Throughout the pandemic, retailers have been jolted by shutdowns, supply chain delays and radical lifestyle changes among consumers. Following a slump, fashion brands and retailers soon recovered, posting banner sales in 2021. But 2022 signalled the beginning of a new phase — one that picks up where we had left off nearly four years ago.

Discounts, a habit that temporarily disappeared in the face of booming demand as the world reopened, are back. E-commerce, which spiked in 2020 and 2021, has since returned to its slower, pre-pandemic pace of growth. Brick-and-mortar retail, meanwhile, saw a renaissance, and tourism — with the exception of China — exceeded 2019 levels by the summer of 2022. Even wholesale got a boost.

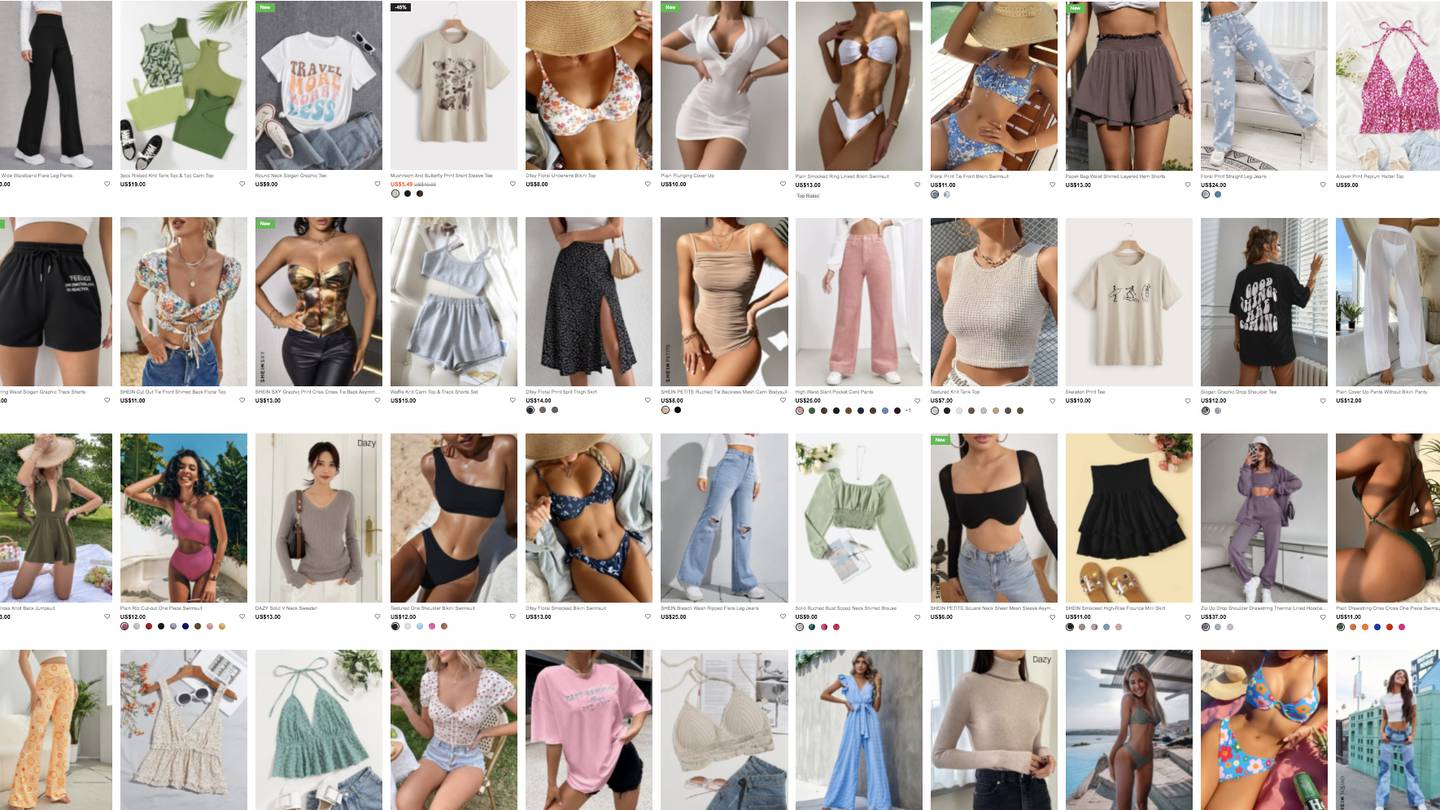

Yet, the world is not the same. In the face of inflation and economic uncertainty, consumers are more careful about how they spend. Alternative models of consumptions, including secondhand fashion and rental services, are growing their share of the market, though whether these business models are both scalable and profitable remains to be seen. Then there’s Chinese e-commerce juggernaut Shein, which in the space of a few years became one of the world’s biggest fashion retailers.

For the most part, pandemic surprises are over. But as those in the industry already know, the market remains volatile. The savviest survivors will be the ones quick to adapt.

What Happens When the E-Commerce Boom Ends: Online sales growth is returning to its slower, pre-pandemic trajectory. As shoppers head back into stores, new expectations around service are setting the stage for the next chapter of retail.

How to Open a Store in 2022: From seamless online-to-offline offerings to Metaverse-inspired installations, the standards of brick-and-mortar retail have evolved since the pandemic struck.

Searching for the Next Barneys: American luxury retail has changed, but customers are still hungry for the special feeling only an exceptional multi-brand store can offer. Can a crop of upstarts and a few savvy incumbents succeed where others have failed?

Activewear’s Biggest Disruptors: Breaking into the $384 billion sports apparel market is no easy task, but fast-growing start-ups are stealing market share by creating specialised, fashion-forward products around underserved interests.

How to Navigate the Return of Wholesale: After a pandemic pivot to e-commerce, many brands are back to working with third-party retailers. This time, they say the terms are better.

The Two Hottest Cities in America: Young, wealthy professionals have flooded Miami and Austin over the last 18 months and luxury brands are following the money. But selling to a newly minted tech millionaire isn’t always so simple.

How to Compete With Shein: The Chinese fast fashion giant built an empire on unmatched speed-to-market and unbelievably low prices. To compete, others must play a different game.

Can Fashion Resale Ever Be a Profitable Business?: Companies like The RealReal and ThredUp promised Wall Street that with scale comes profit. But operational costs and competition have kept them in the red.