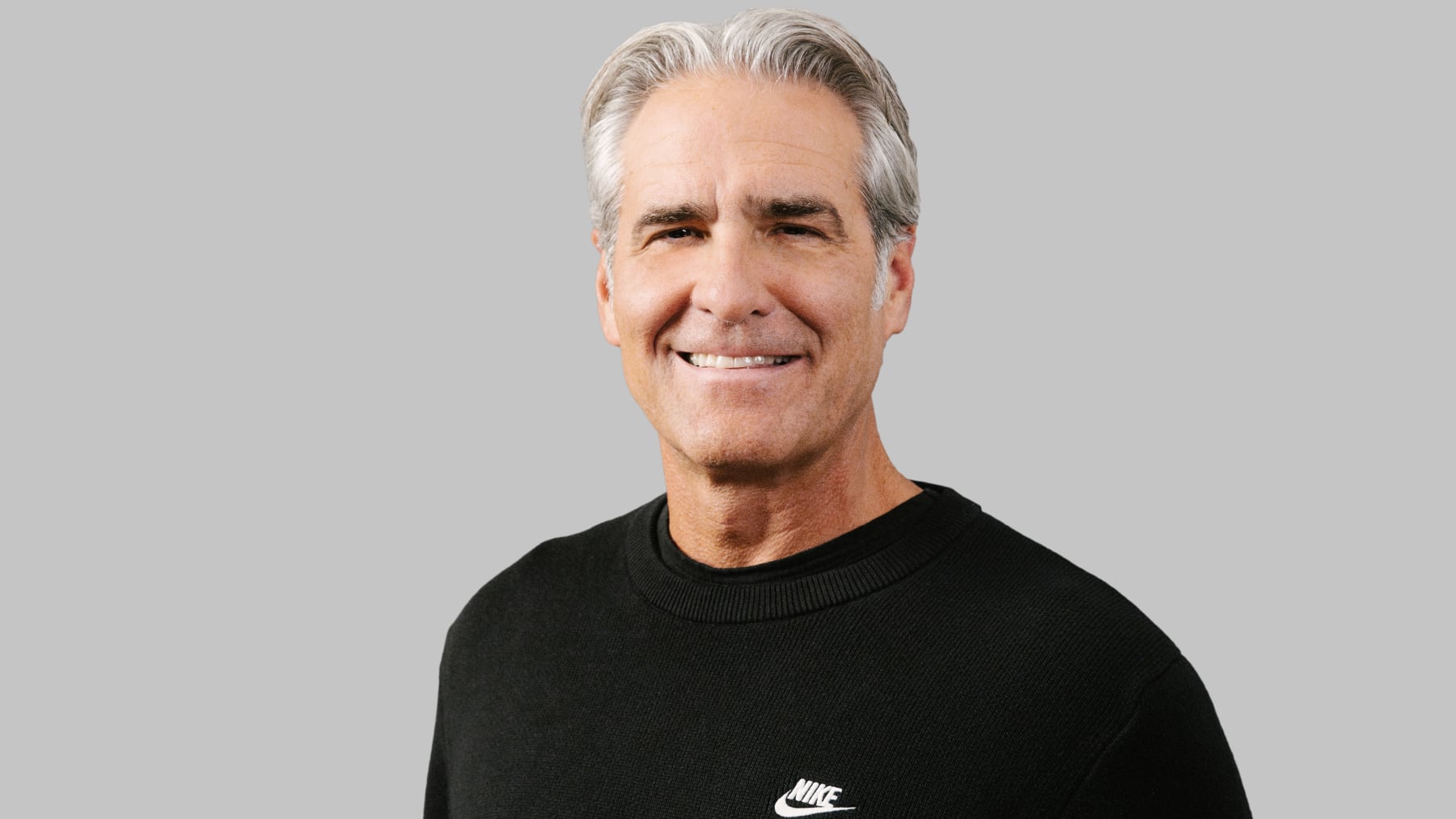

Nike has a fresh-faced new hire starting Monday.

Elliott Hill begins his tenure as Nike’s new chief executive following last month’s announcement that his embattled predecessor, John Donahoe, would be departing after more than four years in the role.

News that Hill — a Nike lifer who began as an intern in 1988 before retiring in 2020 as head of commercial and marketing operations for Nike and Jordan Brand — would return and become CEO sparked a wave of jubilation among a number of current and past Nike employees. Former Nike historian Scott Reaves said on LinkedIn that a few people, himself included, shed actual tears of joy. Analysts who had begun speculating openly about Donahoe’s future welcomed the news as well.

But while Hill enters the job with a great deal of good will, he also faces an imposing challenge. Nike finds itself being outperformed by a resurgent Adidas and a host of smaller, specialised challengers like On and Hoka as it tries to wean itself off its over-reliance on a handful of retro styles and prove to shoppers and investors alike that it can still create exciting new products. Hill may have the buy-in of analysts, investors and the wider Nike community, but he now confronts the job of actually delivering on those expectations.

“Elliott Hill is the perfect candidate for the turnaround and beyond. He is extremely capable and well regarded,” said sneaker industry analyst Matt Powell. “But there are no quick fixes here.”

Hill will have to tackle several critical issues currently hamstringing Nike’s business. Here’s where he needs to start.

Set Expectations Low

Hill is in a position akin to the one Adidas CEO Bjørn Gulden found himself in when he parachuted into the company’s top job in January 2023, following its decision to terminate its Yeezy business. Adidas was facing a crisis that it knew would take work — and time — to resolve. Like Gulden, Hill has one advantage in that he played no part in the last three years of Nike’s downturn and is untainted by those associations.

But at every opportunity Hill will also want to emphasise to investors that the brand is back at square one, curbing any expectations of a rapid turnaround and buying himself and his management team time to craft a strategy without the pressure of meeting immediate financial targets.

Nike has already started laying the groundwork. On a recent earnings call, chief financial officer Matthew Friend told investors the company was withdrawing its initial full-year guidance, which projected the brand was headed for its worst financial performance in 26 years, and would instead issue quarterly guidance for the rest of the fiscal year, which ends in May 2025. Friend said it would give Hill the flexibility to reconnect with employees, evaluate current trends and strategies and devise a plan. Nike also postponed the Investor Day it had slated for November.

“[Setting low expectations] is also good for a company’s internal teams and regular employees, because they are empowered to do what’s right for the long term and not bound to quarterly targets where they need to rush and hit numbers that are good for the P&L but are not necessarily good for the long-term brand equity,” said Erwan Rambourg, global head of consumer and retail research at HSBC.

By giving conservative quarterly guidance, Nike can also help to build positive sentiment once it starts recording small wins under the turnaround plan, Rambourg added, citing Adidas’ approach to issuing low guidance before recording earnings beats in its last six quarters.

Innovate, Innovate, Innovate

One of Hill’s top priorities must be proving that Nike hasn’t lost its ability to create exciting products in both the performance and lifestyle categories. It won’t be easy. Considering how much Nike speaks about “innovation” in press releases and on earnings calls, there has been little evidence of it over the past few years.

The company has instead become known for churning out retro basketball sneakers like the Jordan 1, Air Force 1 and Dunk in endless iterations that diminished their cachet and left consumers fatigued. Now, as it tries to rein in distribution and clean up the marketplace, sales are taking a hit.

“Naively, management didn’t understand that pulling back [on Jordan 1s, Dunks and Air Force 1s] would mean the brand would do a lot less business,” said Powell. “A lack of new and fresh products has also slowed recovery.”

In key performance categories like running, the brand has increasingly been outflanked by competitors when it comes to bringing through and marketing new technology. On used the Paris Olympics this summer as the perfect stage to show off its new LightSpray “spray-on” manufacturing technique which allows for the creation of ultralight one-piece uppers for its latest racing shoes, while Adidas’ $500 Pro Evo 1 supershoes (worn by marathon silver medalist Tigist Assefa and Pharrell Williams for his opening ceremony duties) got valuable airtime too. By contrast, Nike had little new product to point to.

It’s a long road ahead. Analysts at Bernstein have said Nike’s stagnant innovation pipeline is unlikely to show signs of revival until the first half of 2026, at the earliest.

Get Sneakerheads Back on Side

Winning back the attention of sneakerheads is a two-fold issue. Part one, already in motion, is removing oversaturated styles from the marketplace.

Part two, which has proved more elusive for Nike, is coming up with new styles and marketing new technologies which get people talking again.

Models such as the casual Air Max Dn and the Pegasus 41 running shoe have not sold as well as Nike had probably hoped since releasing earlier this year, especially in the key North America market, BMO analyst Simeon Siegel said in a research note earlier this month. The lesson to be taken from these launches — both billed as new and futuristic innovations — is that consumers can’t be fooled into thinking something is fresh and exciting just because Nike markets it as such. In reality, both shoes were mere iterations of Nike features which have existed for years, or in the case of the Dn’s updated “Air” technology — decades.

Hill, unlike his predecessor, has time on his side. But he needs to show that Nike at least has effective and genuinely new ideas on the way — or even old ones that it can give a fresh spin. Key to Adidas’ recent comeback has been the way it has reinvigorated the Samba. It’s debatable whether Nike has any archival silhouettes it can scale to the same level of popularity as those it’s now pulling back on, however, increasing the pressure on Nike to come up with novel ideas.

One positive note is that Hill will be able to rely on veteran sneaker designer Frank Cooker — known for his work on some of Jordan Brand’s most hyped sneaker collabs and special projects — who announced his comeback in September after leaving the Swoosh in 2018.

Keep Retailers Happy

Nike’s radical DTC pivot over the past several years alienated some of retail partners and shrank its coverage of the marketplace, creating openings for competitors to fill the gaps left on store shelves. Hill will need to continue the work started under Donahoe of rebuilding Nike’s wholesale partnerships and getting Nike back in front of customers wherever they want to shop. Meanwhile, the return of Nike veteran Tom Peddie (who, like Hill, retired in 2020) as vice president of marketplace partners was met positively by retailers in July. On the eve of Hill’s arrival as CEO, Peddie was promoted into the role of vice president, general manager of Nike’s North America business.

But again, it won’t be a simple task. On this month’s earnings call, CFO Friend admitted orders from retailers for spring 2025 were flat compared to last year, calling them “a little lighter than we had planned.” Lukewarm interest from retailers could be a sign of both a lack of exciting products in Nike’s innovation pipeline and also the continuing struggle to recapture the space it abandoned in retailers’ stores.

Nike’s weakened standpoint when it comes to wholesale is not only a problem for its balance sheet, experts say.

“These aren’t just sales channels — they’re cultural touchpoints that influence trends and communities,” said Howard Yu, professor of management and innovation at IMD Business School. “Elliott must rebuild those relationships.”