Two years after Apple threw a wrench in the once easy-to-penetrate online marketing ecosystem, Instagram ads remain a tough addiction for fashion and beauty start-ups to quit.

Brands are spending 28 percent more on paid ads on social media, mostly on Meta (Facebook and Instagram’s parent company), this year, according to data from analytics software firm Triple Whale. Many brands say more than half of their marketing budgets goes toward buying ads on Facebook and Instagram. This is reflected in Meta’s own rebound: The company’s advertising revenue fell 1 percent to $114 billion in 2022 but rose 4 percent year-over-year to $28 billion in the first quarter of 2023.

“People never really left [Meta],” said Rabah Rahil, chief evangelist at Triple Whale, which helps brands manage their digital marketing. “They might have turned spend down a bit. There was never an exodus.”

The rules of advertising on the social media giant have changed, though.

For starters, brands today are not as dependent on Instagram for growth. When Apple introduced privacy restrictions in 2021 — letting iPhone users opt out of being tracked across different apps and sites — brands saw their sales plummet as it became harder to target shoppers most likely to buy their goods.

Instead of leaving social media, brands adapted. Before they dive into paid ads, brands are ramping up content on their own feeds — such as short videos that show people discussing their products — so there’s more for prospective consumers who have seen their ads to engage with. Many brands are only increasing their ad budgets on platforms like Meta when they know that the shoppers they’re targeting will spend enough for the brands to generate a profit on those orders.

“What we would observe two years ago was a much broader, inefficient throw money at a bunch of ideas kind of approach,” said Taryn Jones Laeben, president and founder of IRL Ventures, which consults DTC start-ups like intimates brand Parade on their business strategies. “What we advocate for now is, in a more modulated way, testing into more targeted hypotheses on a much smaller scale and then leaning into spend as you find success.”

A Measured Approach

Companies are targeting ads at customers on platforms like Meta when it’s clear that the value of those shoppers’ first order will be more than the cost to run a campaign.

To help track that, advertisers are accounting for the costs to produce, pack and ship the goods when they place those ads. Meta also released new tools in 2022 — like its feature that automates the process of selecting the best campaigns to reach new audiences who are most likely to shop with a brand — to support these efforts. (Meta is still the biggest social media platform in online marketing, owning a little over 20 percent of total digital advertising in the US in 2022, according to estimates by Insider Intelligence).

Brands are also willing to reduce spending at any moment if they are not breaking even.

This tactic is working for brands like wellness start-up Bear Balanced. The 3-year-old company, which sells energy-boosting creatine gummies, is not afraid to spend up to 50 percent of its marketing budget on Facebook and Instagram ads or to significantly drop that portion, depending on how profitable the sales it gets from those ads are. Bear Balanced generates up to 35 percent EBITDA margins — earnings before interest and taxes — each month, and it expects its annual sales will grow 100 percent year-over-year in the next 12 months, largely from its paid ad strategy on Instagram.

“You put in a dollar, you get a second dollar out,” said Dylan Menter, founder and chief executive of Bear Balanced. “The further we are away from that, the less I’m going to spend on those campaigns.”

The Right Content

Newer brands are easing their way into buying ads on social media, which they are using to punctuate their pre-existing brand-building tactics.

When Dibs Beauty launched in 2021, it was mostly posting videos on its social pages of the brand’s co-founder and other content creators using items like its double-ended blush and bronzer sticks and face and body highlighters. Last September, the 2-year-old cosmetics seller started placing ads on Instagram to increase sales on its site.

The company repurposed the videos on its page as campaigns, spending as little as $10,000 a month, and saw a sales bump. That monthly budget has increased to more than $100,000, which also accounts for other social media platforms like TikTok, YouTube and ads on Google. Dibs Beauty anticipates it can triple sales this year as its social media advertising budget grows.

“We’ve been pretty conservative in terms of how we begin to scale our [paid ad] program,” said Mindy Luong, vice president of digital at Dibs Beauty. “It is cost-efficient for us to lean into content that is already created in the marketplace.”

In the last six months, more brands have used social media management platform Dash Hudson’s entertainment score, which measures engagement and how long people spend watching a brands’ videos, to decide which content to use as paid ads on Instagram and TikTok, said Kate Kenner Archibald, chief marketing officer at Dash Hudson.

“The right content in the right space matters more than ever,” Archibald said. “The better content you have, the better it is going to drive people down the funnel.”

Refining the Mix

Brands have become exact in how they identify the right moment to raise their social media marketing budgets, often doing so when they know they can drive higher revenue.

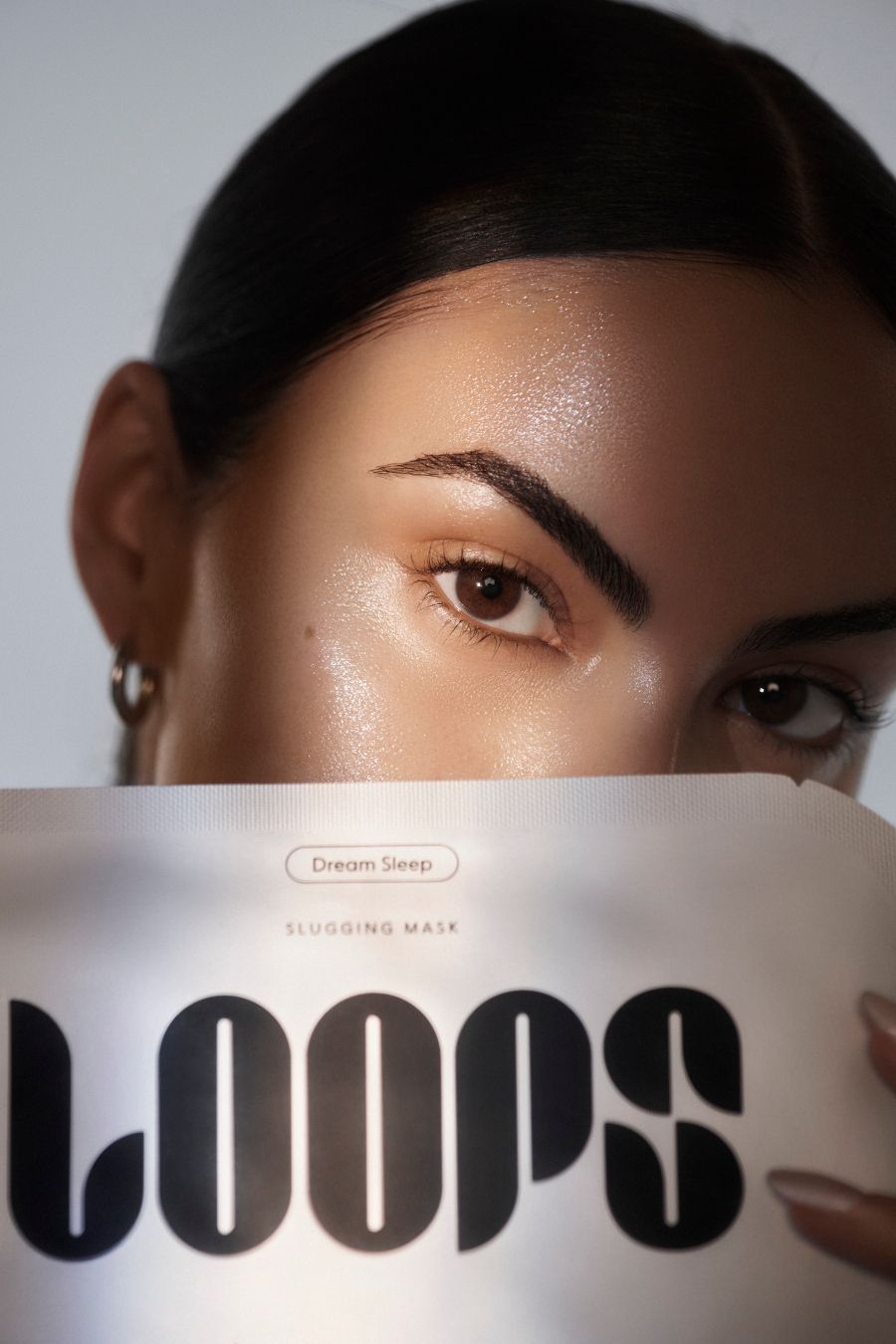

Skin care brand Loops, which sells hydrogel masks, will spend as much as seven times more on paid ads when launching a new product.

Prior to launch, the brand will send out email ads to prospective customers to sign-up for the new product. The day the product is unveiled, the brand will target ads at people on social media who signed up for events, offers and launches through email, along with the audiences of its celebrity creative director, actor Camila Mendes, its retail partners like Ulta and Target, and content creators, who are also promoting the new item. If the brand breaks even on the orders from those ads, it will increase spending to push out more ads in the following days.

“We know who’s promoting it and who’s talking about it,” said Meg Bedford, Loops’ chief executive. “It always behoves us to have partners to help amplify the message and kind of make the conversation bigger.”

Loops’ approach also proves that brands’ paid ads work best when coupled with other marketing channels.

Glamnetic, which offers magnetic eyelashes and press-on nails, counts on its email and text message marketing, loyal fans congregating on Facebook groups and distribution at retail partners, including Ulta and Sephora, to establish brand awareness. That awareness increases the likelihood that a person who is exposed to the brand’s campaigns on social media will click through and spend enough money for the brand to earn a profit from that order.

“All of those things have to work,” said Kevin Gould, founder and CEO of holding and operating company Kombo Ventures and co-owner of Glamnetic. “If you’re missing one, that one piece can make the whole performance funnel not work.”