VENICE — How did Miu Miu generate revenue growth of 89 percent in the first quarter of the year even as the rest of the luxury sector struggled to maintain its post-pandemic momentum? What will it take for Gucci to get back on track after its sales contracted by 18 percent over the same period? And why does Bottega Veneta choose not to participate in the race for attention on social media?

Just before luxury brand CEOs took to the stage to address these questions at the FT Business of Luxury Summit in Venice this week, BoF unveiled the second iteration of The BoF Brand Magic Index, a new brand measurement tool co-created by BoF Insights and data and AI insights company Quilt.AI. Our new report is chock-full of insights for anyone interested in luxury brand management, including an updated methodology building on the first edition of the report we unveiled in September 2023.

In case you missed it, Dior, Louis Vuitton and Versace ranked in the top three brands this time around. You can see the results here. The full 178 page report, including 50 brand profiles, is available to our Executive Members.

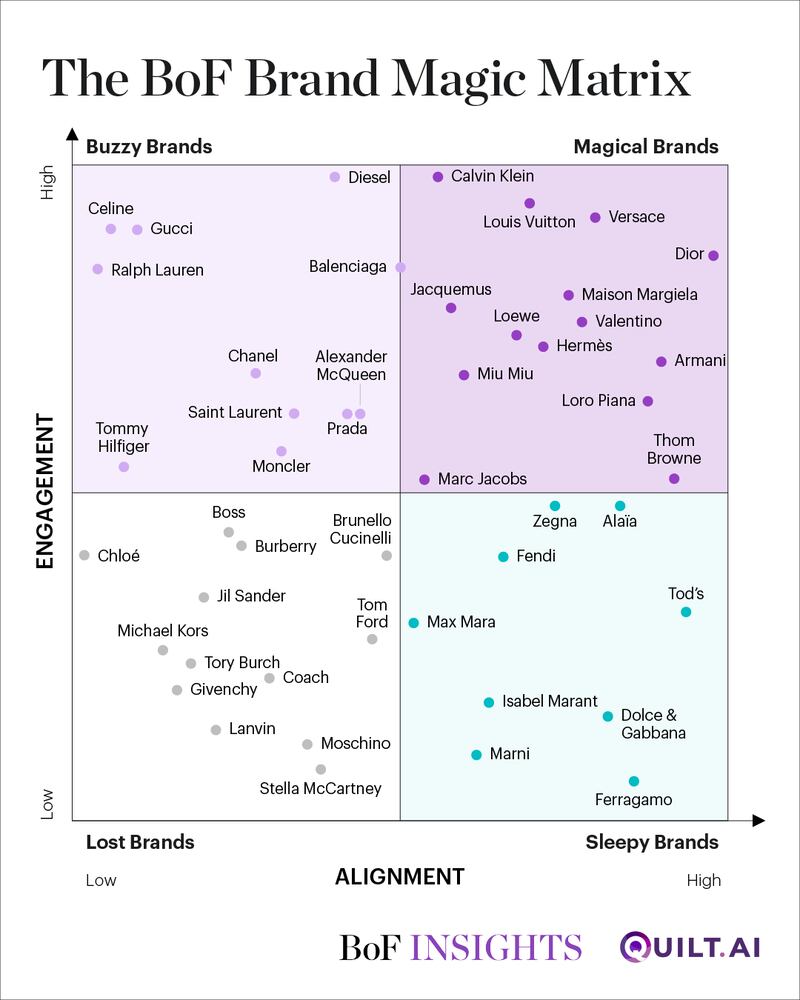

Although my days as a management consultant are long behind me, my favourite new addition to our new report is The BoF Brand Magic Matrix. I have not lost my love for a good 2×2 matrix!

This provides a visual depiction of 47 of the 50 brands we analysed along two of our three core metrics:

- Alignment: We measure how clear a brand’s identity is to customers, based on the analysis of brand and user-generated content on Instagram, TikTok and YouTube, using proprietary AI models created by Quilt.AI. We look at how customers communicate about a brand and compare that to the way the brand talks about itself. The greater alignment, the higher the score.

- Engagement: To determine how effective a brand is in inspiring customers, we measure a brand’s engagement rate on Instagram and how much user-generated content customers create about a brand on TikTok. This indicates how much buzz a brand is creating, irrespective of the actual size of its following, enabling us to more fairly compare brands of different sizes.

Decoding The Magic of Miu Miu

Miu Miu, which appears in the top right quadrant of The BoF Brand Magic Matrix, is one of the 14 Magical Brands that have found alignment with their customers, while also generating meaningful engagement from fans, followers and customers online.

How have they done this? According to Prada Group CEO Andrea Guerra who spoke at the Financial Times Summit, the key to luxury brand management is carefully managing the key “tension of who you are and who you would like to be in the future.”

This is exactly what The BoF Brand Magic Matrix measures, providing insight into how effectively brands balance the timelessness of their identity with the timeliness of the culture.

When it comes to thinking about timelessness, Guerra credits Lorenzo Bertelli for coming in to work with his parents in the family business. “This is one of the things I love about the Prada Group and the entrance of Lorenzo [Bertelli, son of Miuccia Prada and Patrizio Bertelli] in the group. The two brands were really centred again in their positioning in the long-term. No tactics. No shortcuts. Long-term. And being credible to that group of consumers. This is one of the most important things to be constantly done. Do not betray that small group of consumers that are your real long-term backbone.”

On the other side of the equation, there is creativity, where Miu Miu has undoubtedly been one of the industry leaders for several seasons. Much of this success of Miu Miu has come from translating the runway offer into highly wearable preppy daywear, plus some viral hits that start conversations.

But Guerra says Miuccia Prada uses her gut as a creative starting point. “Mrs Miuccia does what she feels there. She does what comes to her mind, how she’s living the world in the right moment, how she’s capturing the cultural world. It’s more about instinct. It’s for sure a younger brand, but I think it represents the happiness of Mrs Miuccia.”

It can’t hurt that Mrs Prada has found such great creative foil in the stylist Lotta Volkova, who has been working behind the scenes with Mrs Prada on styling the shows and campaigns, which have had a palpable impact on Miu Miu’s strong brand image.

Guerra says this dual focus on long-term brand management anchored and short-term creativity and image creates a valuable and necessary tension. “On one side, there are people who are dealing with brand, and there’s people dealing with creativity and image. If you have a positive tension there, if you have a constructive tension there, if there’s not a clear winner there, I think you are on a good track.”

(For more on the magic of Miu Miu, read Rachel Sanderson’s excellent analysis: The Strategy Behind Miu Miu’s Explosive Growth.)

Getting Gucci Back on Track

Although Francesca Bellettini is better known among industry insiders as the CEO of Saint Laurent, she has also recently taken on an expanded role as deputy CEO of Kering in charge of Brand Development, tasked with working with the CEOs of the brands in the group, including flagship Gucci. So naturally the biggest question on the minds of attendees was about the future of the mega-brand amid sales that have declined precipitously while competitors have continued to grow.

This week, Chanel revealed that its sales for 2023 expanded by 16 percent, while Gucci’s revenue was down 2 percent to €9.9 billion over the same period. Gucci continued to lose momentum in the first quarter of this year, with sales down 18 percent versus the same quarter last year. Kering has warned that Gucci’s underperformance will mean recurring operating income for the group will plunge 40 to 45 percent in the first-half, because of the disproportionate share of profit that Gucci normally generates.

Gucci is positioned in the top left quadrant of our Brand Matrix. It is a Buzzy Brand that has high levels of Engagement on social media channels, made possible in part to its huge marketing spend. But with a creative transition under Sabato de Sarno still not bedded in a year and a half after his runway debut, many customers have not yet clocked Gucci’s new aesthetic. Some of them still see Gucci as the maximalist fashion brand that registered explosive growth under the creative direction of Alessandro Michele before sputtering during the pandemic as consumers flocked to blue-chip luxury brands seen as less likely to go out of style than fashion-driven Gucci.

Bellettini acknowledged that Kering’s brands, Gucci included, have relied more than its competitors in driving growth from aspirational clients, many of whom have pulled back their spend, especially in China and the US and that they needed to reassert their luxury credentials. “The brands that are performing better are the ones whose share of business relies more on those top customers,” she said. “I don’t like the word, but it is true that the group is embracing a journey of elevation for a few years, making sure that everything we do speaks to luxury.”

Brand elevation is also not simply about raising prices, she said. “You cannot take the shortcut of simply increasing the price of the products that you have. If I were a consumer, I would feel fooled around if I see a product today that is costing double what it was costing one year ago. That’s not elevation,” she insisted. “Elevation is: I work on the brand. I work on the positioning. I work on the quality of my product and I have a legitimacy to introduce more expensive products in my collection.”

Indeed, while Bellettini said Gucci’s growth spurt was a “case study” in the luxury space, its short-term growth focused on trendy fashions and aspirational clients was not balanced with the longer-term health of a business based on building relationships with the top luxury clients.

Turning things around will take time. “I don’t like when people say you have to do a revolution. I don’t like revolutions. I like evolutions because when you evolve you don’t throw the good things in the bin, but you actually build on that,” she said. “What is very important is to take the time to create efficiency, to take the time to work on the quality of the product. When you grow, you need to run after the demand and sometimes you don’t have the time to focus on that. Now we do.”

There’s no doubt that under Michele, Gucci lost sight of the long-term timelessness that our Brand Matrix measures. But Kering must not forget that this needs to be balanced with short-term timeliness that keeps Gucci in the fashion conversation — a challenging balance to strike.

I’m still waiting for the fashion sizzle that will get customers excited about Gucci again. Under Tom Ford and Michele, Gucci played a leading role in shaping the fashion agenda, something that has yet to take hold under de Sarno. His recent cruise show in London was a small step forward, but we need to see a more cohesive and distinctive fashion vision from Gucci in order for it to become a Magical Brand.

“Sabato is the first creative director at Gucci that comes from the outside. Tom Ford was promoted from the inside. Freda [Gianini] was promoted from the inside,” Bellettini said. Alessandro Michele had been also inside Gucci for 18 years before taking on the role of creative director.

“The reality is that by doing that you also build certain ways of working that are not necessarily the right one for the future. So with Sabato we are also learning together how a company with the eyes of an outsider is supposed to work with a creative person. We are building teams around [him] that work also in a different way that before were not necessary because basically everybody grew and kept doing things as they were done.”

Finding the internal balance between a designer and the teams working around them is key to finding constructive tension at Gucci that Guerra says underpins the magic of Miu Miu. If you don’t have the tension, you have to create it.

What About Bottega Veneta?

Some of you have been wondering why Bottega Veneta is not ranked in our Index (and therefore does not appear on the Matrix), despite being a bright spot at Kering, up 2 percent on a comparable basis to €388 million in Q1 2024. The short answer is that Bottega has no social media presence of its own, so many of the metrics we use to measure brand magic are not available.

As CEO Leo Rongone said at the Summit, Bottega’s decision to wipe their social media accounts is part of an intentional strategy to ensure their communications are consistent with a brand whose founding motto is “When your own initials are enough.”

“The fact of being non-conformist — not having a logo, doing a denim that is made out of leather — is consistent with using social media in a different way. The intention wasn’t to be out of social media or to be in social media,” he said. “We discovered that when you get out of [social media], you start moving from a one-to-many relationship to many-to-many. Everybody can say whatever in social media about Bottega, and we are happy about this.”

“Bottega Veneta, unlike many other brands, is not linked to a founder. We don’t have the name of the founder in the name of a brand,” he said. “We are a discreet brand, our products are discreet.”

This Weekend on The BoF Podcast

The author has shared a Podcast.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

In 2014, in a nondescript basement club in East London, Charles Jeffrey’s Loverboy was born. At the age of 18, the Scottish-born designer moved from Glasgow to London to pursue a BA in Fashion Design at Central Saint Martins and has since earned his place in the long line of highly creative fashion designers coming from the city. With an upcoming exhibition at Somerset House, the one time upstart is ready to look back on 10 years of his brand.

This week on The BoF Podcast, Jeffrey joins me to share his journey into London’s fashion scene and reflect on the past, present and future of Loverboy, underscoring that he has his own unique vision to contribute to fashion.

Wishing you all a great weekend!

Imran Amed, Founder, CEO and Editor-in-Chief, The Business of Fashion

Plus, here are my other top picks from our analysis on fashion, luxury and beauty:

1. The Existential Threat to Independent Brands. This week, The Vampire’s Wife announced its closure and Dion Lee called in administrators, only days after Mara Hoffman said it was shutting down and Roksanda narrowly escaped administration. For independent labels, things are set to get worse before they get better.

2. Chanel Defies Luxury Slowdown as Annual Sales Surge to $20 Billion. The French couture house reported revenues up 16 percent in 2023 and plans to increase capital expenditure by as much as 50 percent in 2024.

3. Why Legacy Labels Still Want to Be DTC Brands. Companies like Nike, Levi’s and PVH, which have been on years-long journeys to ramp up their direct businesses amid ongoing challenges in wholesale, provide case studies for how to invest in the selling channel.

4. Why Women’s Basketball Stars Are Finally Getting Big Sneaker Deals. Nike’s upcoming launch with WNBA star A’ja Wilson is the latest in a wave of sponsorship and endorsement deals capitalising on the growing popularity of the sport.

5. How to Grow a Fashion Brand Without Trashing the Planet. Over the last six years Puma has managed to double its revenue while shrinking its carbon footprint by almost a third. It’s an example more brands need to follow, argues Kenneth P. Pucker.

To receive this email in your inbox each Saturday, sign up to The Daily Digest newsletter for agenda-setting intelligence, analysis and advice that you won’t find anywhere else.