When it comes to sustainability, luxury fashion is often promoted as operating better than lower-cost players.

It stands to reason that higher prices should translate into better working conditions for people working in the supply chain. And higher quality products should be used for longer and create less waste. But does that stand up to scrutiny?

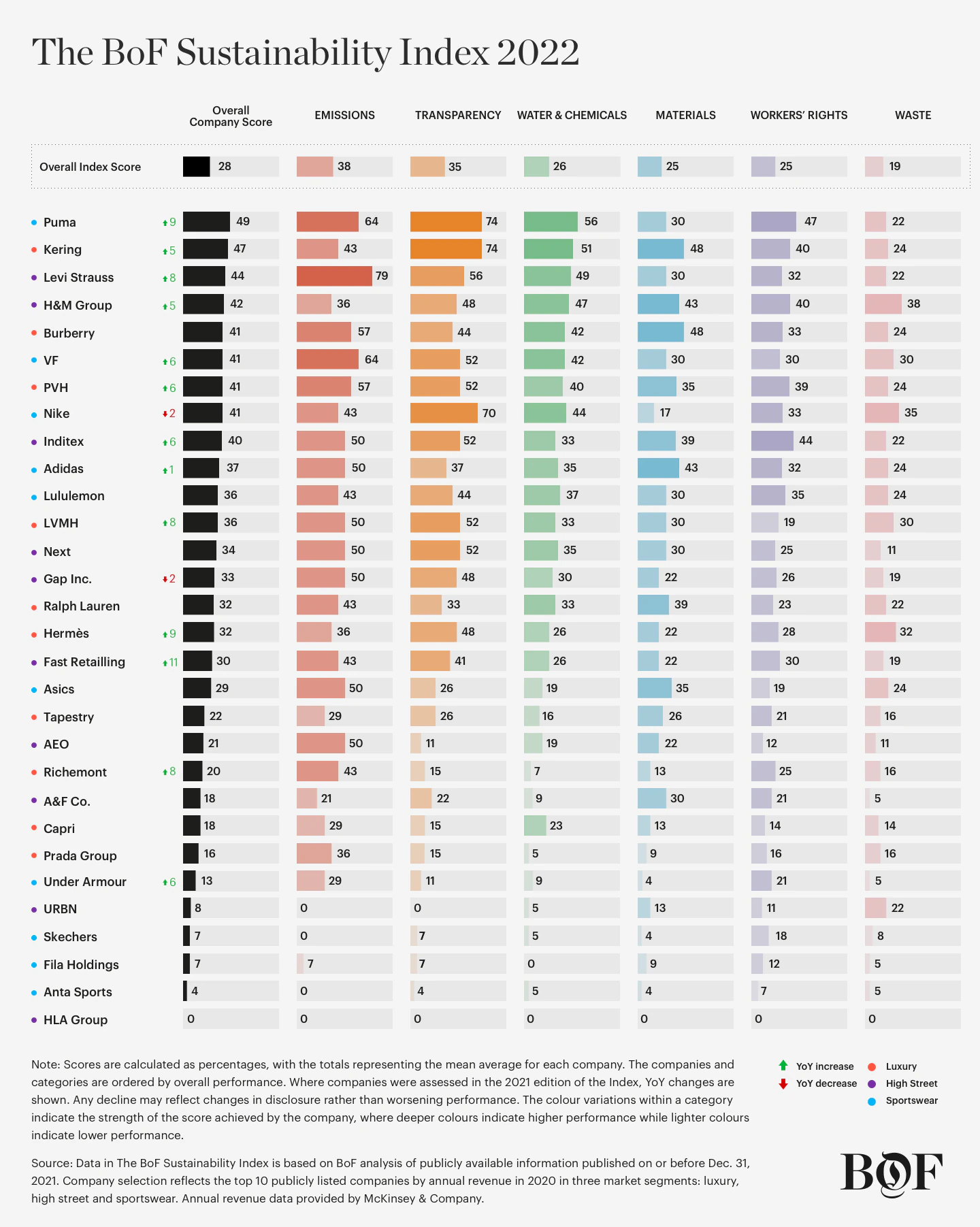

Every year, BoF Insights benchmarks the sustainability efforts of fashion’s biggest companies within the luxury, high street and sportswear segments to understand the answers to just these kinds of questions. The BoF Sustainability Index assesses fashion companies’ progress towards ambitious environmental and social targets across six impact categories, designed to align with the UN’s Sustainable Development Goals and efforts to curb global warming by 2030.

The 2022 edition of the Index analyses the sustainability performance at 30 of fashion’s largest public companies by 2020, addressing the 10 biggest each of the luxury, high street and sportswear segments. Performance is assessed using a framework of more than 200 different questions, with companies gaining a point if their public disclosures indicate they meet the required criteria. The results enable like-for-like comparisons and in-depth market segment analysis on fashion’s sustainability performance.

How did the luxury segment perform in The BoF Sustainability Index 2022?

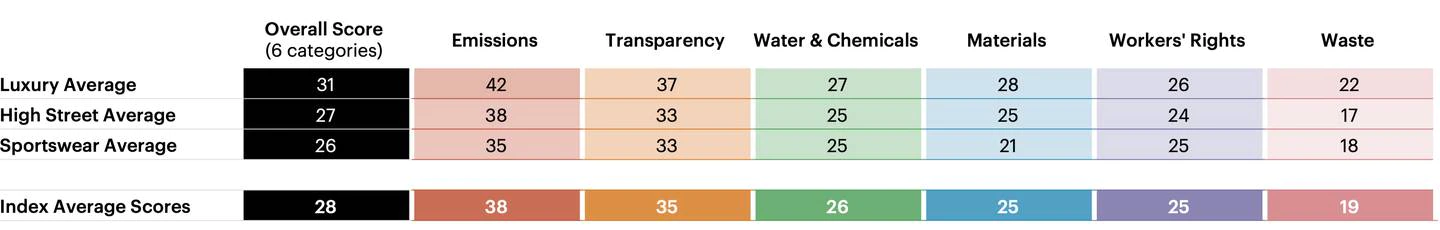

Luxury companies outperformed the Index average in every category, but it wasn’t by much.

The overall average score for the segment came in at 31 points out of 100, compared to 28 points for the complete Index of 30 companies.

Luxury’s stronger showing is largely due to the fact none of the weakest performers sit in this segment. No luxury company scored below 10 points out of 100, while the overall performance of the high street and sportswear segments was dragged lower by a number of players that scored below this threshold (two and three respectively). Nonetheless, four of the luxury companies assessed still scored an overall average of less than 25 points.

Who leads the luxury segment on sustainability?

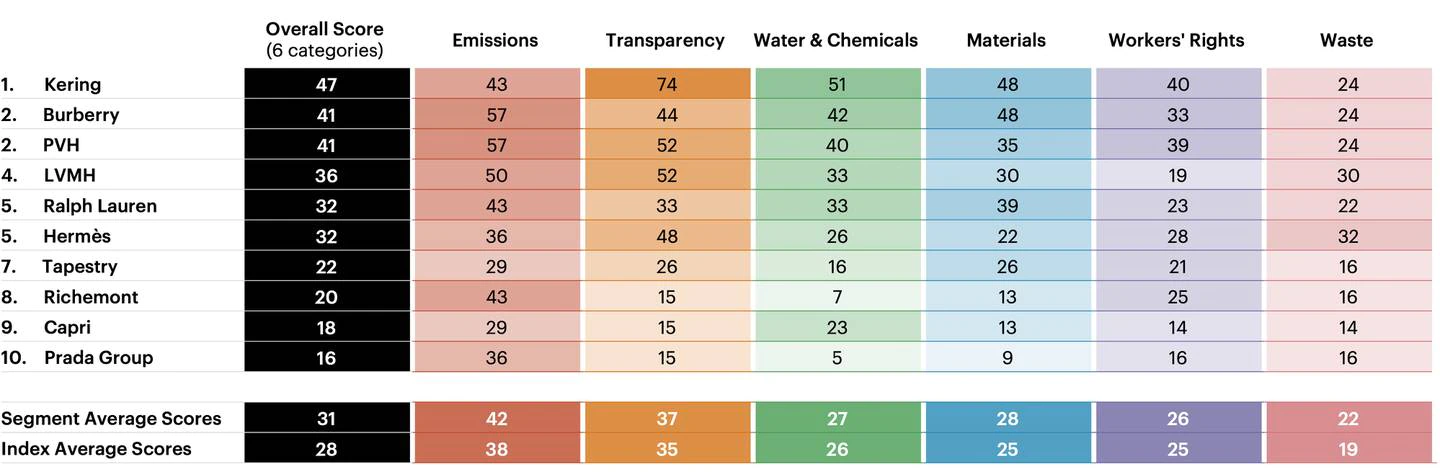

Kering tops the luxury leader board for the second year in a row. The French luxury giant’s overall score of 47 points out of 100 also placed it second in the complete Index of 30 companies, behind Puma.

While the company ranked above its peers in most categories, its long-standing practice of publishing an annual account of its impact through its environmental profit & loss report gave it a particularly strong showing in transparency.

Burberry, a new addition to the Index this year, and PVH tied for second place within the segment with scores of 41 points each.

Which luxury companies are lagging?

Prada, Capri, Richemont and Tapestry all scored an average of less than 25 points out of 100, placing them at the bottom of the luxury ranking and in the lower half of the complete Index of 30 companies.

Emissions was the only impact category in which all four companies achieved a score of more than 25 points, in line with the Index’s broader findings that indicate concerns about climate change are driving widespread action in this area.

The bottom line

While there are luxury players among fashion’s frontrunners on sustainability, the segment can hardly claim leadership on the topic. Its performance largely aligns with the overall findings of the Index: with just eight years left to reach targets, inaction at many of the industry’s biggest players is eclipsing incremental progress among frontrunners, leaving the industry with the need to urgently improve in every area of analysis.

How does The BoF Sustainability Index Work?

The BoF Sustainability Index examines the 10 biggest public companies by revenue in 2020 in three distinct fashion industry segments: luxury, high street and sportswear. It assesses performance across six impact categories: emissions, transparency, water & chemicals, waste, materials and workers’ rights.

Within those categories, the companies are benchmarked against 16 ambitious environmental and social targets established by The Business of Fashion in consultation with a group of respected global experts. Each target contains a series of binary metrics (201 in total), which BoF researchers scored “yes” or “no” based on information that was publicly available on or prior to December 31, 2021.

More information on the methodology is available in our FAQs, or purchase the report from BoF Insights to review it in full.

This article forms part of a series that will publish this week. Similar analysis on the performance of the high street segment can be found on June 8 and on the sportswear segment on June 10.

Sign up now for our new Weekly Sustainability Briefing by Sarah Kent, launching June 10.

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until Dec. 31, 2021. It should be viewed as a proxy for sustainability performance and not an absolute measure. BoF accepts advertising arrangements from a range of partners, some of which may appear in The Sustainability Index. Such advertising arrangements and the Index are handled by separate parts of the business. LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.