Tatler might seem like an unusual place to look for differences between Hong Kong and mainland China but the two editions reveal more about each region than first meets the eye. Each edition of the high society magazine operates independently of the other, curating content that appeals to the distinct demographic it aims to serve.

A recent cover of the Hong Kong edition of the title features chef Vicky Cheng looking confident and relaxed in a Zegna suit, flexing an impressive Omega watch. On the corresponding issue of Shangliu Tatler however, which is available to readers just across the border in mainland China, the spotlight is on Zhang Xiaohui (aka Teresa Cheung Siu-wai), a 60-year-old actress leaning atop a marble table wearing Brunello Cucinelli, Fred jewellery and a massive grin.

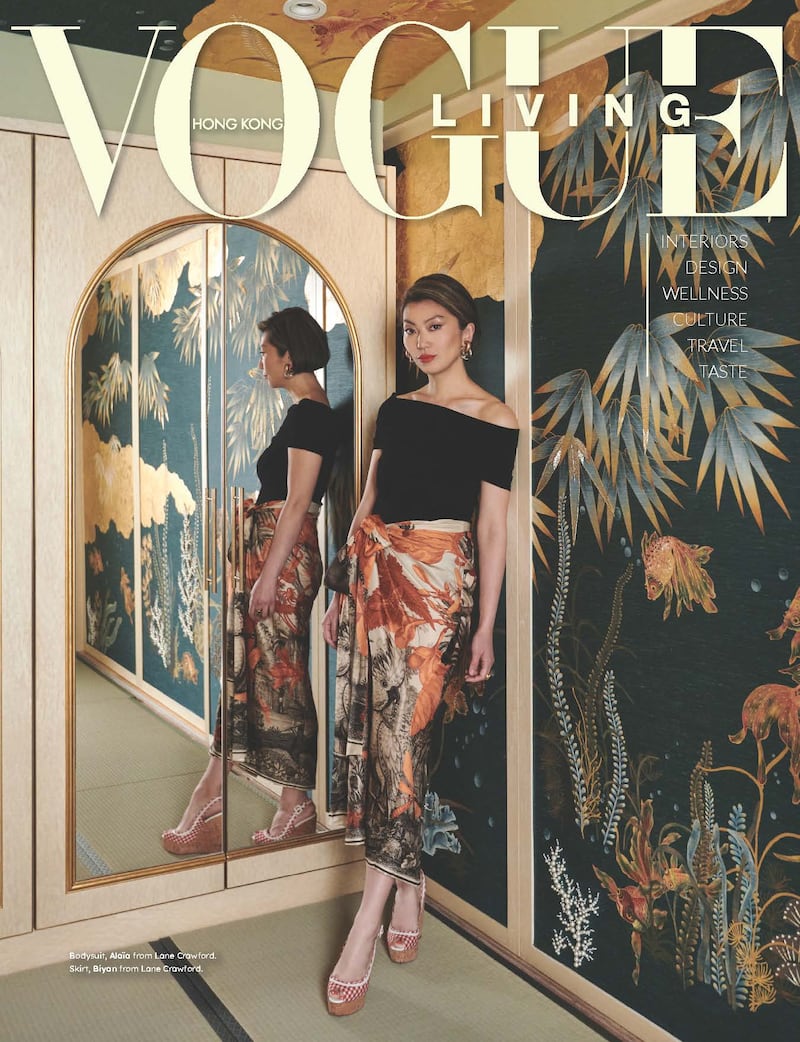

Tatler is not alone in opening a separate edition for the semi-autonomous city and special administrative region of China. Hong Kong has dedicated print versions of Vogue, Vogue Man, Harper’s Bazaar, Elle and Esquire and digital versions of Madame Figaro and L’Officiel among others. The latter launched just six months ago and is planning to make its print debut later this year.

“There is a long history of localised international fashion titles in Hong Kong — that hasn’t changed — and indeed new launches signal the continued importance of the area as a luxury fashion capital both from a business and cultural perspective,” said Tiffany Lam, vice president of marketing and communications at luxury retailer Lane Crawford, which is headquartered in the city and has several branches in the mainland.

The mood in Hong Kong is much brighter now than it was at the height of political turmoil five years ago when mass pro-democracy protests hit the economy hard by deterring inbound tourism and disrupting residents’ routines. The city’s troubles are far from over but, by February of this year, retail sales had risen for the 15th straight month, government data showed.

“People still look to Hong Kong as this international city within the landscape of bigger first-tier markets in the China and East Asia region,” said Zaneta Cheng, editor-in-chief of local magazine Legend. “So I still believe in the importance of it. I understand there is uncertainty given the last five years, but I think its resilient and bouncing back.”

Hong Kong’s recent economic recovery has helped it attract high-profile events like Louis Vuitton’s starry extravaganza last November and, more recently, local editions of Art Basel and ComplexCon, events which encourage the return of tourists. Chanel just announced it plans to restage its latest cruise show in the city later this year. New and newly renovated stores like Hermès at Causeway Bay and Manolo Blahnik’s expansion are further evidence that the city has turned a corner.

According to Federica Levato, senior partner at consultancy Bain & Company, the city’s personal luxury goods market experienced double-digit growth last year. “[It] is currently valued at 3-5 billion euros ($3.2-5.4 billion), which is significantly lower than the peak of around 8 billion ($8.7 billion) in the mid-2010s. However, the location has regained its position as the market with the highest per capita spending on luxury goods [worldwide],” she told MFF.

With luxury brands once again investing in the city, local fashion media are poised to capture a share of the marketing budgets that brands allocate for local customers, a group that has become increasingly important in recent years.

The value of separate editions

Hong Kong is a highly distinctive market, which goes some way toward explaining the reason publishers believe it warrants a separate edition from mainland China. Historically, the city has been touted as the pinnacle of luxury’s hierarchy in Asia not least due to its role as a gateway between and East and West and its proximity to the mainland.

With 129,500 millionaires, 290 centi-millionaires, and 32 billionaires according to a 2023 report by advisors Henley & Partners, the financial hub has a disproportionately wealthy consumer base, comprising well-seasoned third and fourth generation luxury shoppers.

“There is [also] a high proportion of middle class, probably one of the richest [territories in the world],” said Francois Coruzzi, chief executive of the international licenses division at Elle magazine.

The business model behind localised editions must be working as the advertising revenue they earn has sustained some titles for decades.

Elle, which launched a local edition 37 years ago, was originally attracted to the city’s wealth and sophistication. At the time, the company had only a handful of other editions, so the Hong Kong edition has become “a very important one” in the intervening years, said Coruzzi. Not long after Elle, Marie Claire launched an edition for the city in 1990.

Language is another point of differentiation. The legacy of spoken Cantonese and use of traditional Chinese characters in writing in Hong Kong contrasts with the dominance of Mandarin and simplified Chinese characters on the mainland. Under British rule for more than 150 years, the multi-cultural city saw English emerge as a second language to many before Hong Kong was returned to China in 1997.

There are also several long-running local editions of global magazine brands in Taiwan, such as Vogue, Elle and GQ, which operate separately from mainland China editions on the self-ruled island that Beijing sees as a breakaway province. Unlike Taiwan, Hong Kong’s political status as a special administrative region of China is not disputed.

Nevertheless it is a place of “distinct characteristics” said Elisa Harca, the co-founder of marketing agency Red Ant, based in the city. “The global editions [of magazines] don’t really cut through the local population [but] the Hong Kong-specific editions have an active community of captive readers [and local] movers and shakers, tastemakers and entrepreneurs.”

This helps explain why publishing partners operating Hong Kong editions rely on local editorial leaders who commission original content to complements syndicated content from international editions. Condé Nast’s licensing partner Rubicon Media works with Simon Au, editorial director of Vogue Hong Kong, while SCMP Hearst has Winnie Wan as chief editor of Elle Hong Kong and Crystal Wong as chief editor of Harper’s Bazaar Hong Kong.

To amplify their content, Hong Kong editions tend to use a different social media and messaging platform matrix than their mainland counterparts. Instagram, Facebook and Whatsapp are more prevalent for the former while Weibo, WeChat and Xiaohongshu dominate in the latter.

Distinctions in culture also play a role. The Hong Kong and mainland editions of magazines are “increasingly segregating from each other, tapping into different niche segments of audiences,” said Brian Yeung, Hong Kong-based co-founder of Brandstorm Communications agency. In the former, these include “gender neutral, LGBTQ+ and Gen-Z” communities who expect topical, authentic and original features that are “in line with their lifestyles.”

Hong Kong audiences also expect content to tackle sensitive issues more openly and with a greater degree of freedom of expression than across the border, experts suggest. But as the city is brought further under mainland Chinese administration, legislation such as the national security law has threatened this openness, prompting the closure or departure of some media outlets.

Bennett Marcus, a freelance journalist who lived in Hong Kong for five years and is now based between Bangkok and Taipei, is hopeful that local fashion magazines will be able to continue to pursue their preferred editorial direction but says there is a caveat. “[That’s] assuming they know where the often-vague red lines lie,” he explained.

For example, since “certain LGBTQ activist celebrities like singers Anthony Wong Yiu-ming and Denise Ho Wan-see are taboo [as subjects] there may be a bit of self-censorship required,” he added.

According to Zaneta Cheng, casting local celebrities has become increasingly common for Hong Kong editions. Many also rely on a particular mix of regional celebrities. “Korean awards ceremonies and K-favour is big; there’s always been a huge thing for Japanese celebrities in Hong Kong and recently there’s been a Thai craze,” she said.

Featuring local fashion brands and designers living and working in Hong Kong is another point of differentiation.

The author has shared an Instagram Post.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

Return on investment

The distinctive nature of Hong Kong’s publishing industry may be clear to see but less so is the degree to which local editions are a good return on investment.

The scale of the Hong Kong market (population 7.4 million) often seems smaller than it actually is because of inevitable comparisons with its much larger neighbour mainland China (population 1.4 billion). But seen through a wider global lens, the city is in the same league as some small countries that have been given a local edition of major fashion magazines.

For instance, in 2018, Condé Nast launched Vogue Czechoslovakia, for readers in both Czechia and Slovakia, which have a combined population of 15 million. But wealth is another matter altogether. Neither country’s largest city, Prague or Bratislava, appears in the top 50 cities ranking of the highest number of resident millionaires, according to Henley & Partners, whereas Hong Kong ranks ninth in the world.

Indeed, it is the scale of Hong Kong’s substantial luxury market that makes dedicated editions of some high-end fashion magazines viable.

According to Coruzzi, the popularity of the online edition of Elle Men Hong Kong led to the decision to leap to print. Circulation currently hovers around 43,000 copies and 1.9 million unique visitors per month, he said, attracting advertisers from all “the usual suspects” including Louis Vuitton, Chanel, Gucci, Prada, Cartier and Tiffany.

However, Hong Kong editions inevitably have lower ad rates than mainland China edition rates, and they also have fewer opportunities to monetise editorial content than their counterparts across the border. That’s because Hong Kong titles adhere to earned media principles more often than the “pay for play” editorial coverage that dominates in the mainland, as Harca describes it.

Harca says titles such as Tatler Hong Kong and Legend fill the revenue gap by “branching outside of pure play editorial into community activations.” She also cites activations such as Vogue’s Fashion Night Out shopping event across the city and Prestige magazine’s The Prestige Awards.

Despite signs that Hong Kong is fertile ground for local editions, challenges persist. — even though many are universal to legacy media players around the world.

“Platforms like Instagram and TikTok that offer quick, consumable content, are resulting in a decreased interest in in-depth stories and beautifully shot fashion imagery and videos,” explained Connor Lau, contributor to Esquire Hong Kong. This means advertisers have “adjusted their strategies and are allocating focus to social influencers.”

But Lau believes the swing towards digital has challenged local magazines to “reposition themselves” and find a balance between maintaining their authority in the fashion industry and adapting to online trends.

Condé Nast, for example, is looking beyond the magazine page to appeal to younger audiences. Publisher of Vogue Hong Kong, Desiree Au and managing director of Rubicon Media, confirms the pivot, stating that “our video content is a particularly strong performer for us…with an emphasis on events and social media.”

It has become increasingly hard to grow revenues in recent months, concedes Zaneta Cheng, admitting that it has shrunk at Legend. “The revenge promotion of 2023 is gone, and belts have tightened.”

Other challenges the industry faces are more deep-rooted. Since the introduction of Beijing’s national security law, there has been an exodus of some of the city’s local and expatriate professionals. This has reduced both the readership and talent pool for publishers.

Elle’s Coruzzi acknowledged that it has become more difficult to recruit staff in recent years. But given the market’s many positive indicators, he remains optimistic about business in the year ahead. “The lights are green [again] in Hong Kong,” he said.