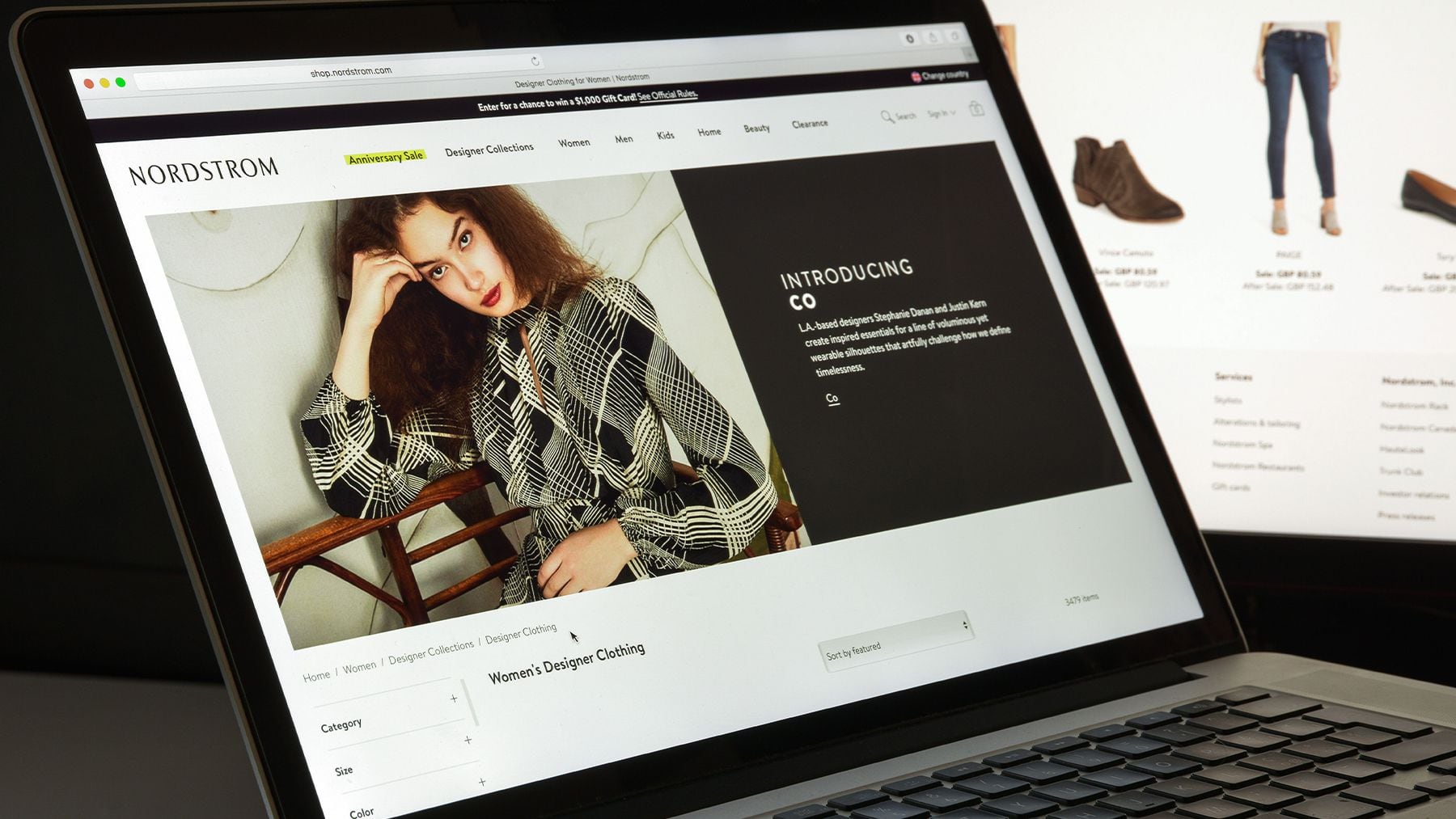

Nordstrom on Thursday warned of an uncertain economy and said consumers were resilient but selective, after the department store owner merely maintained its annual forecasts for sales and profit.

Shares in Nordstrom dropped nearly 5 percent in after-market trading. The company, which sells pricier clothes, shoes, and accessories, beat first-quarter revenue expectations.

Department store chains including Macy’s and Kohl’s have sounded caution on consumer spending as customers have tamped down on discretionary spending amid high interest rates.

Nordstrom reaffirmed its 2024 comparable sales forecast of a 1 percent drop to a 2 percent rise and annual profit per share of $1.65 to $2.05.

“Even though the results seemingly look positive, they were up against weak figures over the year and I think their guidance obviously hasn’t increased. So I think that’s really why we’re still seeing the stock come down,” said Jessica Ramirez, senior analyst at Jane Hali and Associates.

Nordstrom has been trying to drive sales by bringing in more in-demand clothing from brands like Birkenstock and Prada Beauty at its namesake brand.

Sales at the company’s eponymous label recorded a 0.6 percent rise. Discount banner Nordstrom Rack’s sales rose 13.8 percent as the company pushed ahead with plans to open more of its stores in a bid to attract lower-income consumers.

“I mean overall, it’s not terrible. It looks better than what Kohl’s reported this morning,” Morningstar analyst David Swartz said.

Nordstrom’s first-quarter revenue rose 4.8 percent to $3.34 billion, compared to LSEG expectations of a 0.6 percent rise to $3.20 billion. It posted a quarterly loss of 24 cents, compared to estimates of an 8-cent loss.

Gross profit decreased 225 basis points to 31.6 percent, weighed down by “external theft” in its transportation network and inventory cleanup in the supply chain network.

By Ananya Mariam Rajesh; Editing by Maju Samuel

Learn more:

Buyout Firm Sycamore Vies to Take Nordstrom Private, Sources Say

Nordstrom shares rose 6 percent on the news, giving the company a market value of about $3.3 billion.