DUBAI — The Autumn/Winter 2024 women’s ready-to-wear season is done and dusted, and I have already touched down in Dubai where the market for luxury fashion is (still) healthy. I’ll have more on what I have learned on the ground here next week, but in the meantime I’d like to share what I took away from my conversations with industry leaders on the fashion trail in London, Milan and Paris.

Where Are Aspirational Customers Still Spending?

Luxury spending has slowed significantly after a post-pandemic sales boom, especially amongst aspirational shoppers in the United States, and the massive pullback of these customers weighed heavily on the minds of executives this season. But if these customers are cutting back their spend on luxury goods, it’s not for lack of strength in the US economy. This week, analysts polled by Bloomberg upped their 2024 GDP growth forecast for the United States to 2 percent, about double what they were expecting at the end of last year.

“The US economy remains very robust and the main engine of global growth,” Gregory Daco, chief economist at EY, told the Financial Times. “There are headwinds, but overall there are no indications of an imminent retrenchment in the private sector.”

American customers still have money to spend. They are just choosing to spend differently, making more deliberate choices on where to spend. So where are they spending — and why? Executives I spoke to had multiple theories.

One theory advanced by some executives is that there is a renewed focus on ready-to-wear, now that customers have overdosed on handbags. When you double-click on the strong results from Prada Group released yesterday, with an eye-popping 82 percent uptick in Q4 sales at Miu Miu, the main driver of growth is ready-to-wear, up 24 percent year over year, and up 64 percent versus 2021, compared to 3 percent and 25 percent growth in leather goods, respectively.

This means that after years of operational challenges and brand stagnancy, Miu Miu and Prada are gaining significant market share on the strength of their ready to wear offering, and impressively, this is without opening new stores.

Another theory is that aspirational customers are spending more on beauty, which is eating into their spend on other categories. All you need to do is look at the performance of Sephora, the main part of the selective retailing division at LVMH, which registered a 25 percent organic growth rate in 2023. For my 13 year old niece, Raeya, Sephora is the first place she wants to go. She is my real life proof about the how tweens are helping to drive the booming skincare market which is drawing attention from younger customers, where previous generations might be focused on small leather goods from a luxury brand.

Then there is the growing spend on health and wellness, travel and dining experiences. Fashion brands are not just competing with each other for consumers’ share of wallet, they are competing with everything.

The Kering Conundrum

Undoubtedly, the group that has been hardest hit by the shifting behaviour of aspirational customers is Kering. In the year ending 2023, Gucci was down 4 percent, YSL was down 1 percent, and the group of “other houses” was up 5 percent, but this was due to strength in fine jewellery at Boucheron, not at Balenciaga and Alexander McQueen which both had tough years.

In the Kering fashion universe, only Bottega Veneta eked out organic growth of 5 percent, on the strength of new handbags such as the Andiamo and Gemelli, which retailers say are performing well. Once again, Matthieu Blazy put on one of the strongest fashion shows of the season showcasing innovation in craftsmanship you can’t see anywhere else on the runway. But if some customers are returning to ready-to-wear it’s unlikely to happen at Bottega where the prices are eye-wateringly high.

Kering’s overall results have also been impacted by significant wholesale rationalisation and retrenchment, but there’s no doubt that the aspirational customers have pulled away from its brands, and that executives are laser focused on fixing what is not working.

The biggest challenge at Kering’s anchor brand Gucci, which accounts for more than half of the group’s revenues and about two thirds of its operating profit, is the lack of a clear expression of what the new vision for the brand is. After the avalanche of Gucci “Ancora” communications, followed by a spree of co-ordinated global Vogue and Elle covers featuring de Sarno’s first collection, most industry observers still don’t understand what the new Gucci is aiming to be. The advertising and fashion shows lack the impact one would expect from a brand of its scale, and even the execution is sometimes flawed. Driving past a massive Gucci hoarding along the Seine in Paris, I couldn’t read the Gucci branding on the advertising because the G and I in the Gucci branding were unreadable as they were in white text on a white background. All I could read was “UCC’

But the early signs from retail are good. Two very experienced Gucci retail associates at the Gucci flagship on via Montenapoleone in Milan told me that early deliveries from Sabato de Sarno’s first collection are getting a promising response, and that Gucci customers are excited about the new things they can buy. Among the products I saw customers trying on were bags that de Sarno has revitalised from the past, include a revamp of the Horsebit Clutch from the Tom Ford era and the Jackie bag, now lined in leather. As Tim Blanks said to me on this week’s BoF Podcast, now we need to see what DeSarno himself can offer. It seems it will be some time before see any meaningful results of the Gucci elevation strategy.

Meanwhile, Sean McGirr’s debut at McQueen was highly anticipated, and perhaps unsurprisingly, highly divisive too, when you consider how passionately the fashion community feels about the brand created by the designer Lee Alexander McQueen. There were many critics, but I liked the energy of the show which appealed to other industry insiders I spoke to afterwards. However, retailers were unhappy with the ready to wear offering which was clearly defined under Sarah Burton. We need to give McGirr time to develop his vision and people need to show a little patience so he can build a product offering around his energy. This can happen in due course. It’s much harder to create new energy than it is to create new products.

My advice to McGirr is to move his show to London, where McQueen first started his business and which will embrace the youthful edge he is trying to capture from the brand’s earliest days. This will be much more appreciated in London than in Paris, where the brand needs to compete with the heavyweights. They can still sell the collection in Paris where the buyers are.

A Richemont Revival

And in other news, Richemont might finally be getting its act together on the fashion front. Simon Holloway’s show for Dunhill was well received in London. And Chemena Kamali’s debut as creative director at Chloé was widely viewed as a successful reset and return to the core DNA of Chloe. Now, it remains to be seen what Chemena and her dynamic CEO Laurent Malecaze can do to capture the moment. A big focus will be the new bag silhouettes that have been missing at Chloe in recent years, though the people I spoke to aren’t convinced that Kamali has got the bags right just yet. That will take time too.

One bag from the Richemont group that is working is the Le Teckel by Alaïa, shaped like a long French baguette with a top handle. I spotted it on a number of industry insiders, it-girls, editors, models and top customers. Surely, many of these were gifted by the brand, but the mere fact that these women who have countless bags to choose from are carrying around Le Teckel speaks volumes.

And what about LVMH? Well, apart from a spectacular 10th anniversary show by Nicolas Ghesquière at Louis Vuitton and the top show of the season by Jonathan Anderson at Loewe, one felt a bit of stasis settling in at some of the other houses: Givenchy and Fendi, in particular. Insiders were speculating about a designer shuffle that, were it to materialise, could re-energise these brands.

This Weekend on The BoF Podcast

The author has shared a Podcast.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

It’s time for our seasonal review of the fashion season that was. Several newly-appointed creative directors including Seán McGirr at Alexander McQueen, Adrian Appiolaza at Moschino and Chemena Kamali at Chloé debuted at their respective houses while recurring motifs of sci-fi and elevated everyday clothes were a response to anxiety about the current state of the world.

As always, I sat down with BoF editor-at-large Tim Blanks to discuss our highlights and takeaways from the fashion month gone by. (And if you’d like to catch up on Tim’s reports from Milan and Paris, they can be found here).

Imran Amed, Founder, CEO and Editor-in-Chief, The Business of Fashion

P.S. If you haven’t already secured your place at the BoF Professional Summit, save $100 off the full ticket price, using code BoFTECH100. Purchase your ticket now.

Plus, here are my other top picks from our analysis on fashion, luxury and beauty:

1. Is the TikTok Fashion Boom Already Over? The ByteDance-owned app has big ambitions to be an e-commerce player in league with Amazon with influence in fashion on par with Instagram. Now it’s facing new threats — both from outside and within.

2. Why Frasers Group Shuttered Matchesfashion. In the latest blow to the luxury e-commerce sector, the embattled Matches is closing down just over two months after being acquired by Frasers Group as relationships with brands have reportedly soured.

3. Has Creativity Become a Luxury? At Paris Fashion Week creative spark was scarce, but there were bolts of imagination from designers across the aesthetic spectrum, writes Angelo Flaccavento.

4. AI, Outlets, Recycling: Can Luxury Solve Its Billion-Dollar Excess Inventory Problem? LVMH and Kering wrote down billions of dollars of unsold inventory last year. What to do with it has become an increasingly complex challenge.

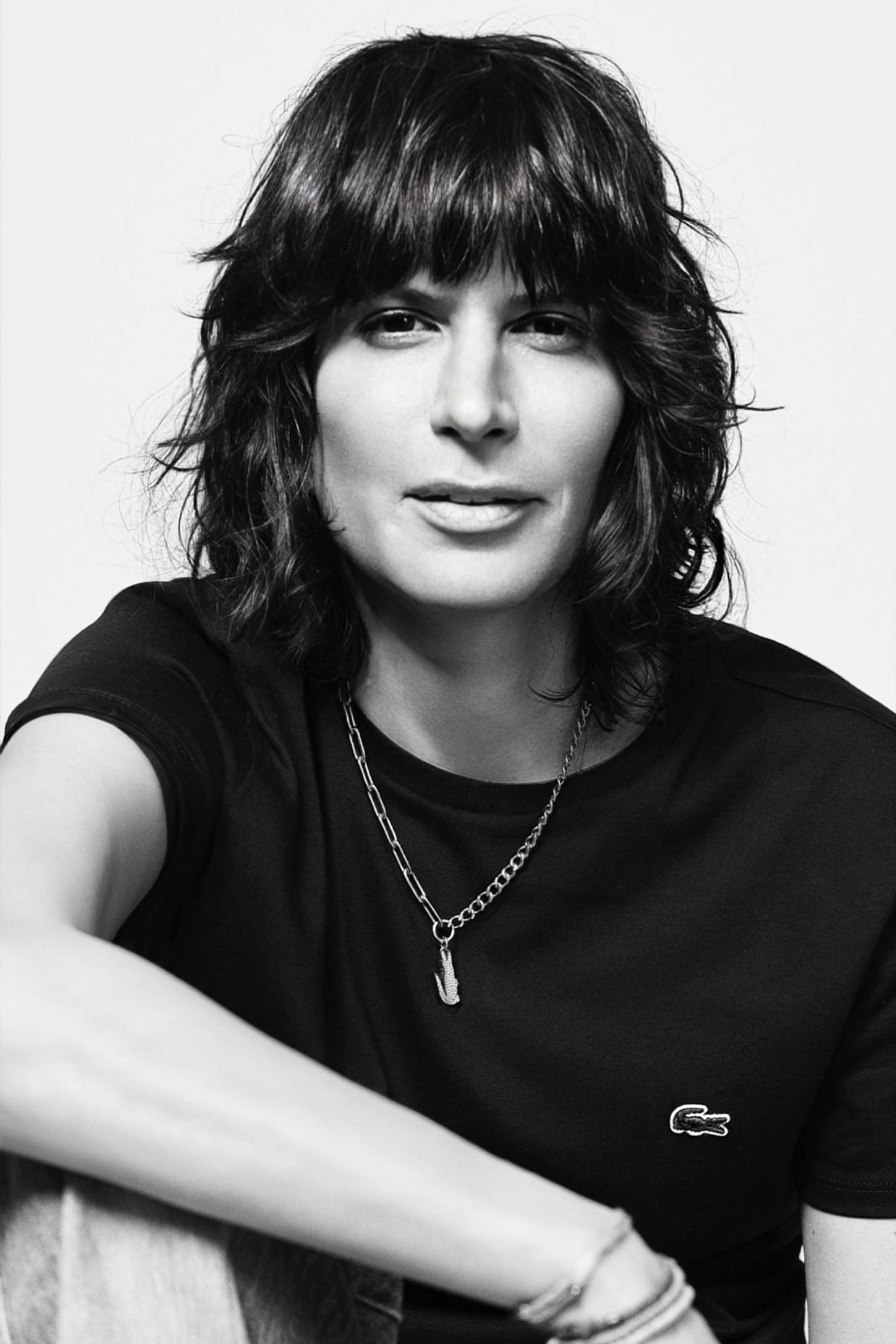

5. Inside Lacoste’s New Fashion Chapter. Creative director Pelagia Kolotouros and CEO Thierry Guibert are banking on a retail-driven strategy and fresh focus on fashion and tennis to power the brand’s growth.

To receive this email in your inbox each Saturday, sign up to The Daily Digest newsletter for agenda-setting intelligence, analysis and advice that you won’t find anywhere else.