LONDON — The luxury industry was bracing itself for a week packed full of Q2 earnings from all the major players — LVMH, Kering, Prada, Zegna and Hermès — a signal of how the sector is performing amid declining spending by aspirational customers in the key US market.

Industry heavyweight LVMH was first to report. The fashion and leather goods group still grew by 21 percent in Q2, driven by momentum in China and Japan, and the return of tourist spend in Europe. But its overall results did not meet consensus expectations, and there was a marked weakness in the US where Q2 sales contracted by one percent.

“We have a situation where, by and large, the aspirational customer is suffering a bit,” CFO Jean-Jacques Guiony acknowledged to investors. “We are experiencing drops with entry price products, with online sales, with second tier cities — which is a clear sign that your aspirational customer is not shopping as much as they used to.”

Over at rival Kering, the news was more dire. Gucci grew by only 1 percent in the second quarter, missing analyst expectations of 4.2 percent. Saint Laurent and Bottega Veneta also showed slowing growth of 7 percent and 3 percent respectively. And revenues from Kering’s “other brands” — which include crisis-prone Balenciaga — actually shrank by 1 percent.

But these lacklustre results were eclipsed (smart PR move!) by the announcement that Kering is acquiring 30 percent of Valentino for €1.7 billion ($1.9 billion) with an option to acquire 100 percent of the brand within five years. This is a boon for Kering as it looks to bolster its luxury brand portfolio to drive growth (smart acquisition move!).

Technically, Valentino didn’t report its results this week, but the Kering announcement did underscore that Valentino did more than €1.4 billion in revenue in 2022, delivering €350 million in EBITDA. Kering’s investment came in at a €5.7 billion valuation.

These results are impressive and reflect the deft management of Mayhoola chairman Rachid Mohamed Rachid and CEO Jacopo Venturini, as well as the creativity of Pierpaolo Piccioli. The transaction also reinforces the point that smaller Italian brands like Valentino are still at a structural disadvantage when competing with the big groups to reach the next milestone. Kering could now light a fire under Valentino to take it to €5 billion in revenue.

What’s also remarkable is that they managed to surprise the market. I had not heard a peep about this anywhere, an increasingly rare occurrence with big fashion news. Well done to the bankers for keeping their mouths shut and to Kering and Valentino for managing to keep fashion’s biggest deal of the year a secret.

Hermès was last to report its results this week, but came in first in the league tables. With a focus on high-net-worth customers, the ultra-luxe brand zoomed past all its rivals and consensus expectations, delivering 27.5 percent organic growth in Q2, including more than 20 percent growth in the US market.

As all the results rolled in this week, I couldn’t help but notice it was some of the (relatively) smaller Italian brands that delivered some of the best performances of the first half of the year: Prada, Zegna and Moncler. Could they be the next acquisition targets as industry consolidation continues? Here are my key highlights from H2 results — and the brands you should be watching:

Miu Miu, often thought of as secondary to the Prada brand, delivered an outstanding 50 percent growth in retail sales in H1, showing that the little sister — which now accounts for 14 percent of overall retail sales — is growing up. I have a hunch that Mrs Prada is also putting a lot more of her energy into this brand now that she shares the creative directorship of Prada with Raf Simons. Plus, she has teamed up with stylist Lotta Volkova to freshen Miu Miu’s image. It all really started with that micro mini-skirt trend in the Spring/Summer 2022 season. That made it onto umpteen fashion magazine covers around the world and Mrs P has been nailing the creative expression of the brand ever since. This, combined with an 18 percent rise in H2 sales at the core Prada brand, where scion Lorenzo Bertelli is helping to modernise the marketing function, means the company’s turnaround is gathering momentum. And there is more to come. Retail productivity will be a focus of Andrea Guerra, the new group CEO and Gianfranco D’Attis, chief at the Prada brand. And with Raf Simons firmly entrenched at the helm, succession planning is well in place on both the business and creative sides of the group. (This is not true for many Italian brands — especially Giorgio Armani and Dolce & Gabbana — and positions Prada as a high-value target if the family is open to selling one day).

Ermenegildo Zegna Group had a stonking quarter, delivering 35.1 percent growth year-over-year, while gaining market share in the US and underscoring that the so-called “quiet luxury” trend still has legs. Some of the resilience of the core Zegna brand — which featured heavily in hit TV show Succession — comes from the fact that it is far from “aspirational” in its positioning. The brand is not desirable in the same way as Dior or Vuitton (in that people want to wear their logos), and is therefore less susceptible to the decline in US aspirational shopping. Gildo Zegna is still firmly in the driver’s seat, but I wonder if acquisitive players in the market are now looking at Zegna with a different lens. Only a few years ago, the brand felt a bit like a tired tailoring brand for Dads. Now it’s firmly positioned as a market leader in menswear, with Tom Ford and Thom Browne now in the portfolio too, each with their own distinct market positioning and which helped to boost group results.

Moncler beat consensus estimates, putting to rest market fears that the brand has been losing its way. Revenues jumped 24 percent in the first half of the year delivering more than €1 billion for the first time. Remo Ruffini, the enigmatic visionary behind Moncler’s success, and his trusted chief business strategy and global markets officer Roberto Eggs, may not be ready to sell as they are also working to revive the fortunes of Stone Island, now helmed by former Gucci executive Robert Triefus. But there’s no doubt Moncler still holds a position as the top luxury outerwear brand in the industry, a position that Burberry once held.

Here are more top picks from our analysis on fashion, luxury and beauty:

1. Big Brands Are Taking Back Unwanted Clothes. Where Do They Go? For anyone who missed it, an edifying new investigation by the Changing Markets Foundation showed how companies like H&M and C&A that are taking back unwanted clothes for resale and recycling may simply be shipping problems of overconsumption elsewhere. Instead of resold or recyled, these recycled clothes can end up downcycled, destroyed or dumped. The report embedded bluetooth tracking devices to find out where the clothes ended up. I wish BoF had thought of doing that! A very smart idea and worth your time to read. The journeys these clothes went on, often across multiple continents, were astonishing to take in.

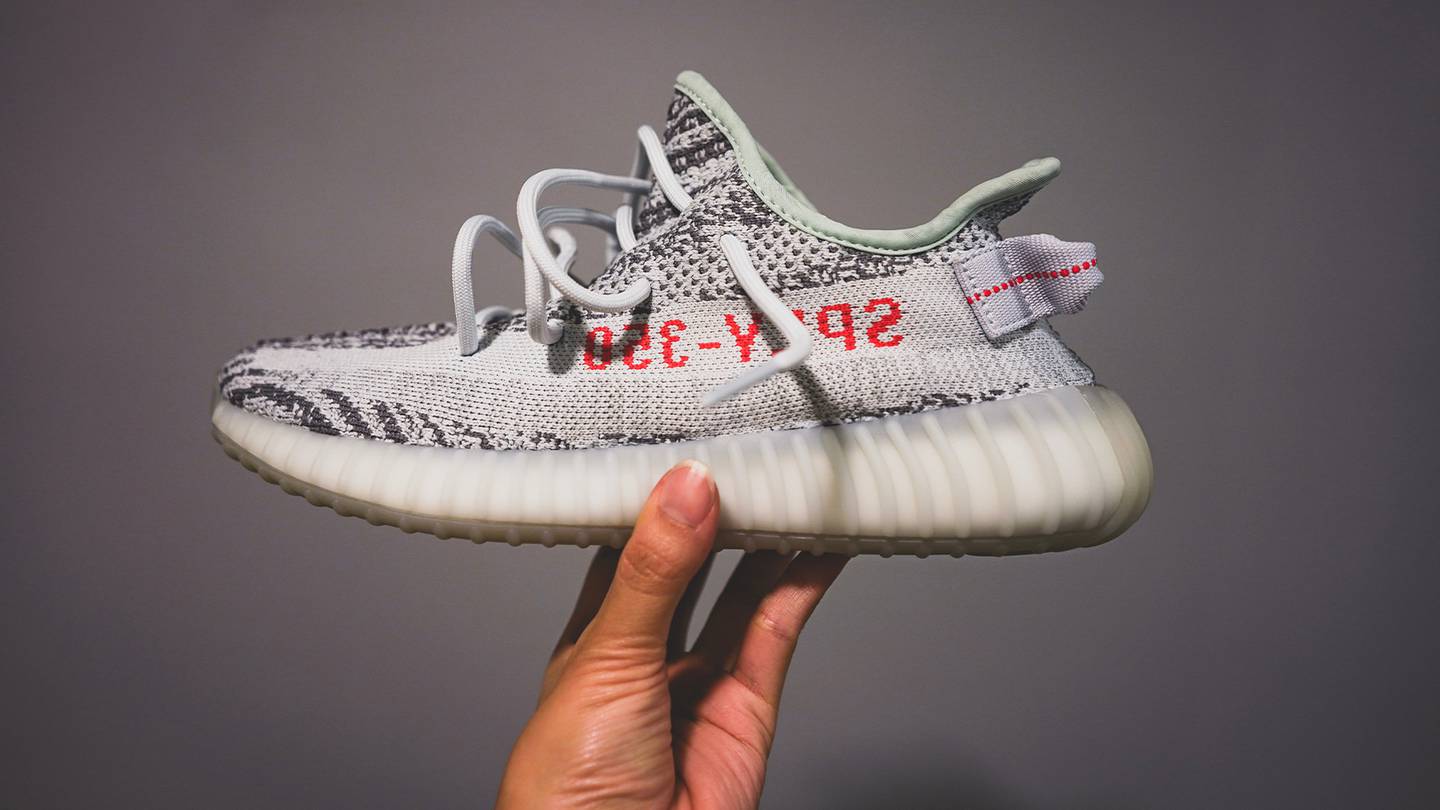

2. Adidas Swamped With $565 Million in Orders for Unsold Yeezy Shoes. The BoF team spent quite a bit of time this week talking about the news of Adidas’ blockbuster liquidation of leftover Yeezy shoes following the collapse of its partnership with Kanye West. Seems Yeezy fans are willing to look past its creator’s misdeeds to snap up what’s left of the sneakers, which will not be manufactured again.

3. Where Did Luxury’s Aspirational Shoppers Go? After years of fuelling growth at luxury brands, the consumer segment — which typically opts for entry-level accessories — pulled back sharply on spending in the first quarter of 2023. BoF unpacks what happened and what’s to come.

4. LVMH Inks Blockbuster Olympics Deal. LVMH made a much anticipated, but unusually timed mid-summer announcement that it is doing a big Paris 2024 Olympics partnership. The tie-up will see many of the group’s brands integrated into the proceedings, which begin one year from now.

5. Can Gap Be Barbie-fied? Recently Marc Bain and Sarah Elson wrote about how Vintage Gap is more popular than current Gap, underscoring the challenge for Gap’s new CEO, the architect behind Barbie’s sensational comeback which has overtaken our social fees in recent months. Can he replicate the playbook to save a $15 billion fashion empire? I hope so. I worked at the Gap when I was 15 years old and still have a soft spot for the brand and what it stands for.

The BoF Podcast

The author has shared a Podcast.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

Last week, Kering announced a new leadership structure and one of the biggest winners in the shuffle was Francesca Bellettini who is now deputy ceo of brand development in addition to her role as CEO of Saint Laurent. That makes her arguably the most powerful female executive in the luxury sector.

It’s a smart move. Francesca has both the business chops and creative sensibility required to be a fashion CEO, and she has a very clear model for how to build luxury brands

This week on The BoF Podcast, I’m pleased to bring back this archive interview with Francesca from BoF VOICES 2018. Listening to it again, there are lessons for all of us on how to lead with purpose and authenticity.

Enjoy your weekend!

Imran Amed, Founder, CEO and Editor-in-Chief, The Business of Fashion

To receive this email in your inbox each Saturday, sign up to The Daily Digest newsletter for agenda-setting intelligence, analysis and advice that you won’t find anywhere else.