For fast fashion, a push into resale is shaping up as one of this season’s hottest trends.

Though investors have soured on resale marketplaces that have yet to show they can turn a profit, big brands have piled in, seeing an opportunity to build consumer loyalty and engagement while plumping their green credentials.

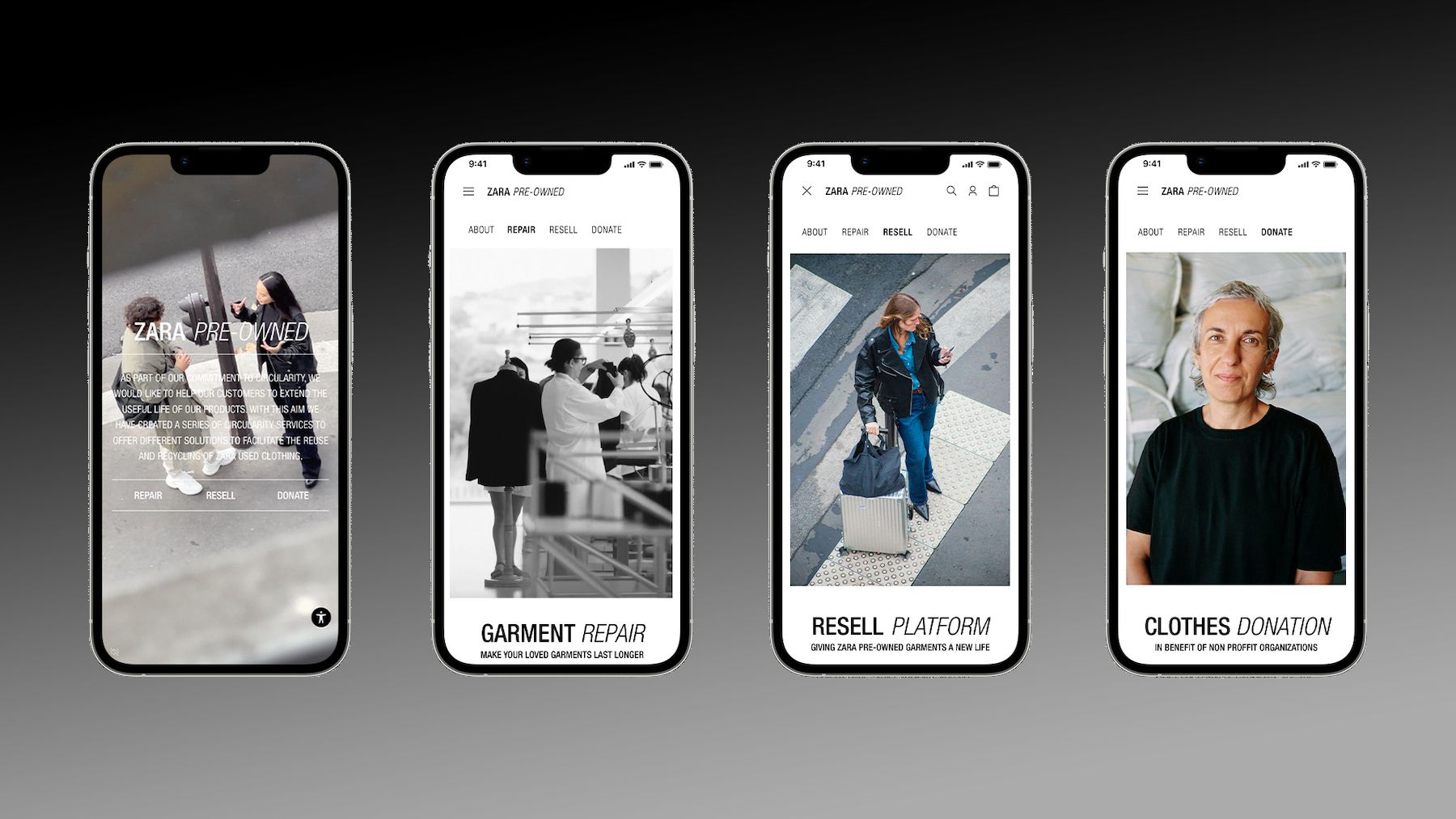

In the last week alone, two of fashion’s biggest players joined the fray. Shein launched an in-app marketplace in the US, allowing shoppers to re-sell the spoils of hauls broadcast on TikTok when they’re done with them. Meanwhile, Zara will launch its own resale marketplace in the UK next month, while also offering repair and donation services.

Both companies said the “circular” moves were intended to encourage virtuous consumer behaviour and reduce clothing waste. Neither expects to make any money from them.

But for resale to really deliver on buzzy promises to offset fashion’s impact, the current crop of pilot programs must give rise to strategies that disrupt, not just complement existing business models. Until then, high-profile new launches risk coming across as little more than performative marketing.

Some 100 brands and retailers have launched their own resale channels over the last couple of years, vying to tap into a fast-growing market and championing their commitment to keep clothes in circulation for as long as possible. But data to understand how this is really affecting consumer behaviour is sparse. Many brands offer store credit for consumers using their resale platforms, incentivising more consumption as much as extending the life of existing garments.

“There’s no proof when brands are putting this into place that they’re reducing production,” said Christine Goulay, founder and CEO of Sustainabelle Advisory Services. “What they’re doing is capturing a new market.”

Critics point to a particular cognitive dissonance for ultra-fast-fashion brands like Shein, which churns out some 1,000 new styles daily.

Meanwhile, although how much brands’ resale channels are changing consumer behaviour is somewhat fuzzy, there are clearer benefits to getting consumers back onto a brand’s site or app, where they can be enticed to spend any cash earned from a secondhand sale.

“This is like feeding the flames of the fire,” said Goulay. “If they don’t have a good explanation of their theory of change as to why this will create better impact, then it’s not a sustainability play, it’s a value play.”

For more BoF sustainability coverage, sign up now for our Weekly Sustainability Briefing by Sarah Kent.