Late last month, smack dab in the middle of the Black Friday holiday shopping frenzy, Vestiaire Collective announced a ban on 30 fast fashion brands, including H&M, Uniqlo, Gap and Zara.

In a campaign dubbed “Think First, Buy Second,” the Kering-backed resale platform released ads showing heaps of discarded clothing in front of iconic monuments such as the Colosseum and Eiffel Tower. Vestiaire’s point: classic quality endures while disposable clothing befouls the landscape.

No doubt, the fact that it’s much harder to make money re-selling cheap jeans and shirts than it is high-priced luxury played a part in motivating the stunt. But notwithstanding any self-interest, Vestiaire’s point is sound. As clothing continues to become less valuable and more disposable, discarded products from the fashion industry are a growing planetary blight.

And the waste problem goes far deeper. For confirmation, explore the cutting room floor of any footwear factory in China, the markdown bins at TJ Maxx in the US or a flaming industrial dump in Ghana.

They’re so much excess and waste at every stage of fashion’s value chain. Why? It is by design. The feature of an economic model that prioritises profit ahead of the planet.

This is the case at every step of a garment’s lifecycle.

Post-Industrial Mess

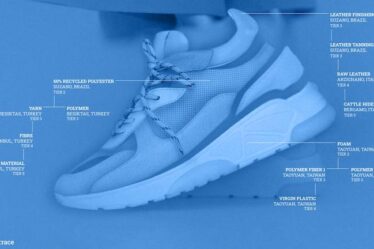

The first step in fashion’s throwaway model occurs before shoes or shirts are even fully produced, with millions of tonnes of scraps that simply end up on the cutting room floor.

That’s because the costs of excess material are often cheaper to absorb compared to the capital required to operate more efficiently. Or, as one footwear executive told me recently, “costing managers have more power than sustainability managers.”

To be sure, the exact scale of the problem is hard to pin down. As a rule, fashion companies don’t report on the volumes of post-industrial waste generated by their suppliers, and the efficiency of manufacturing processes can vary widely.

Even Nike, a company considered a sustainability leader, generates vast amounts of post-industrial waste. (Credit to the company for reporting this information.) In 2022, it produced 109,144 tones of in-process waste at finished goods suppliers alone — the equivalent of approximately 22,000 elephants or almost a half pair’s-worth of waste for each pair of shoes produced.

In Nike’s case, about half of this scrap is recycled, while the other half is burned for energy. This outcome is better than at many peers. For instance, New Balance, another company that deserves credit for providing some transparency on factory waste, reports that it landfills or burns almost two thirds of its post-industrial waste.

Pre-Consumer Excess

Fashion’s post-industrial waste is largely a function of inattention to inefficiency. It’s pre-consumer excess is deliberate; brands plan to overproduce.

That’s because in an industry where top-line growth reigns, a potential missed sale is considered more costly than an end-of-season write-down created by unsold inventory. Executives, who’s incentive pay is often linked to revenue growth, pad production forecasts expecting that a healthy proportion of every collection will sell at discount, modelling waste into the system.

These economics are underpinned by structural inefficiencies that make the problem worse. Most fashion companies work on long lead times that combine with shortening trend cycles to make sales forecasting an exercise in guesswork, resulting in still more waste. Companies that claim to have successfully tackled this challenge, like Shein, have honed their operating model to generate an incomparable churn of styles, designing most waste out of their production and merchandising and into consumers’ wardrobes.

Post-Consumer Fiasco

As clothing and footwear production volumes have ballooned this century, historic amounts of shoes and shirts now end up in secondhand outlets, landfills in the Global South and incinerators. According to the US Environmental Protection Agency, the amount of textile waste generated by Americans has grown nearly 10-fold over the past six decades. Globally, fashion waste is estimated to be approximately 100 million tonnes annually.

There’s little to suggest this trend will improve. Clothing and footwear are now cheaper and more disposable than ever. As illustrations, Aldi is offering $13 sneakers and Temu is selling $12 jeans skirts.

Who Pays?

Despite big brands’ high-profile sustainability commitments, fashion waste continues to accumulate and the industry’s negative environmental impact grows. This is not a result of a lack of good intentions. Instead, it is a function of a system’s structure and misaligned incentives.

After all, it is easier for fashion companies to waste materials than invest capital to pay for yield-optimising machinery; it is cheaper to move production to countries with lax environmental standards than force compliance at outsourced producers; and it makes financial sense to overproduce rather than miss sales.

As a result, fashion company profits are privatised while social and environmental costs are socialised and the industry’s contribution to the destruction of natural habitats, carbon and methane leakage from landfills, and toxins and pollutants release continues to grow.

At long last, regulators are waking to this peril. In 2020, France passed legislation outlawing destruction of excess inventory and both the state of California and the European Union are working on regulations that would make brands responsible for managing textile waste more responsibly.

Forcing the fashion industry to pay for its social and environmental damage makes clear sense, but overproduction is just one half of the problem. After all, were consumers to choose to buy fewer shirts and shoes, waste would decline at every step in the fashion value chain.

Until we find a way to reduce the overall flow of fashion, more leather, plastic, nylon and rubber will continue to burn and pile up.

Kenneth P. Pucker is a professor of practice at the Tufts Fletcher School. He worked at Timberland for 15 years and served as chief operating officer from 2000 to 2007.