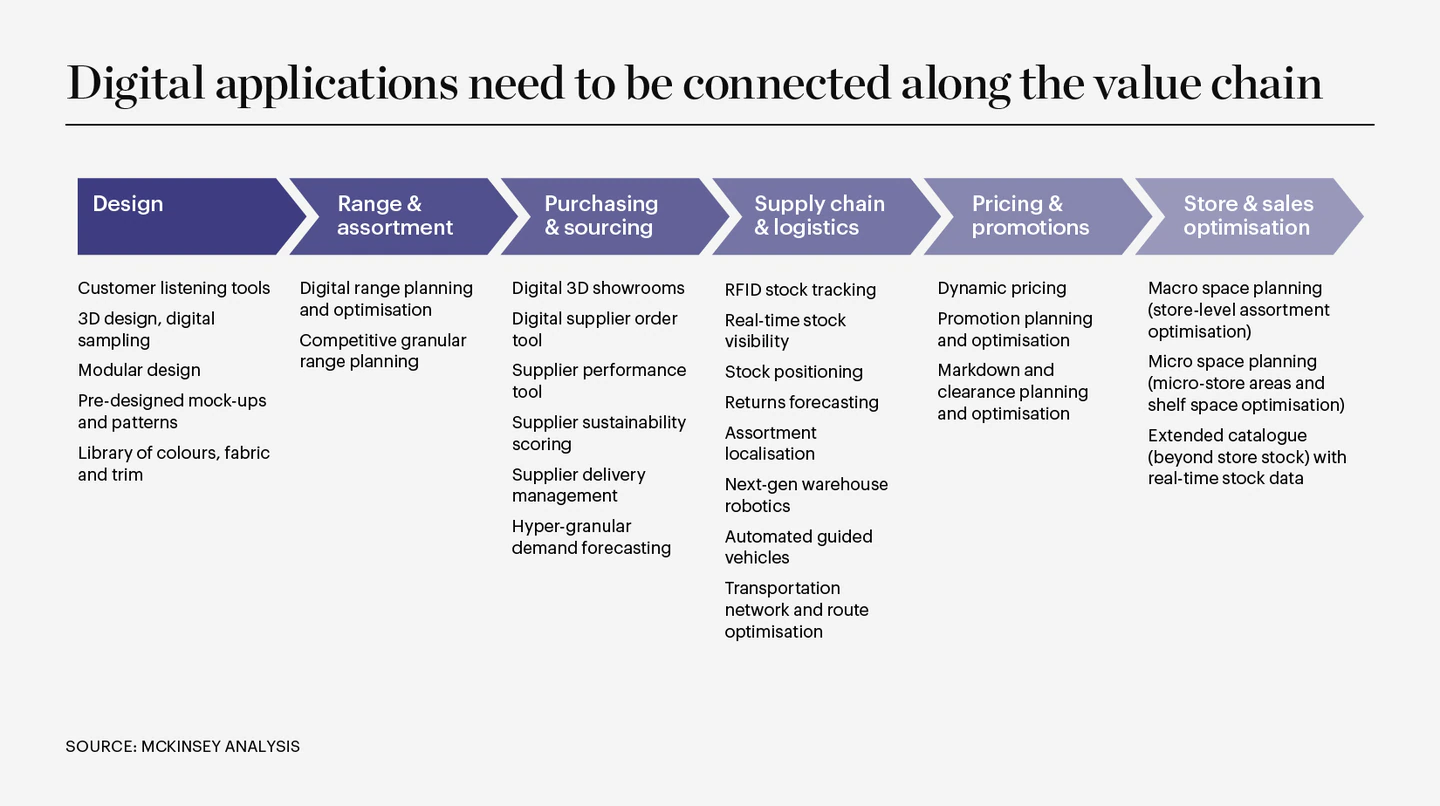

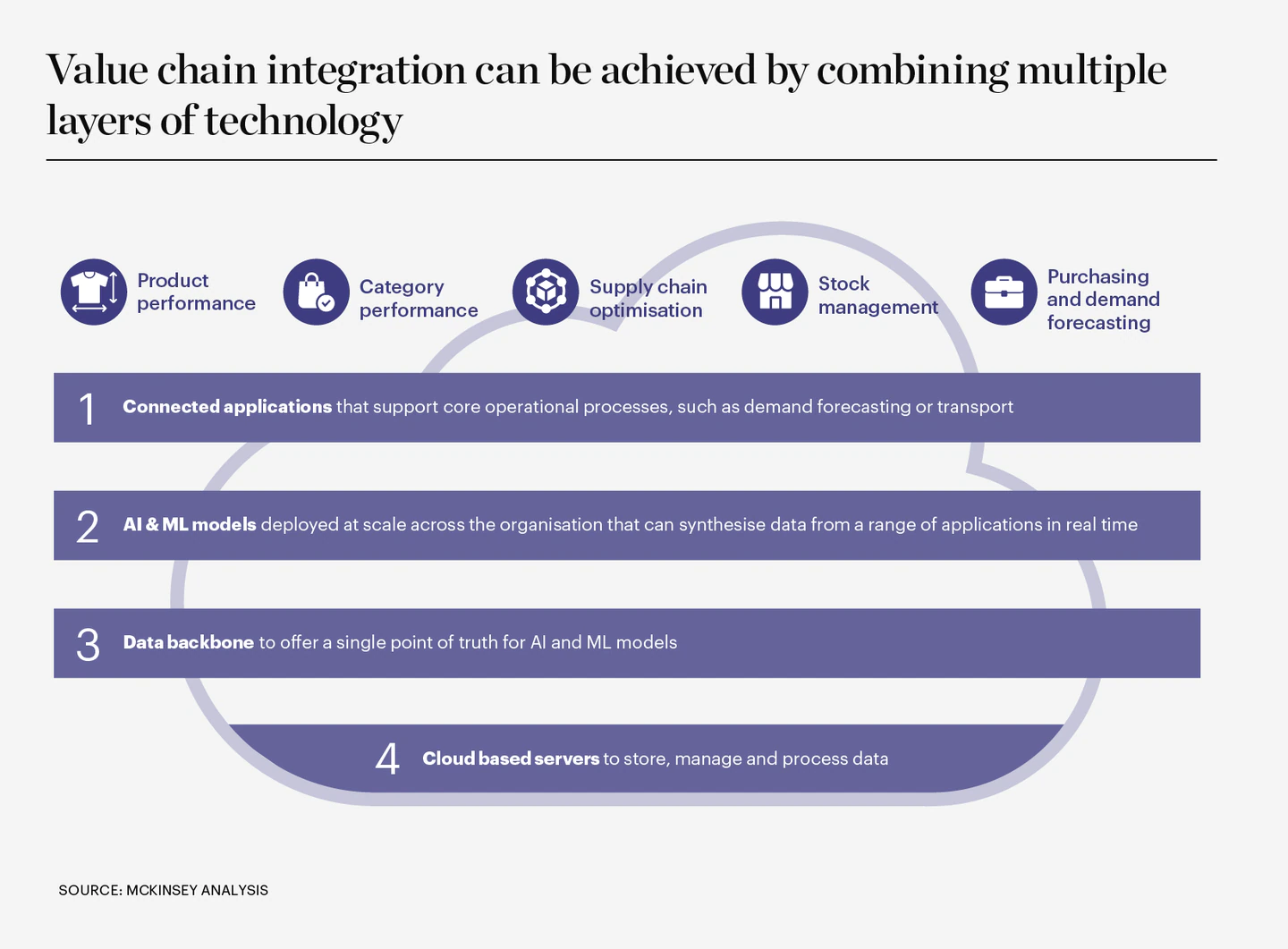

The industry needs a new digitised value chain model that unites multiple internal processes and data sources, from demand forecasting to pricing. Indeed, when it comes to digitisation, 61 percent of fashion executives believe end-to-end process management is among the most important investment areas for their organisations between 2021 and 2025. The result will be more fortified, shock-resistant companies which are able to navigate today’s volatile business landscape.

Many fashion companies have been improving individual value chain processes with digital technologies. But fully integrated backend systems and workflows are still a way off.

One reason is that relatively few off-the-shelf applications are designed to optimise the fashion value chain from end to end. While companies like Nextail, Logility and O9 offer solutions that address certain activities such as buying, first product allocation, replenishment and store transfers, no single solution covers the entire value chain. Brands thus need to identify solutions that address their pain points or custom build applications, which is resource intensive. At the same time, development costs remain high and companies face gaps in their technology stacks and talent pools.

Five critical workflow “journeys” in the fashion value chain lend themselves to end-to-end integration: product performance, category performance, supply chain optimisation, stock management, and purchasing and demand forecasting. Integrating key parts of a value chain journey could make speed to market up to 50 percent faster, full-price sell-through up to 8 percent higher and manufacturing up to 20 percent less costly.

Product performance, or assessment of which products are selling well — shows the impact of end-to-end integration in practice. A siloed pricing and promotions application might use AI and machine learning to determine a product’s promotional price by analysing the current stock, in-season price, time in season and expected elasticity. By contrast, investing in end-to-end integration would expand the scope of the application to also consider similar products already in store or arriving soon, as well as expected returns or a competition range. Each of these data points impact expected sell-through and thus the appropriate promotional pricing, which can ultimately boost gross margins.

At Levi’s, company-wide machine learning combined with a cloud-based data repository containing internal and external sales and inventory information provide multiple processes with resources to make better decisions around everything from pricing to consumer marketing, according to chief strategy and AI officer, Katia Walsh. Data-driven knowledge-sharing also helps Levi’s determine the best locations from which to ship its products, identifying the store or distribution centre that is the closest to the shipping address, helping it to control logistics costs and manage store inventory smoothly.

Integrating key parts of a value chain journey could make speed to market up to 50 percent faster.

Shein takes this even further. Not only has the ultra-fast fashion player integrated its internal processes, but it has also linked those internal processes with that of its suppliers. This enables a fast and efficient ordering and replenishment journey. Shein uses AI modelling to evaluate millions of social media posts across platforms to determine which products to produce, while advanced analytics help its design teams review the performance of design attributes down to details like the zipper and fabric. With its vertically integrated supply chain using software from Singbada, Shein’s designs could reach customers within approximately three weeks after they are first conceived.

To be sure, fashion players’ operating models will continue to require a finely tuned balance of art and science to not lose sight of the creative, experience-focused aspects of decision-making which are critical in fashion. Executives should be prepared to address potential resistance to working in a more connected way, one in which data, and knowledge, flow across processes seamlessly. Embracing deep digital integration will require focusing on change management. Teams will need to be upskilled or reskilled, and tools will need to be designed with a user-centric mindset to ensure their adoption. For example, this may mean adopting “explainable AI” whereby AI predictions and outputs can be easily understood and managed by humans, unlike “black-box” models that are difficult to interpret, and therefore trust.

Ultimately, fashion companies — from mass market to luxury alike — will benefit from optimising their time to market, flexibility and product availability at a time when many companies are struggling to maintain margins. Value chain integration will prove to be a critical point of competitive differentiation.