Last November, while much of the luxury e-commerce sector was in free fall, Mytheresa’s chief executive, Michael Kliger, seemed sanguine.

In the quarter ended Sept. 30, 2023, the high-end e-tailer achieved another quarter of net sales growth, preserving the streak it had maintained since its IPO in 2021. It was faring better than its competitors: The same day, Farfetch abruptly announced it would not provide its usual quarterly results, all but confirming the company’s dire situation that eventually led to its fire sale to South Korean retailer Coupang weeks later.

Asked on a call with investors and analysts how Mytheresa could future-proof itself as conditions deteriorated, Kliger said it would do what it had always done: Focus on its top-end clients, which it kept happy with events they couldn’t experience anywhere else, and exclusive products.

“All of these efforts … allow us to compete not on price, not on discount, but to compete on newness, on exclusivity and combine that with superior service for our best customers,” Kliger said. “That is the approach that has allowed us to grow in a market where most people shrank.”

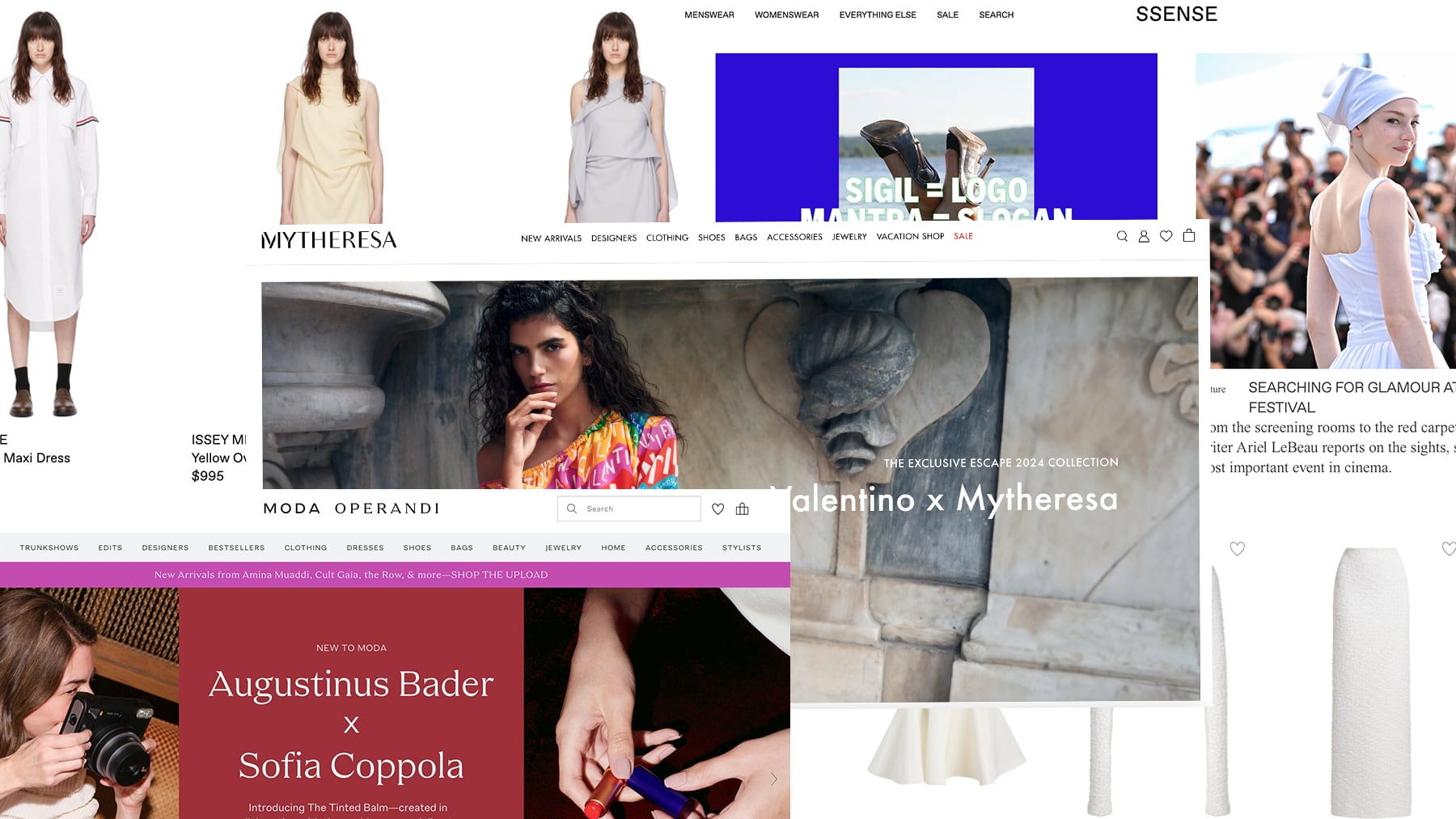

Mytheresa is one of a handful of multi-brand luxury e-commerce retailers, including Moda Operandi and Ssense, marching ahead despite the upheaval roiling their sector. Beyond Farfetch’s woes, in December, the ailing Matchesfashion sold to Frasers Group, which shut it down just months later. Yoox-Net-a-Porter remains up for sale by owner Richemont, whose deal to offload the loss-making company to Farfetch fell through.

Survivors haven’t gone unscathed. Ssense, known for its lengthy sales, slashed its workforce at the start of 2023 due to slower growth; from January to May, sales declined 17 percent from the year prior, according to Earnest Analytics, which analyses credit card data. Moda Operandi said in a statement to BoF that it did not see year-over-year growth in 2023 as it experienced flattening demand.

Still, the companies do appear to be on firmer footing than their peers. Mytheresa continues to report solid sales. Ssense and Moda Operandi are privately held, meaning they don’t have to disclose their financials. Ssense nonetheless claims to be profitable on its site, but would not confirm profitability to BoF. Moda Operandi said its sales to-date in 2024 are running at positive comparisons to last year and 2022, and that its resort and spring 2024 inventory had the highest full-priced sell through in its history. While it’s not yet profitable, it expects to be so “in the very near future,” CEO Jim Gold said in an emailed statement.

Experts say these multi-brand players are doing a number of things right: speaking to a specific customer and curating their assortment for them, as well as executing on the basics of retail, including customer service and managing costs and margins.

Customers, Content, Curation

E-tailers have historically been forced to compete on price, which leads to a cycle of discounting. In an effort to differentiate their offers, Ssense, Mytheresa and Moda Operandi have prioritised curation and honing in on a particular customer: Gen-Z for Ssense, top spenders for Mytheresa and runway watchers for Moda Operandi.

Moda Operandi’s virtual trunk shows — which gave shoppers first dibs on Chemena Kamali’s debut collection for Chloe through pre-order, for example — attract a shopper presumably similar to the site’s founder, New York-based socialite Lauren Santo Domingo. That appealed to The Frankie Shop, an influencer-favourite basics brand, which collaborated with the retailer on a capsule and pop-up shop in May.

“The woman they cater to, she’s confident. Why? She pre-orders,” said Frankie Shop founder Gaëlle Drevet.

Mytheresa churns out exclusive capsules tailored to its wealthy shoppers’ lifestyles — past partners include Valentino, Dolce and Gabbana and Brunello Cucinelli. Ssense, meanwhile, sees itself as the place for emerging designers.

“Our number one goal is, if [our shopper] already knows about a cool brand, they know we will have it first,” said Brigitte Chartrand, Ssense’s vice president of womenswear buying. “‘Of course Ssense has it’ is essential to what we do.”

The e-tailers use content and events to pull shoppers to the site and keep them there — which is increasingly expensive as advertising costs rise, and notoriously difficult because switching tabs is so easy.

“A curator doesn’t only curate ‘stuff.’ They curate a venue and make the stuff accessible to an audience,” said Thom Bettridge, Ssense head of creative and content. “We pick the stuff and have this way of speaking to the audience that brings a certain person there.”

For Ssense, that person knows what minimalist Japanese label Auralee is and is willing to give Rick Owens’ inflatable boots a go. Ssense publishes editorials online — recently, an ode to life in a Vaquera skirt with pink panties sewn on the outside — and fills its Instagram with memes to spur comments and shares. The content is meant to engage with its particular audience, rather than attract a wide one, said Bettridge. It’s the same on the merchandising side, said Chartrand: buyers are focused on picking the designers and products who directly appeal to its customers. The retailer also looks to fill gaps in its offering by introducing its own take on categories like bridal.

Mytheresa’s engagement with top customers often happens offline. It hosts special events for top clients — a trip to the Italian Riviera with Dolce and Gabbana or a private viewing of a New York Ballet rehearsal, for example — that make them feel like part of an exclusive club. In turn, clients shell out: top shoppers, who typically spend six or more figures on clothes annually, drive nearly 40 percent of the business, the retailer told BoF in January.

“Having two days with a customer brings it to an ultimate relationship, which is an emotional tie. And, as we’re selling luxury, an emotional tie is very valuable,” Isabel May, Mytheresa’s then chief customer experience officer, told BoF in January. (May has since left the company to join LVMH).

Retail Basics

Even online, the old principles of retail still apply, like the fact that, at its core, retail is a service business, especially in the case of luxury. Moda Operandi said one factor that has played to its advantage is that it puts more emphasis on personal shopping, exceptional customer service and high-touch relationships than on promotional digital marketing.

One source who spoke on condition of anonymity said companies that have struggled ignored the basic retail principles of curation and customer service, focusing too much on their balance sheets rather than serving shoppers in a way that would keep them happy paying full price.

Even the numbers they focused on may have been the wrong ones.

“We all have been falling for the massive trend of growth, because ultimately you follow the money, right? If valuations are a multiple of gross merchandising value, all you want is more [GMV] rather than anything else,” said Stefano Martinetto, CEO and co-founder of Tomorrow, a growth and development platform for brands.

This approach may have worked when money was cheap, investors were throwing cash around and shoppers across the income spectrum were splurging on luxury. But it proved unsustainable as market conditions changed.

Ariel Ohana, founder of investment firm Ohana & Co, which advised on the 2022 sale of beauty retailer Violet Grey to Farfetch, said companies that prioritise unit economics and profit over growth at any cost are the ones likely to prove more resilient.

“The paradox is that these companies operate in the business of high-end products, but they’re not high-margin companies,” Ohana said. “When you’re not in a high-margin business, a lot of the success relies on operational excellence, meaning managing costs.”

Moda Operandi, for one, said it has been cutting unnecessary costs across tech, marketing and distribution as it looks to be more efficient.

Of course, luxury retail is not a cheap business, and high costs are to be expected. But the spending should ideally go to improving the customer experience. Farfetch, by contrast, became enmeshed in numerous costly ventures that didn’t necessarily benefit the customer, like its acquisition of New Guards Group.

The Road Ahead

Pressure to scale can complicate matters, especially when it comes to maintaining margins and curation.

“Many of the strategies [that make e-tailers early successes] are often in conflict with the notion of scaling the business,” Ohana said. “As you scale you’ll have more brands and less curation, you’ll have more customers and you’re targeting a broader audience.”

The market has fresh challenges. Luxury sales will likely rise 1 percent to 4 percent in 2024, compared to 8 percent growth in 2023, consultancy Bain & Company forecasts. Big players are taking more of their e-commerce in-house, syphoning sales from multi-brand retailers, who are simultaneously facing higher customer-acquisition costs. To succeed, multi-brand e-tailers need to clearly articulate their value proposition and tailor marketing to the next generation of shoppers, said Federica Levato, senior partner and EMEA leader of fashion and luxury at Bain & Company.

Plus, there’s the still unanswered question of how many retailers the market can sustain — and how big they can get. Too many, and they could end up cannibalising each other or become trapped in the perpetual race to the bottom on price.

“We’ve been in situations where a rising tide lifts all boats. Now, when the tide is going out, who’s going to be left floating?” said Brian Ehrig, partner in Kearney’s consumer practice.