When Ryan Babenzien launched his sneaker brand Greats in 2014, about three of every 10 creators he sent shoes to would end up posting about the brand. Back then, most of Babenzien’s direct-to-consumer peers were buying ads on Facebook and Instagram to supercharge their sales, and a word-of-mouth-based strategy wasn’t as effective by comparison.

But Babenzien was on to something earlier than most. By the time he launched his new beauty wellness brand Jolie in December 2021, seven out of every 10 creators he sent the company’s purifying showerheads to would spread the word.

Jolie may be operating in a different market, but the lessons Babenzien learned through his first venture apply to his second, even as he operates in a different category and caters to shifting consumer preferences.

No longer are glossy social media ads designed to drive immediate sales the most effective tactic. Instead, organic marketing that caters to a specific audience is the marketing trend du jour. Beauty start-ups today also have to serve a distinct purpose to reach younger shoppers overwhelmed with choices. Babenzien and co-founder Arjan Singh argue they’ve been able to do that by selling an item that typically isn’t classified as a beauty product at all — a showerhead that filters out contaminants like chlorine, marketed as beneficial to skin and hair health; it retails for $165.

“We’re not a showerhead. We’re a beauty wellness tool,” Babenzien said.

So far, that positioning has worked. The company has amassed over 80,000 customers — mostly women ages 18 to 35 — since its December 2021 launch. Already, it’s outpacing Babenzien’s last venture: Jolie is on pace to increase sales more than 500 percent year over year to $25 million in 2023; when Steve Madden acquired Greats in 2019 for an undisclosed sum, the sneaker start-up generated sales of $13 million.

Babenzien may have been entrenched in the first wave of digitally-native brands, which was defined by sleek branding, selling through owned channels and shaking up sleepy categories. But he’s now reshaping his approach to fit the second wave, which is more about building organic buzz, inking wholesale partnerships early on and building products that address a hole in the market.

Jolie has made careful moves to further integrate itself into wellness culture. It runs low-cost online and out-of-home marketing campaigns that link clean water to beauty routines, and sells in niche retailers with beauty and health-obsessed clientele like Los Angeles-based Erewhon, Goop and 65 independent hair salons across the country.

“This showerhead ties into this whole concept of values and wellness,” said Larissa Jensen, vice president and beauty industry advisor at Circana. “It’s not another cleanser, laser or toner device. It has a very unique position.”

Testing the Waters

With Jolie, Babenzien wanted to have a firmer and more predictable grip on inventory management. Greats saw its initial profits evaporate in part because the costs to keep up with inventory demands rose each year.

Before Jolie started selling its showerheads, it gauged consumer interest in a brand of its kind. In late 2021, the brand promoted a water report on social media. The report — which is produced in partnership with an environmental agency — lets people see what skin and hair-damaging chemicals are in the water in their area. The company received more than 20,000 sign-ups online, which served as an early indicator of demand for the product.

After Jolie sold out of the initial run of its showerheads released in December 2021, it used pre-orders to capture sales before the next batch of items hit its warehouse. The brand also has a subscription service, where subscribers receive a new filter every quarter for a recurring fee.

That instinct to test for demand and plan accordingly is part of what instilled confidence in investors like Rob Dyrdek, the owner of the brand creation firm Dyrdek Machine. His company invested in Jolie in 2021 for an undisclosed sum and is currently its largest investor. He was also drawn to the brand, he said, because of its potential to create a new segment in the saturated beauty industry.

“The potential if it worked to have a much bigger and longer lifetime value was super appealing to us,” Dyrdek said.

Starting a Conversation

Most of Jolie’s marketing is content made by creators and customers who discuss how Jolie improves their hair and skin. The campaigns the company produces on its own are similarly educational and explain why cleaner water is fundamental to beauty routines.

In October 2021, prior to its official launch, Jolie released a “weather-report” style concept video on its social media pages, where a model tells viewers that a key step to achieving better skin and hair is removing chlorine and other harmful chemicals found in shower water.

“A lot of this has been convincing and educating people and fundamentally reorienting how they view what we’re doing,” said Singh, who also serves as Jolie’s head of brand marketing and operations.

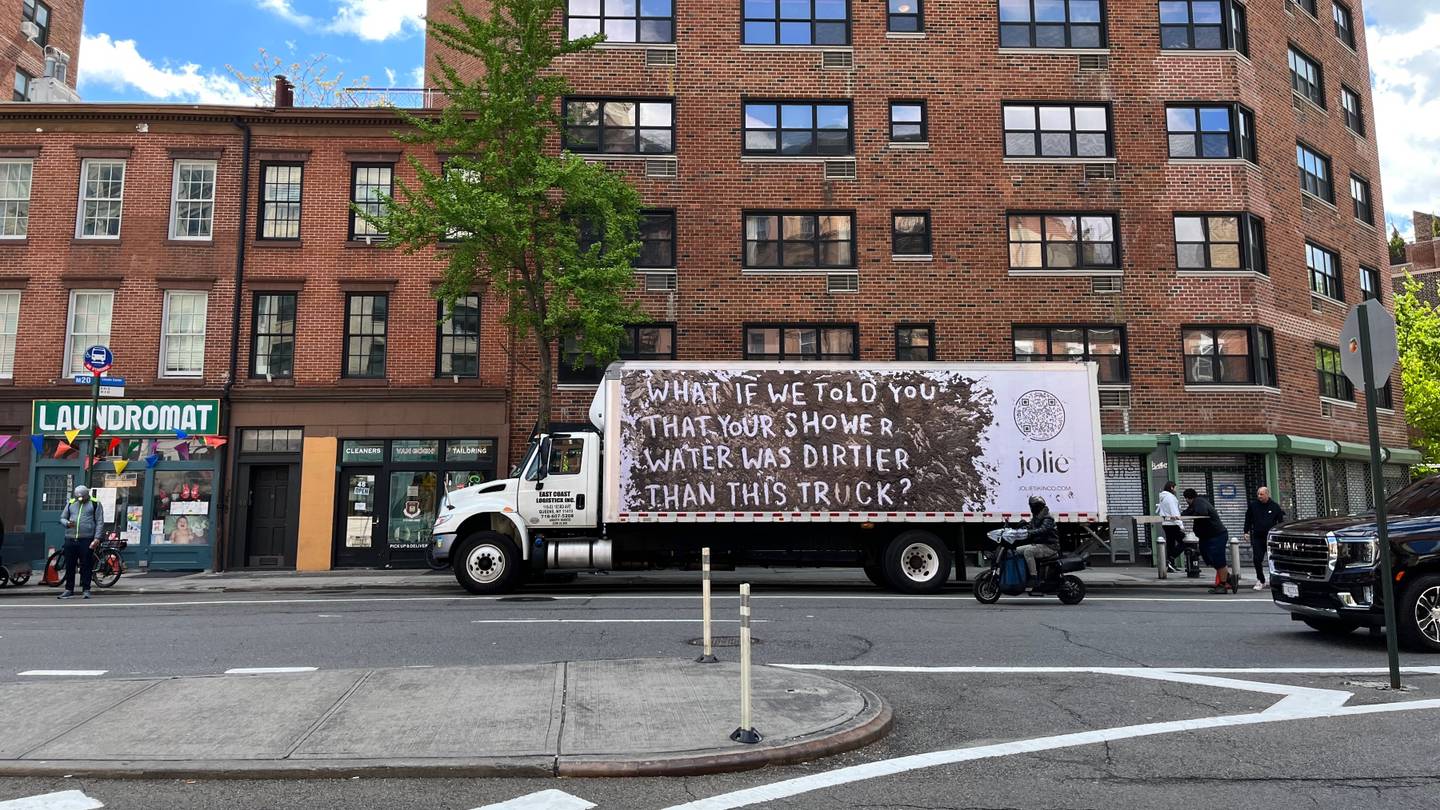

The brand recently deployed more guerilla-style tactics to build organic buzz.

In May, the company sent five trucks wrapped in a dirty-appearing facade bearing the Jolie logo around NYC printed with the question, “what if we told you your shower water is dirtier than this truck?” Simultaneously, the brand hosted a giveaway, where the first five people who spotted the truck and posted about it on their social media would receive a free Jolie showerhead. Winners were selected within an hour.

Jolie’s awareness-focused and largely user-generated content marketing has helped reach its goal of quickly achieving profitability. Jolie spends just over $100,000 a month on marketing as opposed to the millions it could burn if it ran mostly paid ads on Meta and Google. The brand generates at least 12 percent EBITDA margins each month.

“We’re not paying to target that [customer], but she’s being targeted by this really vocal community that is discovering Jolie, buying Jolie and then sharing Jolie,” Babenzien said.

Jolie has similarly had to convince some potential retail partners that its showerheads are beauty tools. When Babenzien spoke with Erewhon’s executive vice president, Vito Antoci, last December, Antoci was unsure of how Jolie’s product would make sense in the high-end grocery store chain. A week after one of Antoci’s team members used the product, he offered Babenzien and Singh a partnership. Jolie’s showerheads were unveiled in the retailer’s nine locations in May.

Betting on a Hero

Most beauty start-ups start with a few hero products. Jolie not only started with a single item, but is betting that it can lead it to the next phase of growth.

The company expects it can triple its sales by 2025, off-the-strength of its filtering showerheads. “We see that revenue number as a pretty small dent in the size of the market,” Babenzien said. “300 million showers in the US is an incredibly big market.”

Early success in retail partners signal the sustained demand for Jolie’s hero product. Erewhon originally ordered nine units for each of its nine locations, and the company has reordered the product 15 times in under three weeks. Jolie has been a top ranking device in the beauty category on Goop’s site for the past seven months, said Jaimee Holmes, vice president of beauty and wellness at Goop.

Jolie plans to widen its retail distribution to support its growth projections. The brand could appear in more retail concepts that cater to wellness-centric consumers. Babenzien noted the farm shop at luxury boutique hotel Inness in Hudson Valley, which sells Aesop’s body cleansers and hair conditioners, as one example of a potential retail destination. The brand will also go the traditional route and eventually enter doors like Ulta Beauty and Nordstrom, Babenzien said.

“They are in the right place to target that niche consumer,” Jensen of Circana said. “If you want to get to those levels you need to continue to expand your distribution.”