When Macy’s unveiled a new turnaround plan on Tuesday, it came along with a collective sense of deja vu.

The American department store chain is set to close 150 stores by 2026, bringing its total down to 350 — nearly half of the 650 locations it operated just five years ago. The hope is that shuttering those unproductive stores will allow the retailer to allocate more than $500 million in savings toward more promising areas of improvement, such as small-format stores and online-offline customer service.

But Macy’s has been shuttering unprofitable locations for years, well before new CEO Tony Spring unveiled what the retailer has dubbed as its “Bold New Chapter” strategy. As Bloomberg columnist Leticia Miranda noted this week, former Macy’s chief executive Jeff Gennette embarked on not just one, but two nearly identical store optimisation initiatives in his six-year tenure, which ended at the start of this year. And in closing stores, Macy’s is arguably further diminishing its presence in the lives of American consumers, which could ultimately be its death knell. The same trajectory pushed Sears and J.C. Penney into bankruptcy and liquidation.

If Spring were to succeed where his predecessor couldn’t — his modest objective is to deliver low single-digit in-store sales growth by 2025 and increase cash flow to pre-pandemic levels — it will come down to execution rather than direction, analysts said.

In addition to scaling back retail, Spring’s plan includes growing a fleet of small-format Macy’s stores; consolidating the merchandising team to bring together owned and licensed brands; continuing to tighten and improve private labels and refining the e-commerce experience. Macy’s will also expand its premium segment with 15 new Bloomgindale’s locations and 30 new Bluemercury stores.

Profitability, product improvements and backend efficiencies are perennial concerns for any fashion retailer; for Macy’s to finally pull off a turnaround, Spring’s proposed actions must result in a palpable difference to the customer experience — and fast. Its waning relevance among shoppers, after all, is its greatest dilemma.

“What exactly is different this time? I think this round is hopefully informed with more technical data around traffic patterns, and there’s already a big effort underway with product improvements and private label,” said Oliver Chen, retail analyst at TD Cowen.

Even so, Chen downgraded Macy’s in a note published Thursday morning, highlighting the chain’s lack of revenue growth in recent quarters despite overall consumer resilience in the US.

Other industry experts are even more sceptical of Macy’s prospects, citing the decline of the department store model that relies on promotions and commodified merchandise. Even the biggest big box store can’t compete with the endless aisles of e-commerce, and no American retailer can offer prices as low as Temu or Shein — not even Amazon.

“For Macy’s, the time for a bold move was four, five years ago,” said Doug Stephens, retail consultant and author. “At this point, they’re rearranging deck chairs on the Titanic.”

Still, it’s not too late for Macy’s to instil a little more “theatre” to its stores, according to Michael Brown, partner in Kearney’s consumer products and retail practice. Stephens recommends shifting the focus from selling product to hosting experiences like parties or panel discussions. Fashion shows and sharp merchandising were what made department stores so glamorous in the 1970s and 1980s, Brown added.

“Department stores have to be reinvigorated with experiences that make consumers come out and shop,” he said.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Shein considers London IPO amid US resistance to listing. The company would need to file a new overseas listing application with Chinese regulators if it decided to switch to London or elsewhere. Other venues including Hong Kong or Singapore may also be considered.

Warby Parker continues stable growth and store expansions. Revenue for 2023 rose 12 percent year over year to $670 million. The brand increased store count to 237 during the year, up from 200 at the end of 2022.

Birkenstock posts strong earnings with sandal demand growing. Adjusted earnings were €81 million ($88 million) before interest, taxes, depreciation and amortisation in the quarter ending in December. Revenue in the quarter reached €303 million, higher than the €285 million average estimate.

Puma sees sneaker demand picking up in the second half of the year. The company expects to gain more momentum as it introduces new products and implements a revival plan. Puma shares rose as much as 3.9 percent in early trading before paring gains.

Mercado Libre slumps most in two years on profit shortfall. Shares slumped 13 percent Friday, the worst intraday drop since May 2022, after the company reported earnings per share of $3.25. The company posted full year net revenue of around $14.5 billion and net income of $1.2 billion for the year.

The RealReal reaches EBITDA profitability. The resale platform saw revenue drop 10 percent in the fourth quarter of 2023, but met its profitability benchmark by prioritising consignment margins.

EBay reports strong holiday quarter and expands buyback plan. Fourth-quarter profit was $1.07 a share on sales of $2.56 billion. The shares rose about 4 percent in extended trading after closing at $44.39 in New York. The stock has increased 1.8 percent this year.

Inditex to gradually reopen stores in Ukraine. The company plans to reopen its first 20 stores in Ukraine, three of them under the Zara brand, and resume online sales. Inditex cited improved local market circumstances as reason for the reopenings.

Moncler CEO Ruffini will hold 16 percent of shares after Rivetti family invests directly. The Rivetti family, who founded Stone Island, will become a direct shareholder in the luxury group after ending an investment agreement with Ruffini’s holding company Double R. Carlo Rivetti will remain a Moncler board member and chairman of Stone Island.

Adidas is dropping a new batch of controversial Yeezy shoes on digital channels. The sportswear company looks to boost earnings by working through the backlog of footwear from its cancelled partnership with Ye. The products will be released in phases over the coming weeks.

Rowing Blazers acquired by Burch Creative Capital. The deal will inject new capital into the New York-based preppy streetwear brand. This will allow it to expand its womenswear assortment and move into a larger Manhattan flagship.

Renewcell files for bankruptcy. The Swedish textile recycler said it was unable to secure sufficient long-term funds to continue operations. The situation marks a blow to efforts to introduce new, more sustainable materials to the market at scale.

EU states block supply chain due diligence law. The stalling of the law designed to clean up corporate supply chains drew condemnation from climate and human-rights activists. The opposing countries cited concerns over how such a law would affect the competitiveness of European businesses.

Sustainable Apparel Coalition rebrands as Cascale. The move distances the organisation from a greenwashing scandal focused on its Higg sustainability tools. The rebrand also indicates ambitions to expand beyond fashion.

Investment in next-gen materials rebounded to $500 million in 2023. The figure is up nearly 10 percent from a year before. Investors funnelled more money into the space despite a wider slump that saw venture capital funding fall 42 percent and deal count decline 30 percent.

THE BUSINESS OF BEAUTY

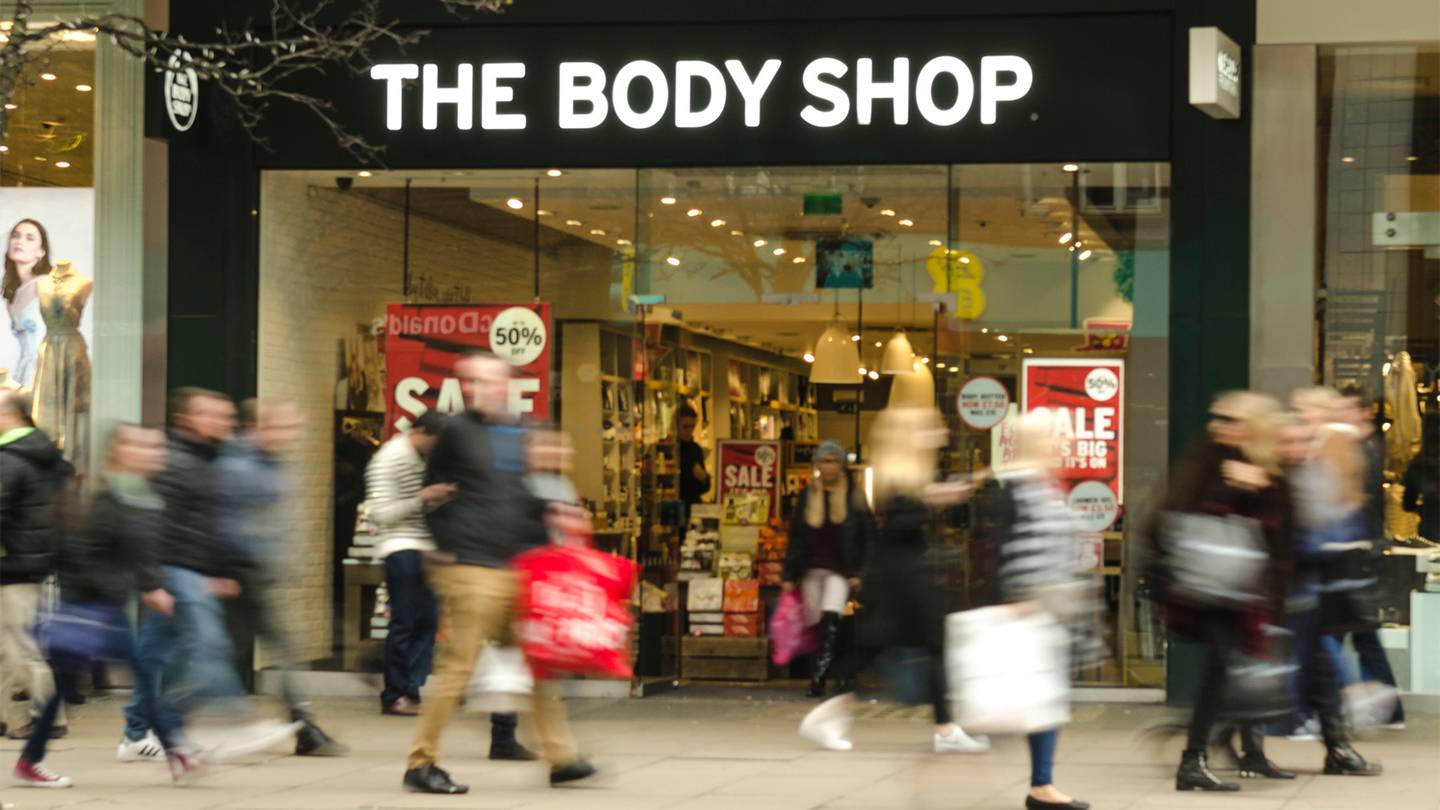

British fashion chain Next is in talks to acquire The Body Shop assets. Any sale, however, would not include The Body Shop’s most recognisable assets. The news follows announcements of The Body Shop shuttering 75 stores across the UK.

Bath & Body Works projects downbeat full year sales and profit on slowing demand. Shares were down 9 percent in pre-market trading. The beauty and skincare firm expects 2024 annual net sales to range between a decline of 3 percent to flat.

US FDA chief is very concerned about fake weight loss drugs. Demand for weight loss drugs is far outpacing supply with some analysts forecasting the market for weight-loss drugs could reach $100 billion a year by the end of the decade. Earlier this month, the FDA sent warning letters to two online vendors for selling unapproved and misbranded versions of semaglutide and tirzepatide.

Supergoop names Lisa Sequino as new CEO. Most recently, Sequino was CEO at Jennifer Lopez’s skincare brand JLo Beauty. Sequino takes the helm after former CEO Amanda Baldwin joined Olaplex late last year.

Estée Lauder announces collaboration with Sabyasachi on a collection of 10 lipsticks. The partnership is part of the conglomerate’s larger strategy to capture the Indian market. It also marks Sabyasachi’s first foray into beauty.

MEDIA AND TECHNOLOGY

Vogue World to kick off Couture Week with Olympics tribute. The production will take place on June 23 on Place Vendôme. It will feature fashion content overseen by editor Carine Roitfeld, Off-White designer Ibrahim Kamara and fashion historian Alexandre Samson.

LVMH in exclusive talks with Lagardere for Paris Match magazine. A sale would expand the media assets of LVMH CEO Bernard Arnault, which include French business daily Les Echos and national newspaper Le Parisien.

Samsung to unveil wearable smart ring at World Mobile Congress. The South Korean company will publicly display the Galaxy Ring for the first time after teasing it last month. The Galaxy Ring’s official launch is expected later in 2024.

Compiled by Yola Mzizi.