Digital marketing playbooks have been turned upside down by recent data privacy changes, mandating an existential shift for fashion brands that once relied on customer targeting tools offered at scale by Silicon Valley’s tech giants. Third-party ad targeting, social media growth hacking techniques and early iterations of loyalty programmes and personalisation had been important contributors to the rise of digital marketing and e-commerce brands.

But a new era has arrived, requiring brands to rethink how they reach new consumers and engage with existing ones. Instead of pushing content to pre-selected groups, as was so effective over the last decade, the key now is to pull in customers with a fast-paced stream of creative campaigns. Once brands have access to valuable first-party data, they can prioritise channels that deliver a strong return on investment and enable them to build deep, long-lasting relationships and foster communities among customers.

The disruption of the digital marketing playbook is a culmination of several years of regulatory and technical shifts that targeted online privacy and security risks. The EU’s General Data Protection Regulation and the California Consumer Privacy Act — landmark laws rolled out in 2016 and 2020, respectively — have given users more agency over their data. Meanwhile, Apple’s iOS 14 software update in 2020 allowed users to opt out of tracking across apps and websites. And as part of its privacy initiatives in 2022, Google plans to discontinue third-party cookie tracking in Chrome, which commands 65 percent of global web browser market share. When given a choice, many consumers are declining tracking: a McKinsey survey found 41 percent of users said they opted out of cookies.

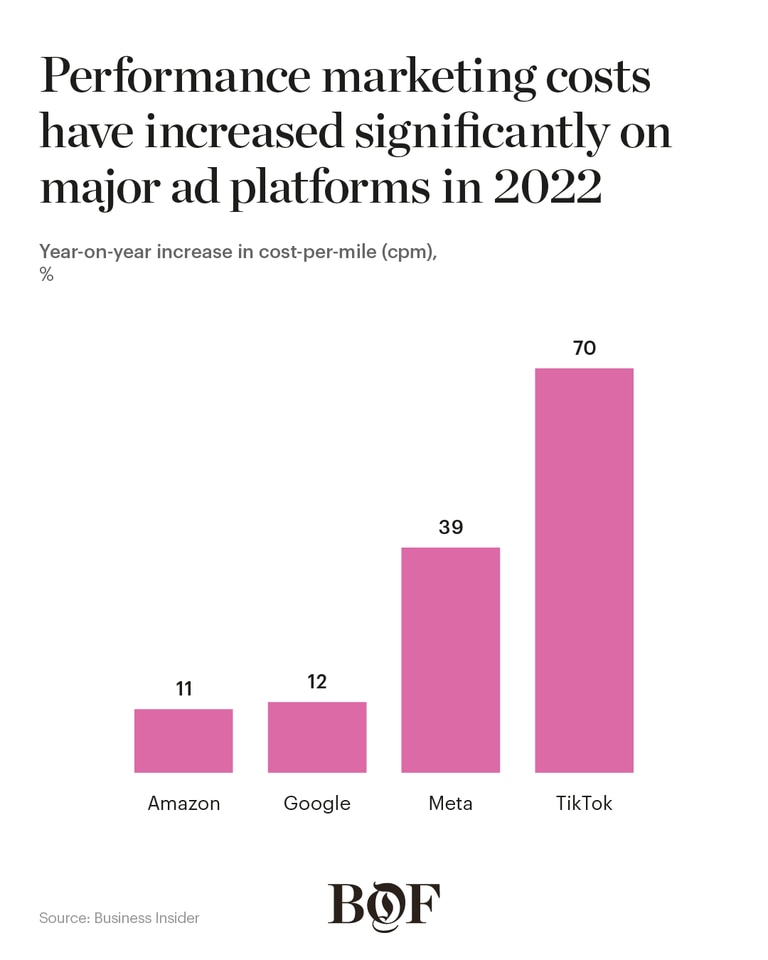

As a result of the tracking limitations, customer acquisition costs have spiked, rising on average 70 percent on TikTok and 39 percent on Meta platforms. In 2022, advertisers spent about $29 to acquire each customer, compared with $9 in 2013. All together, these changes signal a new reality: the era of third-party digital targeting is over. Brands will need to find different ways to differentiate their marketing strategies, broadening their social platform use beyond bottom of funnel ads, and focus on creativity and quality of the customer experience.

Reaching Customers: Content is King

Winners in the year ahead will embrace creativity and experimentation to stand out in the glut of online content. The updated approach will mirror some of the strategies from the golden age of advertising running from the 1960s to the late 1980s, when campaigns competed on creativity and quality to capture audiences. However, the internet requires both a faster pace and a wider range of mediums, particularly video used in multiple ways. The lifecycle of a digital campaign can be as short as two to three weeks before the impact dissipates due to repeated views by users.

To meet escalating digital content demands, brands are looking outside their organisations for creative development and dissemination. As such, influencers are already key partners for many fashion advertisers, with brands tapping their content-creation skills and accessing their loyal audiences. But competition for top influencers can be stiff, as well as expensive. Spending on influencer marketing skyrocketed from $1.7 billion in 2016 to $13.8 billion in 2021. There are also risks involved, particularly if relationships sour or if the influencer is involved in a scandal or controversy. For many brands, though, the rewards outweigh the risks.

In some cases, fashion companies have elevated influencers to brand-defining roles that were once the sole domain of Hollywood stars and supermodels. Hugo Boss, for example, signed a multi-year agreement with TikTok personality Khaby Lame as a global brand spokesperson in 2022. Similarly, YouTube star Emma Chamberlain has appeared in television advertisements, brand campaigns and collaboration for Levi’s since 2021.

Publications also have a new role to play in the content market, extending beyond traditional display and print advertising or old-school advertorials. Their customised features, video series or affiliate marketing links can validate brands and direct readers to e-commerce sites. Brands can also tap the publishing house’s creative teams to produce sponsored projects. Digital streetwear and luxury publication Highsnobiety, for example, has a partnership with Gucci tied to its collaboration with The North Face. A video from the project, released at the start of 2022, featured TikTok star Francis Bourgeois. When Zalando acquired a majority stake in Highsnobiety in June 2022, the e-commerce retailer said the publisher would act as a “strategic and creative consultant” to extend its storytelling capabilities.

In recent years, many fashion companies capitalised on television streaming by partnering with productions for increased exposure. For example, Gucci provided access to its archives and allowed shooting in its Rome flagship for “House of Gucci,” a film directed by Ridley Scott and starring Lady Gaga and Adam Driver, which generated 25,000 posts across news and social media in the months ahead of the film’s release in 2021.

Follow the Audience

Fashion brands will need to scrutinise their marketing strategies at the channel level to offset the declining returns of paid social and search channels. The greatest return on investment will come from channels that reach customers further down the marketing funnel where they have high purchase intent, as well as those that provide opportunities for brands to create direct, first-party relationships with customers.

Multi-brand retailers over the past few years have increased advertising opportunities on their websites, apps, emails and social channels as well as in-store aisles and displays. Following Amazon’s ad strategy, players like Target and Ulta Beauty have deployed “retail media networks” in the US, which help brands benefit from proximity to the end of the purchasing funnel. RMNs also enable brands to gain access to retailers’ first-party data for closed-loop reporting. This enables brands to run reports on the effectiveness of ads throughout a customer journey, from displaying the ad to purchasing a product.

For many fashion companies, advertising with retailers is more efficient than other forms of performance marketing. Among apparel and footwear executives responding to a recent survey, about 80 percent reported somewhat better or significantly better performance of advertising on RMNs than on other marketing channels. Spending on these networks, including on Amazon, is expected to reach $100 billion by 2026.

Another rising marketing channel is the virtual worlds of the metaverse, ranging from gaming to immersive social environments. While the space is less developed than RMNs, the potential audience is growing and highly engaged — and allows brands to form first-party relationships with customers. As of August 2022, online gaming platform Roblox drew nearly 60 million daily active users, an increase of 24 percent year on year, leading brands like Vans to launch virtual worlds on the platform. Brands that opt to pursue projects in the space will need to be disciplined to ensure their activations are more than one-off projects.

Meanwhile, blockchain-based web3 technologies such as non-fungible tokens can be deployed to build communities. Several brands have experimented with NFT collections, like Adidas’ “Into the Metaverse” NFTs and Prada’s “Timecapsule” NFTs. Brands will find the most effective web3 and metaverse projects offer users value or utility, such as rewarding them with exclusive access to gated products or experiences, which in turn create a stronger affinity for the brand.

Innovating Customer Relationships and Communities

Once a customer makes a purchase, brands need to focus on relationship-building, including examining how best to leverage customer data. While a privacy-first world creates near-term challenges, brands that build transparent, mutually beneficial relationships with customers are well-placed to realise huge benefits in the long term.

Even as the data-sharing environment becomes more restrictive, not all customers are opposed to giving brands access to personal information. According to a recent poll, over 50 percent of customers said they are more likely to share data if they receive something in exchange, such as discounts, sizing advice or personalised product recommendations.

Brands can both protect customers’ privacy while incentivising them with value and services, such as personalisation. Using data to enhance a customer’s experience can help brands to address rising online return rates by offering accurate sizing recommendations, for example. This is particularly critical for the fashion industry at a time when as much as 15 percent of returned online purchases is attributed to “bracketing,” the practice of consumers ordering the same items in multiple sizes and colours. Bolstering loyalty programmes can also drive meaningful benefits: nearly two-thirds of US consumers who are satisfied with loyalty programmes say they are more likely to increase the frequency of purchases.

Customer data can inform product development, too. When a skin care brand partnered with a retailer’s RMN, it discovered through analysis of the RMN’s data that consumers were interested in Korean skin care routines, and thus launched a line of products to tap that customer interest.

The reward for brands that build trust-based, mutually beneficial relationships with customers are the communities that grow around them. For example, loyal customers can influence others by creating user-generated content, as seen with Gymshark’s community of fitness enthusiasts who post large volumes of user-generated content showcasing the UK sports-apparel brand’s products on social media. Gymshark nurtures this community with a dedicated “In Real Life” team that meets up with members at offline events.

New Ways of Working

To win in world of fast-paced, customer-focused marketing, agile ways of working will become a necessity. By bringing together cross-functional teams that comprise marketing, product, brand, sales, analytics and insights, brands can rapidly iterate on effective creatives, channels and customer experiences.

To ensure this new approach succeeds, brands need to invest in technology. Investments may include data systems, such as customer relationship management software, or digital asset management software that maximises the value of existing content by allowing brands to edit and re-cut existing material from their content libraries into new forms. Investing in centralised dashboards that monitor the impact of campaigns will help brands make quick, informed decisions to continuously improve their customer experience.

This article first appeared in The State of Fashion 2023, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.