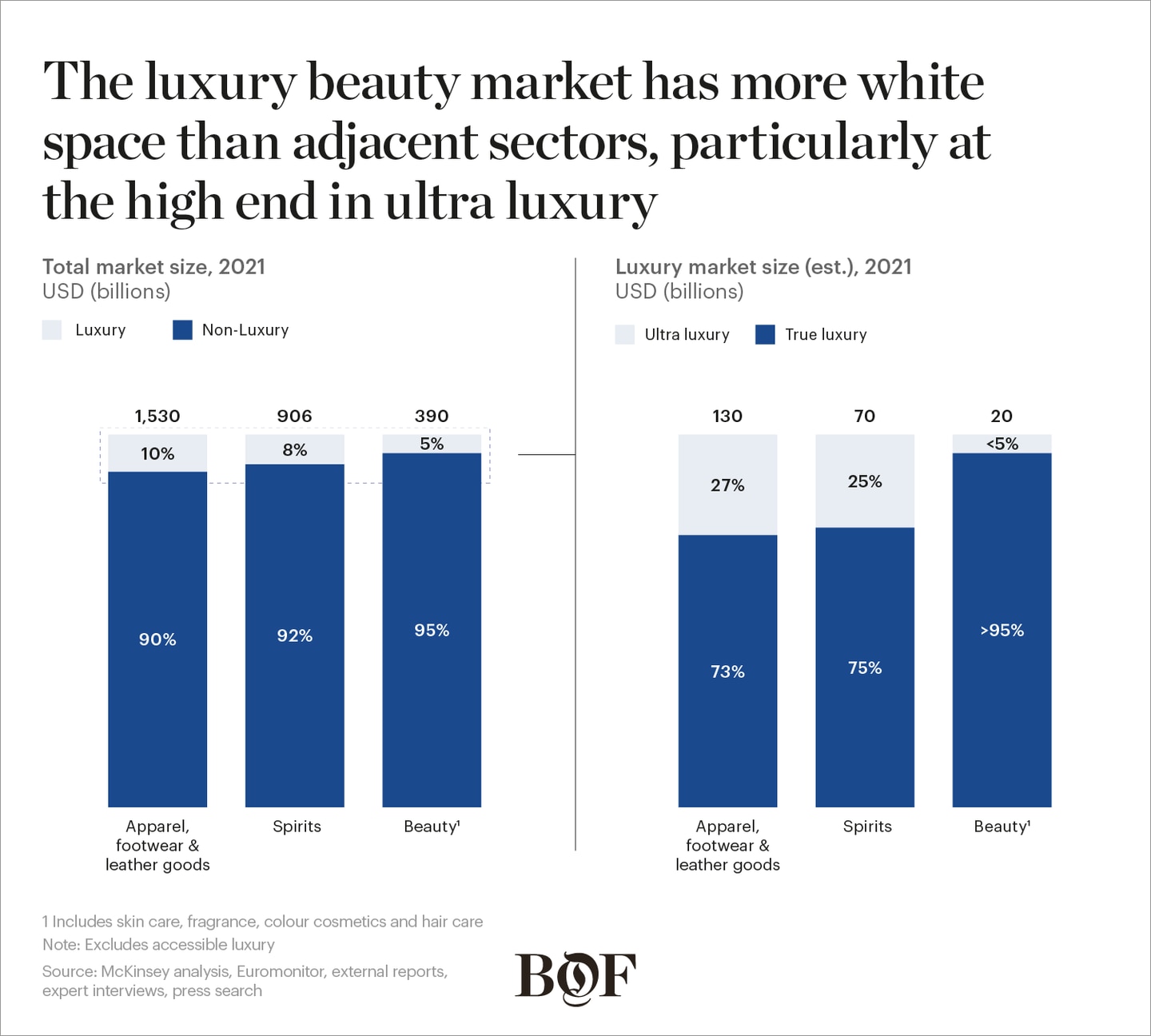

The world’s wealthiest people spend more than $350 billion on luxury goods every year, allocating thousands of dollars to rare liquors or hand-crafted haute couture garments. But when it comes to beauty, luxury shoppers looking for top-tier products and experiences have limited choice. Generally, high-end beauty products simply represent premium alternatives to mass beauty, falling within the prestige category with products such as $60 lipsticks or $130 face creams. As a result, luxury shoppers’ relative spending on skin care, cosmetics and other beauty items is well below what they allocate to comparable discretionary spending categories. The beauty industry now has a unique opportunity to change that.

Luxury beauty cuts across two categories. “True luxury” includes products that retail for hundreds of dollars and can generate strong profits at high volumes. Skin care brands La Mer and La Prairie cater to this space, as do niche fragrance brands like Roja and House of Creed. Meanwhile, “ultra luxury” is another level up, with products that retail for thousands of dollars. While appealing to a smaller cohort, ultra-luxury beauty can elevate a brand’s reputation for exclusivity and quality. French perfumer Guerlain, for example, aims to reinforce its artisanal history when it collaborates with artists on special editions of its signature “bee motif” bottles. The brand collaborated with jeweller Lorenz Bäumer and crystal manufacturer Baccarat to produce $25,000 versions of its bottles in 2022. Similarly, Clé de Peau Beauté celebrated its 40th anniversary by commissioning jeweller Elie Top to create diamond-studded cases for its best-selling lipstick and cream that retailed for as much as $16,000.

We estimate that true luxury and ultra luxury beauty combined represent an approximately $20 billion market today, with a potential compound annual growth rate of between 15 percent and 20 percent, amounting to an additional $15 billion to $20 billion in sales by 2027. The growth will be driven by both increasing consumer demand and investment from beauty brands looking to expand their offerings at higher price points.

The Luxury Consumer

The global community of high-earning and luxury clients is growing in size and spending power. The US and Europe are each home to more than 30 percent of the world’s high-net-worth individuals (with investable assets of $1 million or more) and ultra-high-net-worth individuals (with investable assets of $30 million or more), while approximately 16 percent are based in mainland China, Hong Kong and Taiwan. The number of luxury clients is growing fastest in China and is expected to increase at a compound annual rate of 12 percent between now and 2027.

This wealth distribution is expected to be a factor in market growth. Erwan Rambourg, author of the 2020 book “Future Luxe: What’s Ahead for the Business of Luxury,” told us: “Every nationality is trading up — luxury companies understand that luxury is no longer singular, but a play on global wealth.” However, he added, “Clearly, the main engines of growth for luxury over the next 10 years will still be China and America.”

The world’s wealthiest shoppers are attracted to status symbols, such as limited-edition products that could be considered works of art. In 2020, for instance, Hennessy created a limited-edition cognac bottle designed by architect Frank Gehry. Only 150 bottles were produced, each retailing for $17,000. The collaboration’s success led to a sequel the following year, when the price of each bottle increased to $165,000. Although luxury shoppers are more likely to display a rare cognac prominently in their home than they would an ornate jar of moisturiser, social media has helped bring beauty routines out into public spaces.

These shoppers are also less interested in trendy brands and products. Instead, they’re seeking unique and exclusive items, which brands have started to provide. Cartier, for instance, offers luxury consumers the opportunity to co-create fully tailored scents with its in-house perfumer.

But luxury beauty brands’ allure extends beyond the global elite. Consumers who are not high-net-worth individuals might still splurge on lower-priced true-luxury beauty items. For this cohort, purchases of exclusive or status-defining beauty products may be more accessible than buying haute couture or fine jewellery.

Keeping Higher Standards

Beauty players that seek to tap the true luxury and ultra luxury markets will need creativity and innovation. Go-to-market strategies will share many elements with the standard luxury playbook, which requires exceptional product quality. Luxury houses are already setting the stage for top-tier formulations. Chanel, Dior and Tom Ford have secured access to rare ingredients for their luxury fragrances, for example.

Beauty brands with luxury ambitions will need to combine compelling storytelling with exceptional customer service, which can come to life through elite experiences. Alexander McQueen, for example, invited select clients to a historic former monastery in London to mark the launch of its eight-piece luxury fragrance collection in 2018. Each scent was exhibited with pieces from the fashion label’s archive. Dior opened a temporary luxury spa on the Orient Express in 2022 for VIP guests on their way to the Cannes Film Festival. The French fashion house has also invested in estates and gardens to host special events.

As brands expand into luxury segments, they also need to tailor their offerings to local cultural expectations. Armani Privé launched an haute Oud collection exclusively designed for the Middle Eastern fragrance market, with references to the region’s traditional perfumery and local ingredients.

“You have to adapt to local culture, which can vary tremendously,” Rambourg said. “For instance, fragrances used to have very little traction in Asia, while being very popular in the Middle East with very specific scents. Localisation is very important, and with the world reopening, what you will be displaying in Paris will be different from what you show in Tokyo.”

Regardless of the region, beauty brands have an opportunity to adapt distribution. While some wholesale retailers, such as luxury department stores, can serve as appropriate partners, direct-to-consumer may be a better option for brands seeking to retain control of clients’ entire experience and ensure an elite shopping journey. Some brands will be able to leverage their existing boutiques, while others may need to open dedicated beauty locations. Traditional speciality beauty retailers that want to participate in luxury beauty’s growth will also need to invest in new retail formats to attract top clients.

Who Can Win?

Though shoppers are eager to try new brands, the luxury segment will be challenging for completely new players that don’t already have credibility. Success is possible, however, if new brands bring a creative proposition as well as a compelling origin or product story. British perfumery house Roja, known for using rare ingredients, launched directly into the luxury space in 2011 and offers bespoke services that can exceed $31,000. London-based artisan perfumer Electimuss, founded in 2015, draws inspiration from Ancient Rome.

Established luxury brands with a track record of creativity, quality and status are well positioned to target luxury beauty. Fashion brands, especially the luxury megabrands, are particularly credible, as they can leverage their reputation for craftmanship as well as their existing relationships with wealthy clients. In addition, megabrands, such as Dior and Chanel, can maintain and leverage their high-volume prestige beauty lines while introducing elevated ranges that cater to top spenders.

Designer and luxury fashion labels launched prestige beauty divisions in the 2010s, building profitable businesses by offering an accessible entry point into their brands. While few have looked beyond the mid-market consumer, many luxury fashion brands are reprioritising their beauty strategies. Expanding on its prestige fragrances, Gucci launched the luxury Alchemist Garden collection, while Versace introduced luxury Atelier Versace scents. In 2023, Kering announced plans to form a new beauty division that is expected to address true luxury and ultra luxury.

To ensure the credibility of beauty lines across both luxury and prestige, megabrands will face a delicate balancing act. Brands will need to carefully consider which categories are most suitable for luxury expansion.

“Fashion to colour is an easier move than, say, fashion to skin care,” said Vanessa Goddevrind, chief operating officer of luxury skin care brand 111Skin. “Skin care and hair care products will be a more challenging jump for some brands, as top clients expect high levels of efficacy in those categories.”

Established prestige beauty brands can more easily tap the luxury skin care market, especially if they already have a reputation for efficacy. Similarly, luxury hotels are well placed to expand into luxury beauty products, as are high-end wellness clinics and spas that offer clients a combination of beauty, wellness and medical services. Aman, a collection of 34 luxury resorts, released a luxury skin care line in 2018 with packaging designed by architect Kengo Kuma. The skin care line connects to the global resorts via natural ingredients drawn from Aman destinations around the world — for example, sea buckthorn oil from Bhutan and vetiver from Indonesia.

As beauty brands and luxury houses embark on what could be a transformative journey, capturing the attention and trust of luxury clients will require creativity and innovation, as well as a razor-sharp understanding of affluent clients. Venturing into a largely untapped market, the sector’s most innovative and credible players will build competitive advantage as they establish themselves as the reference points for the sector and its underserved customers.

This article first appeared in The State of Fashion: Beauty report, co-published by BoF and McKinsey & Company.